Form Lp Una 128 2005-2026

What is the Form LP UNA 128

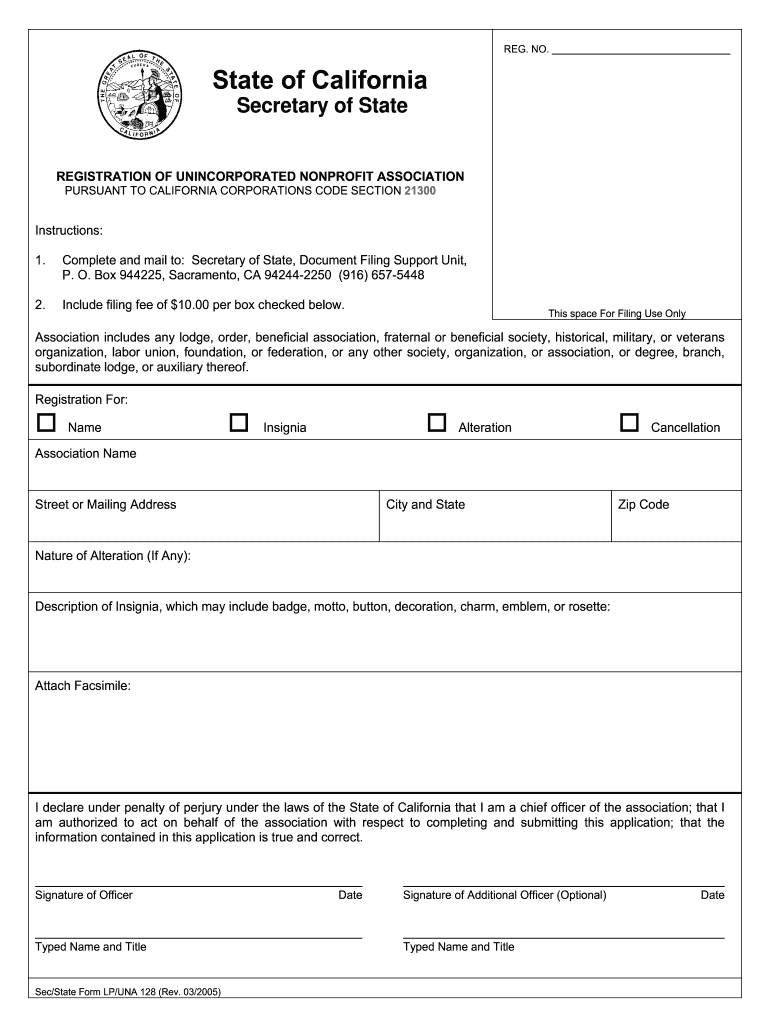

The Form LP UNA 128 is a legal document used to register an unincorporated nonprofit association in California. This form is essential for organizations that wish to operate without formal incorporation while still enjoying certain legal protections. It provides a framework for the association's governance and operations, ensuring compliance with state laws. Completing this form correctly is vital for establishing the association's legitimacy and protecting its interests.

How to use the Form LP UNA 128

Using the Form LP UNA 128 involves several key steps. First, gather all necessary information about the nonprofit association, including its name, purpose, and the names of its officers or members. Next, accurately fill out the form, ensuring all required fields are completed. After completing the form, it must be filed with the California Secretary of State. This process can be done online or through traditional mail, depending on your preference.

Steps to complete the Form LP UNA 128

Completing the Form LP UNA 128 requires careful attention to detail. Follow these steps for a successful submission:

- Gather information about your association, including its name, purpose, and members.

- Access the Form LP UNA 128 from the California Secretary of State's website.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form to the California Secretary of State, either online or by mail.

Key elements of the Form LP UNA 128

The Form LP UNA 128 includes several key elements that must be addressed for proper registration. These elements typically include:

- The name of the unincorporated nonprofit association.

- The purpose of the association, outlining its mission and activities.

- The names and addresses of the association's officers or members.

- Any specific provisions or rules governing the association's operations.

State-specific rules for the Form LP UNA 128

California has specific rules governing the use of the Form LP UNA 128. It is essential to comply with these regulations to ensure the association's legal standing. For instance, the form must be filed with the California Secretary of State, and any changes to the association's structure or purpose must be reported promptly. Additionally, the association must adhere to state laws regarding nonprofit operations, including fundraising and financial reporting.

Form Submission Methods (Online / Mail / In-Person)

The Form LP UNA 128 can be submitted through various methods, providing flexibility for users. The available submission methods include:

- Online: Submit the form directly through the California Secretary of State's online portal.

- Mail: Print the completed form and send it via postal service to the appropriate office.

- In-Person: Deliver the completed form to the Secretary of State's office for immediate processing.

Quick guide on how to complete unincorporated non profit lpuna 128 form

Handle Form Lp Una 128 anytime, anywhere

Your everyday organizational procedures may necessitate extra attention when working with state-specific business documents. Reclaim your work hours and lower the expenses related to document-driven processes with airSlate SignNow. airSlate SignNow provides you with a wide range of pre-made business documents, including Form Lp Una 128, which you can utilize and share with your colleagues. Handle your Form Lp Una 128 seamlessly with robust editing and eSignature features and send it directly to your recipients.

Steps to obtain Form Lp Una 128 in a few clicks:

- Pick a form applicable to your state.

- Click Learn More to access the document and verify its accuracy.

- Click on Get Form to begin working on it.

- Form Lp Una 128 will promptly open in the editor. No further actions are necessary.

- Utilize airSlate SignNow’s sophisticated editing tools to complete or modify the form.

- Select the Sign option to create your signature and eSign your document.

- Once finished, click on Done, save changes, and access your document.

- Share the form via email or text, or use a link-to-fill option with your associates or allow them to download the files.

airSlate SignNow signNowly reduces the time spent managing Form Lp Una 128 and enables you to find important documents in a single location. An extensive library of forms is organized and designed to address key enterprise processes necessary for your business. The advanced editor lessens the chance of errors, as you can easily correct mistakes and review your documents on any device before sending them out. Start your free trial today to explore all the advantages airSlate SignNow offers for your daily business operations.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the Amazon Affiliate W-8 Tax Form as a non-US individual?

It depends on your circumstances.You will probably have a form W8 BEN (for individuals/natural persons) or a form W8 BEN E (for corporations or other businesses that are not natural persons).Does your country have a double tax convention with the USA? Check here United States Income Tax Treaties A to ZDoes your income from Amazon relate to a business activity and does it specifically not include Dividends, Interest, Royalties, Licensing Fees, Fees in return for use of a technology, rental of property or offshore oil exploration?Is all the work carried out to earn this income done outside the US, do you have no employees, assets or offices located in the US that contributed to earning this income?Were you resident in your home country in the year that you earned this income and not resident in the US.Are you registered to pay tax on your business profits in your home country?If you meet these criteria you will probably be looking to claim that the income is taxable at zero % withholding tax under article 7 of your tax treaty as the income type is business profits arises solely from business activity carried out in your home country.

-

How do I find out whether I belong to the OBC creamy or non-creamy layer while filling out a form?

Please go to the caste census of 2011 to find out whether you are a backward caste . Then find out from the website of Backward Classes Commission whether you fall in OBC list .Having found that , the criteria is as under -You will be in non-creamy layer if your parents’ total annual income is not more than Rs.8 lakh . Your own income , if any , is not included . Any agricultural income of your parents is also not included .

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

Create this form in 5 minutes!

How to create an eSignature for the unincorporated non profit lpuna 128 form

How to make an eSignature for the Unincorporated Non Profit Lpuna 128 Form online

How to create an electronic signature for the Unincorporated Non Profit Lpuna 128 Form in Google Chrome

How to generate an electronic signature for putting it on the Unincorporated Non Profit Lpuna 128 Form in Gmail

How to create an electronic signature for the Unincorporated Non Profit Lpuna 128 Form straight from your mobile device

How to create an electronic signature for the Unincorporated Non Profit Lpuna 128 Form on iOS devices

How to create an electronic signature for the Unincorporated Non Profit Lpuna 128 Form on Android

People also ask

-

What is an unincorporated nonprofit association in California?

An unincorporated nonprofit association in California is a group of individuals engaging in a common charitable purpose without formal incorporation. These associations can operate without filing incorporation documents, which simplifies the setup process. However, it's important for members to understand the legal implications and responsibilities that come with this structure.

-

How do I form an unincorporated nonprofit association in California?

To form an unincorporated nonprofit association in California, you should draft a set of bylaws outlining the purpose, governance, and membership rules. While no formal filing is needed, it's essential to keep internal records to ensure compliance with state laws. Additionally, seeking legal advice can help clarify operating procedures and protect your association's interests.

-

What are the benefits of using airSlate SignNow for my unincorporated nonprofit association in California?

Using airSlate SignNow provides your unincorporated nonprofit association in California with a user-friendly platform to streamline document signing and management. This solution can save time and reduce administrative burdens, allowing your association to focus more on its charitable activities. Plus, the cost-effective pricing aligns with your nonprofit's budgetary needs.

-

Is airSlate SignNow compliant with California laws for unincorporated nonprofits?

Yes, airSlate SignNow is designed to be compliant with California laws, making it a reliable solution for your unincorporated nonprofit association. The platform meets security and privacy standards, ensuring that your documents and signatures are legally binding. Always consult legal counsel to confirm compliance with local regulations for your specific activities.

-

What features does airSlate SignNow offer for managing documents?

airSlate SignNow offers a variety of features for managing documents, including customizable templates, audit trails, and reminders for signatories. These tools enhance the efficiency of your unincorporated nonprofit association in California by ensuring that documents are processed quickly and securely. With these features, managing your important paperwork becomes easier and more effective.

-

Can I integrate airSlate SignNow with other tools for my unincorporated nonprofit association?

Yes, airSlate SignNow offers integrations with various tools, including Google Drive and Microsoft Office. These integrations allow your unincorporated nonprofit association in California to streamline your workflow by connecting different platforms. This capability improves efficiency in document management and simplifies collaboration among members.

-

What is the pricing structure for airSlate SignNow for nonprofits?

airSlate SignNow offers scaling pricing tiers, including discounts for nonprofit organizations, making it affordable for unincorporated nonprofit associations in California. Their cost-effective solutions ensure that you can access essential eSignature features without straining your budget. Check their website for specific pricing and nonprofit options to find the best fit for your needs.

Get more for Form Lp Una 128

Find out other Form Lp Una 128

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online