Kentucky Tax Registration Application PayOptions 2019-2026

Steps to complete the Kentucky Tax Registration Application

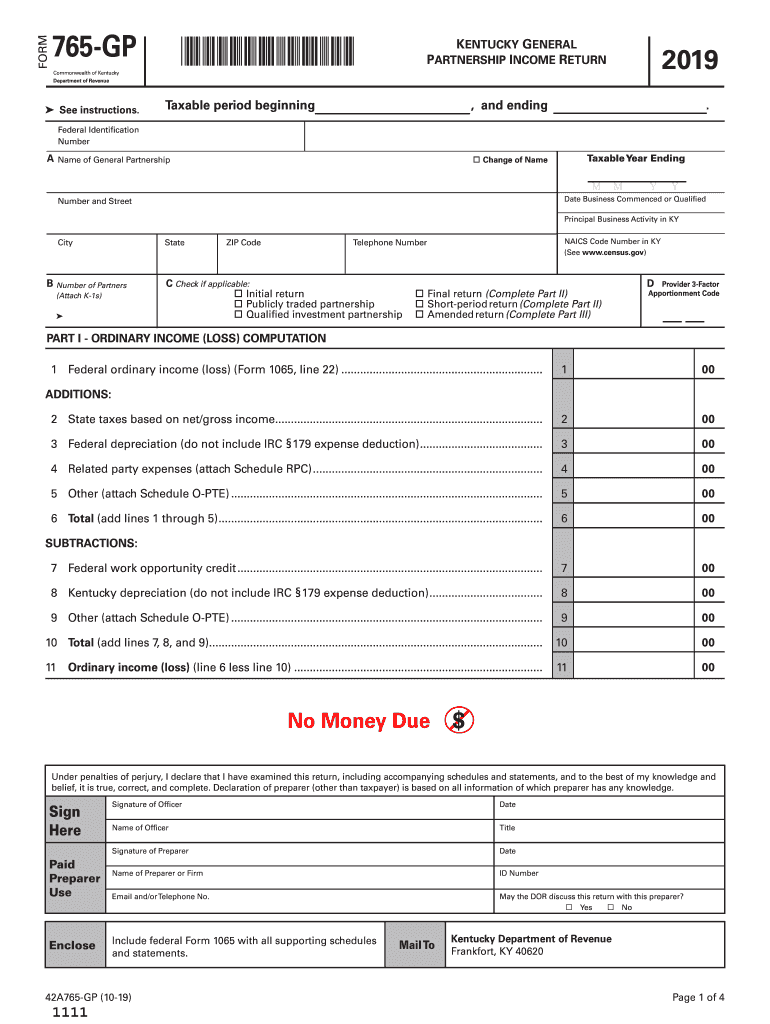

Completing the Kentucky Tax Registration Application involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including your business name, address, and federal Employer Identification Number (EIN). This information is crucial for establishing your business identity with the Kentucky Department of Revenue.

Next, access the Kentucky Tax Registration Application form, which can be obtained online or through designated state offices. Fill out the form carefully, ensuring that all sections are completed accurately. Pay particular attention to sections that require specific details about your business structure, such as whether you are a sole proprietor, partnership, or corporation.

Once the form is filled out, review it for any errors or omissions. It is essential to double-check all entries to avoid delays in processing. After verifying the information, submit the application either online or via mail, following the instructions provided on the form.

Legal use of the Kentucky Tax Registration Application

The Kentucky Tax Registration Application is a legal document that enables businesses to register for various state taxes. It is essential to understand that this form must be completed accurately to comply with state laws. The application serves as a formal request to the Kentucky Department of Revenue for the issuance of a tax account number, which is necessary for tax reporting and payment purposes.

Failure to submit the application or inaccuracies within it can lead to penalties or delays in tax processing. Therefore, it is vital to ensure that all information is truthful and complete. Additionally, businesses must maintain records of their registration for future reference and compliance audits.

Required Documents

When completing the Kentucky Tax Registration Application, specific documents may be required to support your application. These typically include your federal Employer Identification Number (EIN), business formation documents (such as Articles of Incorporation or Organization), and any relevant licenses or permits specific to your business type.

Having these documents ready will streamline the application process and help ensure that your registration is processed without unnecessary delays. It is advisable to keep copies of all submitted documents for your records, as they may be needed for future tax filings or audits.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Kentucky Tax Registration Application is crucial for compliance. Generally, businesses should submit their application before they commence operations or before the start of a new tax year. This ensures that they are properly registered to collect and remit taxes from the outset.

It is also important to be aware of any specific deadlines that may apply to different types of taxes, as these can vary. Keeping track of important dates will help avoid penalties and ensure that your business remains in good standing with the Kentucky Department of Revenue.

Form Submission Methods (Online / Mail / In-Person)

The Kentucky Tax Registration Application can be submitted through various methods, making it accessible for all business owners. The online submission is often the quickest and most efficient way to file your application. This method allows for immediate confirmation of receipt and can expedite the processing time.

Alternatively, businesses may choose to submit the application by mail. When doing so, it is recommended to send the form via certified mail to ensure it is received. In-person submissions are also an option at designated state offices, where staff can assist with any questions or concerns regarding the application process.

Eligibility Criteria

To qualify for the Kentucky Tax Registration Application, businesses must meet certain eligibility criteria. These criteria typically include being a legally recognized business entity operating within the state of Kentucky. This includes sole proprietorships, partnerships, corporations, and limited liability companies (LLCs).

Additionally, businesses must have a physical presence in Kentucky or engage in activities that require tax registration, such as selling goods or providing services. It is essential to review the specific eligibility requirements outlined by the Kentucky Department of Revenue to ensure compliance before submitting your application.

Quick guide on how to complete kentucky tax registration application payoptions

Effortlessly prepare Kentucky Tax Registration Application PayOptions on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides you with all the features you need to create, modify, and electronically sign your documents quickly without delays. Manage Kentucky Tax Registration Application PayOptions on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign Kentucky Tax Registration Application PayOptions without effort

- Locate Kentucky Tax Registration Application PayOptions and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Kentucky Tax Registration Application PayOptions and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kentucky tax registration application payoptions

Create this form in 5 minutes!

How to create an eSignature for the kentucky tax registration application payoptions

The way to create an electronic signature for your PDF in the online mode

The way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is GP Kentucky in relation to airSlate SignNow?

GP Kentucky refers to the integration of airSlate SignNow's eSignature solution within Kentucky's regulatory framework. This ensures that businesses in Kentucky can electronically sign documents securely while complying with state laws. Understanding GP Kentucky will enhance your document management efficiency in this jurisdiction.

-

How can airSlate SignNow benefit businesses in Kentucky?

AirSlate SignNow offers seamless eSigning capabilities for businesses operating in Kentucky. With its user-friendly interface, companies can speed up their document workflows, reduce costs, and enhance customer satisfaction. In a competitive landscape, leveraging GP Kentucky allows businesses to stay agile and efficient.

-

What are the pricing plans for airSlate SignNow for Kentucky businesses?

The pricing for airSlate SignNow is competitive and designed to meet the needs of various businesses in Kentucky. Plans start at an affordable rate, giving companies the flexibility to choose the best option for their document management needs. By choosing airSlate SignNow, Kentucky businesses can achieve cost savings while reaping the benefits of eSigning.

-

Does airSlate SignNow support integration with other software popular in Kentucky?

Yes, airSlate SignNow offers integration capabilities with numerous software solutions commonly used by businesses in Kentucky. This includes CRM systems, project management tools, and more. By utilizing these integrations, Kentucky users can streamline their workflows and ensure a seamless document signing process.

-

What features does airSlate SignNow include for users in Kentucky?

AirSlate SignNow provides a robust set of features including customizable templates, advanced security measures, and real-time tracking of document statuses. Kentucky users can benefit from these features to enhance their operational efficiency and maintain compliance with local regulations. Overall, airSlate SignNow is designed to meet the dynamic needs of businesses in Kentucky.

-

What are the main benefits of using airSlate SignNow for Kentucky companies?

Using airSlate SignNow enables Kentucky companies to digitize their document processes, resulting in faster turnaround times and increased productivity. The solution also helps in reducing paper waste and associated costs, aligning with eco-friendly practices. Additionally, the eSigning process is legally compliant in Kentucky, offering peace of mind to users.

-

Is training available for using airSlate SignNow in Kentucky?

Yes, airSlate SignNow provides comprehensive training resources for businesses in Kentucky. These resources include tutorials, webinars, and customer support to help users maximize the effectiveness of the platform. Proper training ensures that Kentucky users can fully leverage the features for optimal document management.

Get more for Kentucky Tax Registration Application PayOptions

Find out other Kentucky Tax Registration Application PayOptions

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT