Protected B DECLARATION of CONDITIONS of EMPLOYMENT When Form

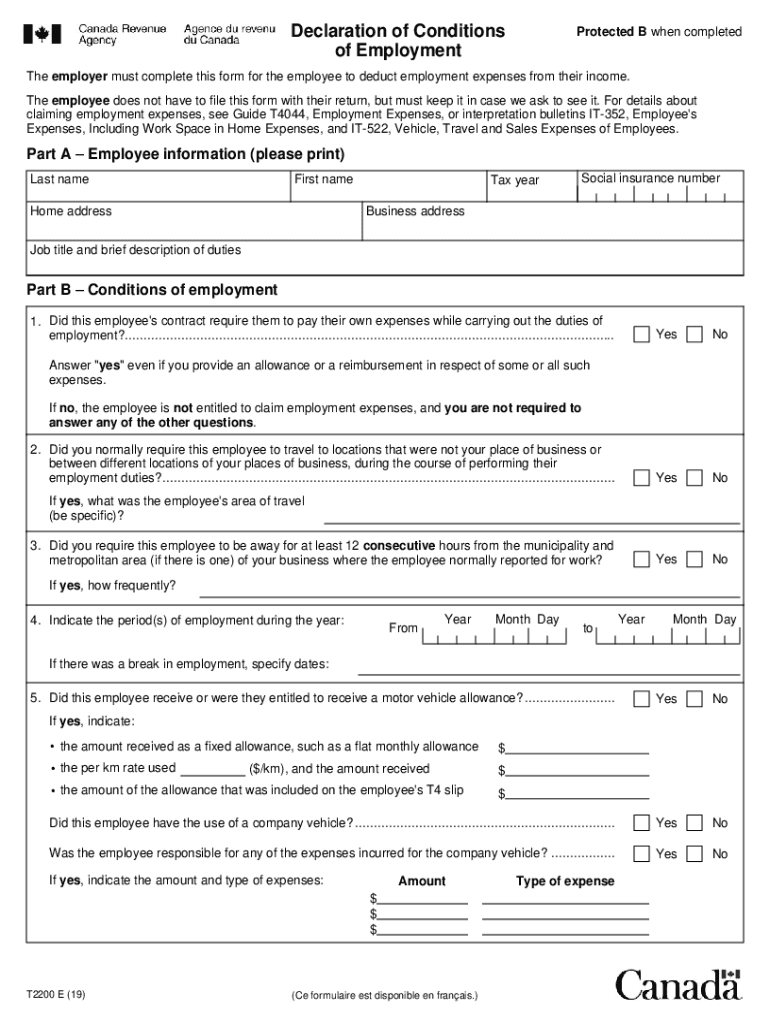

What is the declaration of conditions of employment T2200 form?

The declaration of conditions of employment T2200 form is a document used in the United States for employees who incur expenses related to their work. This form is essential for claiming deductions on your tax return, as it outlines the specific conditions under which an employee must work. It serves as proof that certain expenses were necessary for your job, allowing you to potentially reduce your taxable income. Understanding the purpose and requirements of the T2200 form is crucial for ensuring compliance with tax regulations.

Key elements of the declaration of conditions of employment T2200 form

The T2200 form includes several important elements that must be accurately completed to ensure its validity. Key components include:

- Employee Information: Personal details such as name, address, and social security number.

- Employer Information: The name and address of the employer must be clearly stated.

- Conditions of Employment: A detailed description of the employment conditions that necessitate the incurred expenses.

- Signature: The form must be signed by an authorized representative of the employer to validate it.

Each of these elements plays a critical role in ensuring that the form meets the necessary legal requirements for tax deductions.

Steps to complete the declaration of conditions of employment T2200 form

Completing the T2200 form involves several straightforward steps:

- Gather Information: Collect all necessary information about your employment and expenses.

- Fill Out Employee Details: Enter your personal information accurately in the designated sections.

- Provide Employer Information: Ensure that your employer's details are correctly filled in.

- Detail Employment Conditions: Clearly describe the conditions that require you to incur expenses.

- Obtain Signature: Have the form signed by an authorized employer representative.

- Review for Accuracy: Double-check all information for accuracy before submitting.

Following these steps will help ensure that your T2200 form is completed correctly and ready for submission.

Legal use of the declaration of conditions of employment T2200 form

The T2200 form is legally recognized as a valid document for claiming employment-related expenses. To ensure its legal use, it must be filled out accurately and signed by the employer. The form must also comply with IRS guidelines regarding employee expenses. If the form is not completed correctly, it may lead to issues during tax filing, including potential audits or penalties. Understanding the legal implications of the T2200 form is essential for both employees and employers.

Filing deadlines and important dates for the declaration of conditions of employment T2200 form

It is crucial to be aware of filing deadlines related to the T2200 form to avoid penalties. Generally, the T2200 form should be completed and submitted along with your tax return by the tax filing deadline, which is typically April 15 for most taxpayers. If you are claiming deductions for the previous tax year, ensure that you have the form ready by this date. Staying informed about these deadlines helps in maintaining compliance with tax regulations.

Examples of using the declaration of conditions of employment T2200 form

There are various scenarios where the T2200 form is applicable. For instance:

- Travel Expenses: Employees who travel for work and incur costs for transportation or lodging may use the T2200 form to claim these expenses.

- Home Office Deductions: Employees working from home may need the T2200 form to justify expenses related to their home office setup.

- Tools and Equipment: Workers required to purchase tools or equipment for their job can use the form to claim these costs.

These examples illustrate the practical applications of the T2200 form in various employment situations.

Quick guide on how to complete protected b declaration of conditions of employment when

Effortlessly Prepare Protected B DECLARATION OF CONDITIONS OF EMPLOYMENT When on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without any delays. Manage Protected B DECLARATION OF CONDITIONS OF EMPLOYMENT When on any device using the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

The Easiest Way to Edit and Electronically Sign Protected B DECLARATION OF CONDITIONS OF EMPLOYMENT When

- Obtain Protected B DECLARATION OF CONDITIONS OF EMPLOYMENT When and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from your chosen device. Modify and electronically sign Protected B DECLARATION OF CONDITIONS OF EMPLOYMENT When and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the protected b declaration of conditions of employment when

How to make an eSignature for your PDF online

How to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What is the declaration of conditions of employment T2200 form?

The declaration of conditions of employment T2200 form is a tax document provided by employers in Canada. It outlines the specific conditions under which an employee worked and supports their claims for deductible expenses. Understanding this form is crucial for accurate tax filings and ensuring you receive all eligible deductions.

-

How can airSlate SignNow help with the T2200 form?

airSlate SignNow offers a seamless solution for sending and eSigning the declaration of conditions of employment T2200 form. Our platform allows you to easily create, share, and sign this important document, ensuring that you and your employer can complete the process quickly and efficiently.

-

Is airSlate SignNow cost-effective for handling T2200 forms?

Yes, airSlate SignNow is a cost-effective solution for handling the declaration of conditions of employment T2200 form. Our competitive pricing plans are designed to fit businesses of all sizes, providing high value while allowing you to manage important documents without overspending.

-

What features does airSlate SignNow offer for T2200 form processing?

airSlate SignNow offers features that simplify the processing of the declaration of conditions of employment T2200 form, including easy document creation, secure eSigning, and tracking capabilities. Additionally, our user-friendly interface ensures that both employers and employees can navigate the process with ease.

-

Are there any integrations available for the T2200 form?

Absolutely! airSlate SignNow integrates with a variety of productivity and HR tools, making it simple to manage the declaration of conditions of employment T2200 form alongside other documents and workflows. This integration helps streamline processes and enhances overall efficiency.

-

How does airSlate SignNow ensure the security of T2200 form submissions?

Security is a top priority for airSlate SignNow. We implement advanced encryption and security protocols to protect all documents, including the declaration of conditions of employment T2200 form, ensuring that sensitive information is kept confidential and secure throughout the signing process.

-

Can I track the status of my T2200 form with airSlate SignNow?

Yes, with airSlate SignNow you can easily track the status of your declaration of conditions of employment T2200 form. Our platform provides real-time notifications and updates, allowing you to see when the document is viewed, signed, and completed.

Get more for Protected B DECLARATION OF CONDITIONS OF EMPLOYMENT When

- Virginia lien 497428490 form

- Va corporation form

- Storage business package virginia form

- Child care services package virginia form

- Special or limited power of attorney for real estate sales transaction by seller virginia form

- Closing estate transaction 497428495 form

- Limited power of attorney where you specify powers with sample powers included virginia form

- Limited power of attorney for stock transactions and corporate powers virginia form

Find out other Protected B DECLARATION OF CONDITIONS OF EMPLOYMENT When

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form