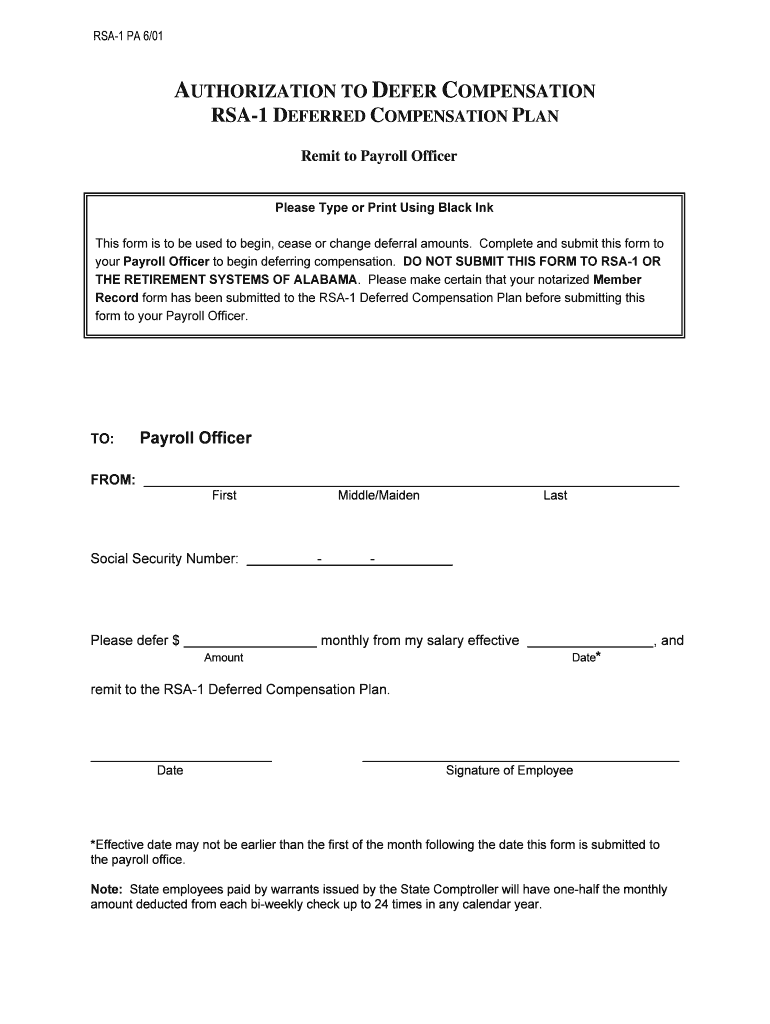

Authorization to Defer Compensation Rsa 1 Deferred Compensation Plan Una Form

What is the rsa 1 withdrawal form?

The rsa 1 withdrawal form is a crucial document used in the context of the rsa 1 deferred compensation plan. This form allows participants to request a withdrawal from their deferred compensation account, which may include retirement savings or other benefits. Understanding the purpose and implications of this form is essential for individuals looking to access their funds. The rsa 1 withdrawal form outlines the specific details regarding the amount being withdrawn, the reason for the withdrawal, and any applicable tax implications. It is important to fill out this form accurately to ensure compliance with IRS regulations and to facilitate a smooth withdrawal process.

Steps to complete the rsa 1 withdrawal form

Completing the rsa 1 withdrawal form requires careful attention to detail to ensure all necessary information is accurately provided. Here are the steps to follow:

- Gather necessary documentation, including your account information and identification.

- Clearly indicate the amount you wish to withdraw and the reason for the withdrawal.

- Review the tax implications associated with your withdrawal, as this may affect your overall financial situation.

- Sign and date the form to authenticate your request.

- Submit the completed form according to the specified submission methods, whether online, by mail, or in person.

Legal use of the rsa 1 withdrawal form

The rsa 1 withdrawal form is legally binding once it is filled out and signed. To ensure its validity, it must comply with relevant legal frameworks, including IRS guidelines. The form serves as a formal request for the withdrawal of funds, and any discrepancies or inaccuracies may lead to delays or complications in processing. It is essential to understand that submitting this form constitutes an agreement to the terms outlined within the rsa 1 deferred compensation plan, making it imperative to read all instructions carefully before completion.

Required documents for the rsa 1 withdrawal form

When preparing to submit the rsa 1 withdrawal form, certain documents may be required to support your request. These may include:

- A valid form of identification, such as a driver's license or passport.

- Your account statement or documentation related to your deferred compensation plan.

- Any additional forms that may be necessary based on the reason for your withdrawal.

Having these documents ready can streamline the process and help avoid any delays in accessing your funds.

Form submission methods for the rsa 1 withdrawal form

The rsa 1 withdrawal form can typically be submitted through various methods, allowing for flexibility based on individual preferences. Common submission methods include:

- Online submission through the official platform, which may offer a more efficient and quicker processing time.

- Mailing the completed form to the designated address provided in the instructions.

- In-person submission at a specified location, which may be necessary for certain types of withdrawals.

Choosing the appropriate submission method can influence the speed and efficiency of processing your withdrawal request.

Eligibility criteria for the rsa 1 withdrawal form

Before completing the rsa 1 withdrawal form, it is important to understand the eligibility criteria that govern withdrawals from the rsa 1 deferred compensation plan. Generally, eligibility may depend on factors such as:

- Your age and the specific terms of the deferred compensation plan.

- The length of time you have participated in the plan.

- The reason for the withdrawal, as some plans may have restrictions on certain types of withdrawals.

Reviewing these criteria can help ensure that your request aligns with the plan's regulations and increases the likelihood of a successful withdrawal.

Quick guide on how to complete authorization to defer compensation rsa 1 deferred compensation plan una

Prepare Authorization To Defer Compensation Rsa 1 Deferred Compensation Plan Una effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary forms and securely save them online. airSlate SignNow equips you with all the features necessary to create, edit, and eSign your documents quickly and efficiently. Manage Authorization To Defer Compensation Rsa 1 Deferred Compensation Plan Una on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to alter and eSign Authorization To Defer Compensation Rsa 1 Deferred Compensation Plan Una with minimal effort

- Find Authorization To Defer Compensation Rsa 1 Deferred Compensation Plan Una and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you'd like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Authorization To Defer Compensation Rsa 1 Deferred Compensation Plan Una and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How should one account for the value of non-qualified deferred compensation and pension plans and its distributions when filling out the college tuition financial aid forms in FAFSA?

How should one account for the value of non-qualified deferred compensation and pension plans and its distributions when filling out the college tuition financial aid forms in FAFSA?Elective employee contributions to and all distributions from the non-qualified plans during the FAFSA’s base year are reported as income on the FAFSA. Employer contributions are not reported as income. If a reportable contribution or distribution is not reported in adjusted gross income (AGI), it is reported as untaxed income of the FAFSA. This is no different than the treatment of qualified retirement plans.A non-qualified plan should not be reported as an asset, if access to the plan is restricted until the employee signNowes retirement age. But, many non-qualified plans provide the employee with access to the plan after employment is terminated, not just when the employee signNowes retirement age. If so, the non-qualified plan should be reported as an asset on the FAFSA, to the extent that it has vested.

-

How do we find out the criteria and if what tech companies offer "deferred compensation" benefits (not 401K) to their employees in the Bay Area?

If you are considering employment with only organizations that are for that provide deferred compensation I suggest you make that a question when you interview with each one of them as deferred compensation is provided on a case-by-case situation

Create this form in 5 minutes!

How to create an eSignature for the authorization to defer compensation rsa 1 deferred compensation plan una

How to make an eSignature for the Authorization To Defer Compensation Rsa 1 Deferred Compensation Plan Una online

How to generate an electronic signature for your Authorization To Defer Compensation Rsa 1 Deferred Compensation Plan Una in Google Chrome

How to make an electronic signature for signing the Authorization To Defer Compensation Rsa 1 Deferred Compensation Plan Una in Gmail

How to generate an electronic signature for the Authorization To Defer Compensation Rsa 1 Deferred Compensation Plan Una from your smartphone

How to generate an electronic signature for the Authorization To Defer Compensation Rsa 1 Deferred Compensation Plan Una on iOS devices

How to generate an electronic signature for the Authorization To Defer Compensation Rsa 1 Deferred Compensation Plan Una on Android devices

People also ask

-

What is rsa 1 withdrawal in the context of airSlate SignNow?

RSA 1 withdrawal refers to the ability to securely manage and withdraw eSigned documents within the airSlate SignNow platform. This feature is essential for businesses that require efficient document handling while ensuring compliance and security. With airSlate SignNow, RSA 1 withdrawal is streamlined, allowing users to access their documents quickly.

-

How does airSlate SignNow facilitate rsa 1 withdrawal for businesses?

airSlate SignNow simplifies rsa 1 withdrawal by providing a user-friendly interface for businesses to send and retrieve signed documents. With electronic signatures and robust document workflow capabilities, companies can manage withdrawals effortlessly and securely. This efficiency enhances overall productivity and reduces the risk of errors.

-

Are there any costs associated with rsa 1 withdrawal using airSlate SignNow?

Using airSlate SignNow for rsa 1 withdrawal is cost-effective, with various pricing plans tailored to fit different business needs. Customers can choose from monthly or annual subscriptions, which provide access to essential features, including rsa 1 withdrawal. This flexible pricing structure ensures that businesses can find a plan that meets their budget.

-

What security features does airSlate SignNow offer for rsa 1 withdrawal?

airSlate SignNow prioritizes security for rsa 1 withdrawal by employing industry-standard encryption and compliance with various regulations, ensuring that your documents are safe. With features like two-factor authentication and audit trails, businesses can maintain full control and visibility over their signed documents. This level of security gives customers peace of mind during document transactions.

-

Can rsa 1 withdrawal be integrated with other software using airSlate SignNow?

Yes, airSlate SignNow offers integrations with a variety of popular applications, facilitating seamless rsa 1 withdrawal. This interoperability enables businesses to connect their existing workflows with airSlate SignNow, enhancing their overall efficiency. Integrations with CRMs, cloud storage, and other tools can streamline the document management process signNowly.

-

What are the benefits of using airSlate SignNow for rsa 1 withdrawal?

The primary benefits of using airSlate SignNow for rsa 1 withdrawal include increased efficiency, improved document security, and enhanced compliance. Businesses can quickly manage their eSigned documents, ensuring that withdrawals are handled promptly and accurately. Additionally, the intuitive design allows for a smoother user experience for both senders and recipients.

-

How can I get started with rsa 1 withdrawal on airSlate SignNow?

Getting started with rsa 1 withdrawal on airSlate SignNow is easy. Simply sign up for an account and explore the platform's features through a guided setup process. You can start sending documents for eSignature right away, ensuring that your withdrawal process is efficient and secure from the beginning.

Get more for Authorization To Defer Compensation Rsa 1 Deferred Compensation Plan Una

- Dcccd transcript request form

- Verification of living with parent form fall spring

- Faculty appraisal and planning form louisiana lctcs

- How to make and print business cards at home form

- Support letter for graduate school application fee waiver form

- Research registration for the major in genetics form

- Stores form

- Ccts clinical support registration form

Find out other Authorization To Defer Compensation Rsa 1 Deferred Compensation Plan Una

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship