Disposition of Taxable Canadian Property Form

What is the Disposition of Taxable Canadian Property?

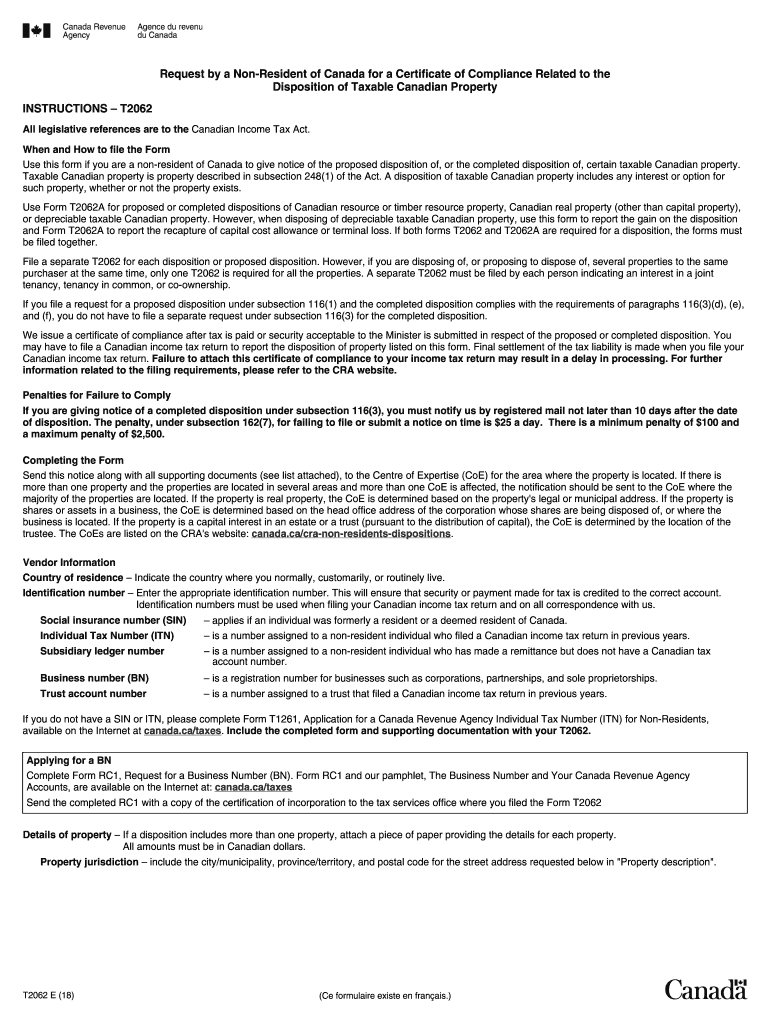

The Disposition of Taxable Canadian Property refers to the sale or transfer of property that is subject to Canadian tax laws. This includes real estate, shares in Canadian corporations, and certain other assets. When a non-resident sells such property, they may be liable for capital gains tax in Canada. Understanding the nature of this property is crucial for compliance with Canadian tax regulations.

Steps to Complete the Disposition of Taxable Canadian Property

Completing the Disposition of Taxable Canadian Property involves several key steps:

- Determine if the property qualifies as taxable under Canadian law.

- Calculate any capital gains or losses associated with the property.

- Complete the necessary forms, including the T2062 form, to report the transaction.

- Submit the completed forms to the Canada Revenue Agency (CRA) within the required timeframe.

Legal Use of the Disposition of Taxable Canadian Property

The legal use of the Disposition of Taxable Canadian Property is governed by the Income Tax Act of Canada. Non-residents must adhere to specific regulations when disposing of property to avoid penalties. This includes accurately reporting gains and ensuring compliance with Canadian tax obligations. Legal advice may be beneficial to navigate these requirements effectively.

Required Documents

To complete the Disposition of Taxable Canadian Property, several documents are necessary:

- The T2062 form, which is essential for reporting the disposition.

- Proof of purchase and sale agreements.

- Documentation supporting the calculation of capital gains or losses.

- Any additional forms required by the CRA for non-residents.

Filing Deadlines / Important Dates

Filing deadlines for the Disposition of Taxable Canadian Property are critical to avoid penalties. Typically, the T2062 form must be filed within ten days of the property transfer. It is advisable to keep track of these dates to ensure timely compliance with CRA regulations.

Form Submission Methods (Online / Mail / In-Person)

The T2062 form can be submitted through various methods, depending on the preference of the filer:

- Online submission via the CRA's secure portal for registered users.

- Mailing the completed form to the appropriate CRA office.

- In-person submission at designated CRA locations, if applicable.

Quick guide on how to complete disposition of taxable canadian property

Effortlessly Prepare Disposition Of Taxable Canadian Property on Any Device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed agreements, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Disposition Of Taxable Canadian Property on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Alter and eSign Disposition Of Taxable Canadian Property with Ease

- Find Disposition Of Taxable Canadian Property and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes only a few seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Modify and eSign Disposition Of Taxable Canadian Property and maintain outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the disposition of taxable canadian property

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What are Canada Revenue Agency forms T2062 and why are they important?

Canada Revenue Agency forms T2062 are used to report certain transactions involving the sale of capital property by non-residents. Completing these forms accurately is crucial for compliance with Canadian tax regulations. Using airSlate SignNow can streamline the process, allowing you to efficiently eSign and submit Canada Revenue Agency forms T2062.

-

How can airSlate SignNow help with filling out Canada Revenue Agency forms T2062?

airSlate SignNow simplifies the process of filling out Canada Revenue Agency forms T2062 by providing an intuitive platform for document management. You can easily add information, and required signatures, and retain copies of completed forms. This not only saves time but ensures you stay organized and on track with your tax obligations.

-

Is there a cost associated with using airSlate SignNow for Canada Revenue Agency forms T2062?

Yes, airSlate SignNow offers various pricing plans tailored to different needs. These plans make it cost-effective for businesses, especially when regularly using Canada Revenue Agency forms T2062. The investment often results in greater efficiency and lower administrative costs.

-

What features does airSlate SignNow offer for managing Canada Revenue Agency forms T2062?

airSlate SignNow provides several features for managing Canada Revenue Agency forms T2062, including customizable templates, in-app eSigning, and real-time tracking of document statuses. These features enhance the user experience, making it easier to handle important tax documents seamlessly.

-

Can airSlate SignNow integrate with other software systems for managing Canada Revenue Agency forms T2062?

Absolutely! airSlate SignNow integrates with various software systems to enhance the management of Canada Revenue Agency forms T2062. Whether you're using CRM, project management, or accounting software, these integrations ensure your workflow remains uninterrupted and efficient.

-

How secure is airSlate SignNow when handling sensitive Canada Revenue Agency forms T2062?

Security is a top priority at airSlate SignNow. When dealing with sensitive documents like Canada Revenue Agency forms T2062, the platform employs encryption and secure sharing options to protect your information. This commitment to security gives you peace of mind while handling important tax forms.

-

What are the benefits of using airSlate SignNow for Canada Revenue Agency forms T2062?

Using airSlate SignNow for Canada Revenue Agency forms T2062 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced accuracy in form completion. Additionally, the eSigning feature makes it easier to gather signatures quickly and securely, which is essential for timely submissions.

Get more for Disposition Of Taxable Canadian Property

- Virginia note form

- Virginia unsecured installment payment promissory note for fixed rate virginia form

- Notice of option for recording virginia form

- Life documents 497428405 form

- General durable power of attorney for property and finances or financial effective upon disability virginia form

- Essential legal life documents for baby boomers virginia form

- General durable power of attorney for property and finances or financial effective immediately virginia form

- Revocation of general durable power of attorney virginia form

Find out other Disposition Of Taxable Canadian Property

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template