Rev 1220 as 9 08 I Form

What is the Rev 1220 As 9 08 I?

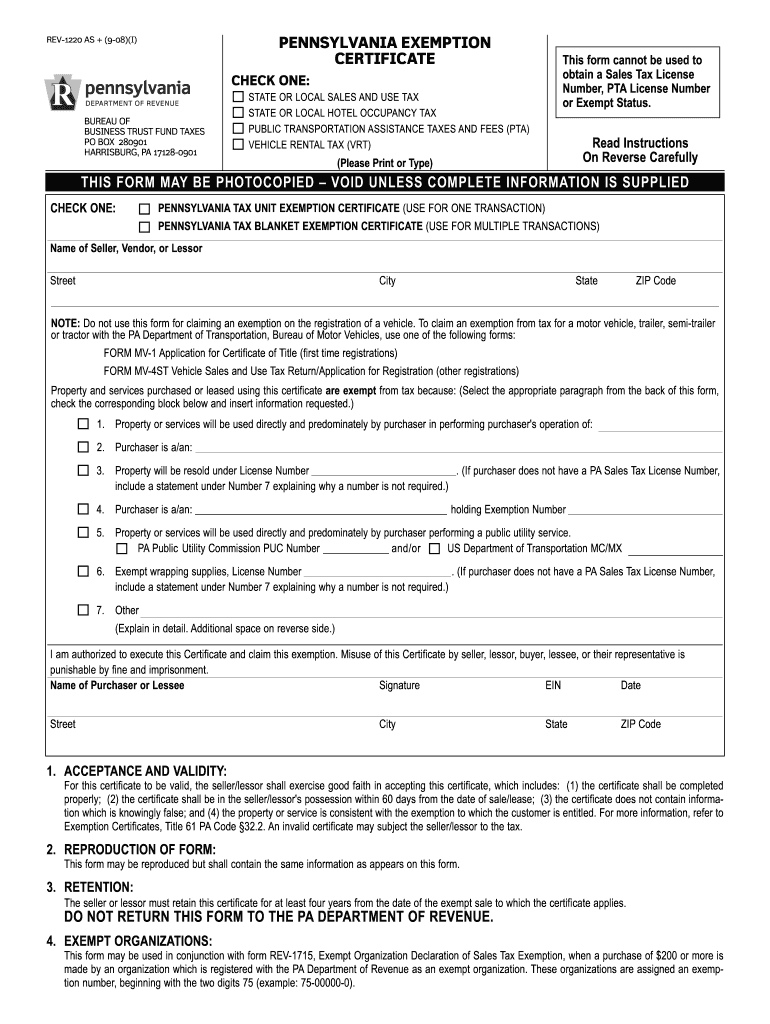

The Rev 1220 As 9 08 I is a Pennsylvania tax exemption form that allows qualifying entities to claim exemption from sales tax on certain purchases. This form is essential for organizations that meet specific criteria, such as non-profit organizations, government agencies, and certain educational institutions. By submitting this form, entities can avoid paying sales tax on eligible transactions, which can lead to significant savings over time.

Steps to Complete the Rev 1220 As 9 08 I

Completing the Rev 1220 As 9 08 I involves several key steps:

- Gather necessary information, including the entity's name, address, and tax identification number.

- Detail the specific purchases for which exemption is being claimed, ensuring they meet the criteria outlined by Pennsylvania tax laws.

- Provide signatures from authorized representatives of the entity, confirming that the information is accurate and complete.

- Review the form for any errors or omissions before submission to ensure compliance with state regulations.

Legal Use of the Rev 1220 As 9 08 I

The Rev 1220 As 9 08 I is legally recognized in Pennsylvania as a valid means for qualifying organizations to claim sales tax exemption. To ensure its legal standing, the form must be filled out accurately and submitted in accordance with state guidelines. Misuse of the form or false claims can lead to penalties, including fines or disqualification from future exemptions.

Who Issues the Form

The Rev 1220 As 9 08 I is issued by the Pennsylvania Department of Revenue. This department is responsible for administering tax laws and ensuring compliance within the state. Organizations seeking to use this form should refer to the Department of Revenue's guidelines for any updates or changes to the form or its requirements.

Eligibility Criteria

To be eligible to use the Rev 1220 As 9 08 I, organizations must meet specific criteria set by Pennsylvania law. Generally, eligible entities include:

- Non-profit organizations that operate for charitable, educational, or religious purposes.

- Government agencies at the federal, state, or local level.

- Certain educational institutions that qualify under state regulations.

It is crucial for applicants to verify their eligibility before completing the form to avoid complications during the exemption process.

Examples of Using the Rev 1220 As 9 08 I

Organizations can use the Rev 1220 As 9 08 I in various scenarios. For example:

- A non-profit organization purchasing office supplies for its operations can submit this form to avoid paying sales tax.

- A local government agency acquiring equipment for public services may also utilize this exemption.

- Educational institutions purchasing materials for classroom use can benefit from tax savings by using the Rev 1220 As 9 08 I.

These examples highlight the practical applications of the form in everyday transactions for eligible entities.

Quick guide on how to complete pa exemption certificate rev 1220 9 08i form

Effortlessly prepare Rev 1220 As 9 08 I on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate forms and securely keep them online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents rapidly without delays. Handle Rev 1220 As 9 08 I on any device with airSlate SignNow's Android or iOS apps and streamline any document-related process today.

How to modify and electronically sign Rev 1220 As 9 08 I effortlessly

- Find Rev 1220 As 9 08 I and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Rev 1220 As 9 08 I while ensuring effective communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What is the difference between the Pennsylvania Sales Tax ID form (PA-100) and the Tax Exemption form Rev-1220? I am an online reseller, and I want to purchase from a wholesaler.

PA-100 is a general registration form that enables you to register for all the necessary taxes in the state - not just sales & use, but also employer withholding, unemployment insurance tax, and many other miscellaneous taxes. The REV-1220 is typically used by businesses with no physical presence in Pennsylvania (or only entering the state temporarily, for something like a trade show), to inform other businesses they are buying from that they are exempt from sales tax because the purchases are for resale, or they are a tax-exempt organization, etc.

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

I am 2015 passed out CSE student, I am preparing for GATE2016 from a coaching, due to some reasons I do not have my provisional certificate, am I still eligible to fill application form? How?

Yes you are eligible. There is still time, application closes on October 1 this year. So if you get the provisional certificate in time you can just wait or if you know that you won't get it in time, just mail GATE organising institute at helpdesk@gate.iisc.ernet.in mentioning your problem. Hope it helps.

Create this form in 5 minutes!

How to create an eSignature for the pa exemption certificate rev 1220 9 08i form

How to generate an eSignature for your Pa Exemption Certificate Rev 1220 9 08i Form in the online mode

How to make an eSignature for the Pa Exemption Certificate Rev 1220 9 08i Form in Google Chrome

How to make an eSignature for putting it on the Pa Exemption Certificate Rev 1220 9 08i Form in Gmail

How to generate an eSignature for the Pa Exemption Certificate Rev 1220 9 08i Form right from your mobile device

How to create an electronic signature for the Pa Exemption Certificate Rev 1220 9 08i Form on iOS devices

How to make an eSignature for the Pa Exemption Certificate Rev 1220 9 08i Form on Android OS

People also ask

-

What is a PA tax exempt form, and why do I need it?

A PA tax exempt form is a document that allows businesses and organizations in Pennsylvania to make tax-exempt purchases. This form is essential for nonprofits, government entities, and other qualifying buyers to avoid paying sales tax on eligible items. Using the PA tax exempt form can save your organization money and streamline procurement processes.

-

How can airSlate SignNow help me manage my PA tax exempt forms?

airSlate SignNow provides an easy-to-use platform to send, eSign, and manage your PA tax exempt forms digitally. With its intuitive interface, you can quickly create, share, and track your forms. This helps ensure that all necessary documentation is completed accurately and efficiently, minimizing delays in your purchasing process.

-

Is there a cost associated with using airSlate SignNow for PA tax exempt forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Depending on the features you require, you can find a plan that fits your budget while allowing seamless management of your PA tax exempt forms. Our cost-effective solution ensures you get valuable document management without breaking the bank.

-

Can I integrate airSlate SignNow with other software for my PA tax exempt forms?

Absolutely! airSlate SignNow supports integrations with various software platforms, making it easy to incorporate your PA tax exempt forms into your existing workflows. Whether you use CRM systems, project management tools, or accounting software, airSlate SignNow can enhance your document signing and management processes.

-

What are the security features of airSlate SignNow for handling PA tax exempt forms?

airSlate SignNow prioritizes security, providing features such as advanced encryption, secure cloud storage, and compliance with industry standards. When managing your PA tax exempt forms, you can be confident that sensitive information is protected. Our commitment to security ensures that your documents remain confidential and secure throughout the signing process.

-

How quickly can I process my PA tax exempt forms with airSlate SignNow?

You can process your PA tax exempt forms in a matter of minutes using airSlate SignNow. Our platform allows for instant sending and eSigning, signNowly reducing processing time compared to traditional methods. This efficiency can help your organization respond quickly to purchasing needs and keep operations running smoothly.

-

What types of businesses can benefit from using the PA tax exempt form with airSlate SignNow?

Various types of businesses can benefit from using the PA tax exempt form, including nonprofits, educational institutions, and government agencies. Any organization looking to make tax-exempt purchases in Pennsylvania can leverage airSlate SignNow to simplify the process. This valuable tool enhances document management for all qualifying buyers.

Get more for Rev 1220 As 9 08 I

- 00 902 university of texas system payor information form 00 902 university of texas system payor information form

- Spring 2018 registration appeal form hunter college

- Parent plus duplicate check request texas aampampm student form

- Information update form

- Consent to provide employment information 1 29 15pdf

- Decod form

- Forms university of miami calder medical library

- Ustla 5 real property questionnaire ustla 5 real property questionnaire justice form

Find out other Rev 1220 As 9 08 I

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online