See the Last Page of This Form for Definitions and Instructions

Understanding the Fillale T2220 Form

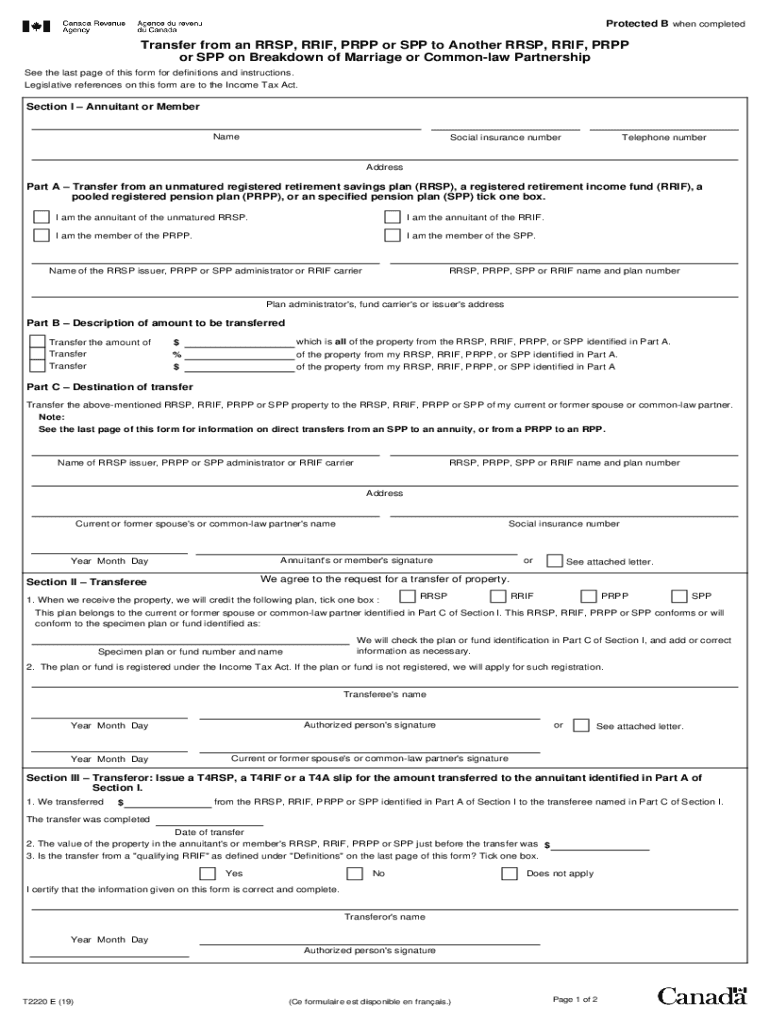

The fillale T2220 form is a crucial document used in Canada for transferring earnings to a Registered Retirement Savings Plan (RRSP). It is essential for individuals looking to manage their retirement savings effectively. This form is particularly relevant for those who have experienced a loss of hearing or other qualifying conditions, allowing them to access their funds in a tax-efficient manner. Understanding the purpose and requirements of the T2220 form is vital for ensuring compliance with tax regulations.

Key Elements of the Fillale T2220 Form

The fillale T2220 form includes several key elements that must be completed accurately. These elements typically consist of personal identification information, details about the earnings being transferred, and the RRSP account information. Additionally, the form may require signatures to validate the transfer. Each section must be filled out with precision to avoid delays or issues with the processing of the transfer.

Steps to Complete the Fillale T2220 Form

Completing the fillale T2220 form involves several steps to ensure accuracy and compliance. First, gather all necessary documents, including your earnings statements and RRSP account details. Next, fill out the personal information section, ensuring that all names and addresses are correct. Proceed to detail the earnings you wish to transfer, and be sure to sign and date the form. Finally, review the entire document for completeness before submission.

Legal Use of the Fillale T2220 Form

The fillale T2220 form is legally recognized for transferring earnings to an RRSP in Canada. To ensure its validity, it must be completed in accordance with the guidelines set forth by the Canada Revenue Agency (CRA). This includes adhering to deadlines for submission and ensuring that all required information is provided. Failure to comply with these legal requirements can result in penalties or delays in processing.

Form Submission Methods

The fillale T2220 form can be submitted through various methods, including online, by mail, or in person. For online submissions, ensure that you have a secure platform to upload your completed form. If submitting by mail, use a reliable postal service to ensure timely delivery. In-person submissions may be made at designated CRA offices, where staff can assist with any questions regarding the process.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the fillale T2220 form to avoid penalties. Typically, the form must be submitted within a specific timeframe following the end of the tax year. Keeping track of these important dates ensures that you remain compliant with tax regulations and can take full advantage of the benefits associated with RRSP contributions.

Quick guide on how to complete see the last page of this form for definitions and instructions

Manage See The Last Page Of This Form For Definitions And Instructions seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to craft, modify, and electronically sign your documents promptly without any holdups. Handle See The Last Page Of This Form For Definitions And Instructions effortlessly on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

Steps to modify and eSign See The Last Page Of This Form For Definitions And Instructions with ease

- Find See The Last Page Of This Form For Definitions And Instructions and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to retain your modifications.

- Choose how you wish to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign See The Last Page Of This Form For Definitions And Instructions and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the see the last page of this form for definitions and instructions

How to make an eSignature for a PDF document in the online mode

How to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the fillale t2220 and its primary function?

The fillale t2220 is a digital form designed for efficient document management. It allows users to fill out and sign necessary forms quickly, streamlining the paper process. Whether you're in an office or working remotely, the fillale t2220 simplifies how you handle important documents.

-

How much does it cost to use the fillale t2220?

The pricing for using fillale t2220 may vary based on the subscription plan you choose. airSlate SignNow offers different tiers designed to fit various business sizes and needs, ensuring that you get a cost-effective solution for document management. You can check the website for detailed pricing plans tailored to your requirements.

-

What features does the fillale t2220 include?

The fillale t2220 comes equipped with features that enhance document workflow such as customizable templates, electronic signatures, and real-time tracking of document statuses. This functionality ensures that you can manage your documents effectively and collaborate easily with team members or clients.

-

What are the benefits of using the fillale t2220?

Using the fillale t2220 offers several benefits, including time savings, reduced paper usage, and improved compliance with document management regulations. By digitizing the process, businesses can enhance productivity and ensure documents are easily accessible anytime, anywhere.

-

Can the fillale t2220 integrate with other tools?

Yes, the fillale t2220 integrates seamlessly with various third-party applications like Google Drive, Salesforce, and more. This compatibility allows you to automate workflows and centralize your document management system, making operations smoother and more efficient.

-

Is the fillale t2220 secure for sensitive documents?

Absolutely! The fillale t2220 is designed with advanced security measures to protect sensitive information. With features like encryption and secure authentication, you can be confident that your documents are safe and compliant with legal standards.

-

How can I get started with the fillale t2220?

Getting started with the fillale t2220 is simple. You can sign up for an account on the airSlate SignNow website, where you'll find easy-to-follow instructions for setting up your first document. Once registered, you can begin utilizing the features available with the fillale t2220 right away.

Get more for See The Last Page Of This Form For Definitions And Instructions

- Virginia identity form

- Virginia deceased form

- Identity theft by known imposter package virginia form

- Your personal assets 497428485 form

- Essential documents for the organized traveler package virginia form

- Essential documents for the organized traveler package with personal organizer virginia form

- Postnuptial agreements package virginia form

- Letters of recommendation package virginia form

Find out other See The Last Page Of This Form For Definitions And Instructions

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors