Personal Property Tax Jefferson County Mo 2018

What is the Personal Property Tax Jefferson County MO

The personal property tax in Jefferson County, Missouri, is a local tax levied on tangible personal property owned by individuals and businesses. This tax is assessed annually and is based on the value of personal property, which can include vehicles, machinery, and equipment. The revenue generated from this tax helps fund local services such as schools, roads, and public safety. Understanding this tax is crucial for residents and business owners to ensure compliance and proper financial planning.

How to use the Personal Property Tax Jefferson County MO

Using the personal property tax in Jefferson County involves several steps, including assessing your property, determining its value, and filing the necessary forms. Residents must report their personal property to the county assessor, who will evaluate its worth. Once the assessment is complete, taxpayers will receive a tax bill that outlines the amount owed. It is important to keep accurate records of your property and its value to facilitate this process and ensure you are paying the correct amount.

Steps to complete the Personal Property Tax Jefferson County MO

Completing the personal property tax process in Jefferson County requires specific actions:

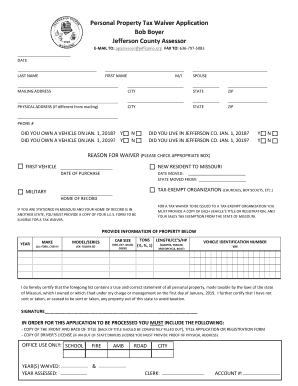

- Gather documentation for all personal property owned, including vehicles and equipment.

- Determine the fair market value of each item, which may involve researching current market prices.

- Fill out the personal property declaration form accurately, detailing all owned items.

- Submit the completed form to the county assessor's office by the designated deadline.

- Review the tax bill once received and ensure that it reflects the assessed value correctly.

Legal use of the Personal Property Tax Jefferson County MO

The legal framework governing the personal property tax in Jefferson County is established by state law. Taxpayers are required to file their personal property declarations annually, and failure to do so can result in penalties. The tax must be paid by the specified due date to avoid additional fees or interest. Understanding the legal obligations surrounding this tax is essential for compliance and to avoid potential legal issues.

Required Documents

To complete the personal property tax process in Jefferson County, several documents are necessary:

- Personal property declaration form, which details all owned items.

- Proof of ownership for each item, such as titles or purchase receipts.

- Documentation supporting the valuation of items, such as appraisals or market research.

Form Submission Methods (Online / Mail / In-Person)

Residents of Jefferson County have multiple options for submitting their personal property tax forms:

- Online submission through the county's official website, if available.

- Mailing the completed form to the county assessor's office.

- In-person submission at the county assessor's office during business hours.

Quick guide on how to complete personal property tax jefferson county mo

Complete Personal Property Tax Jefferson County Mo effortlessly on any device

Digital document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Personal Property Tax Jefferson County Mo on any platform with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Personal Property Tax Jefferson County Mo effortlessly

- Obtain Personal Property Tax Jefferson County Mo and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form: via email, SMS, an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Personal Property Tax Jefferson County Mo and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct personal property tax jefferson county mo

Create this form in 5 minutes!

How to create an eSignature for the personal property tax jefferson county mo

The way to generate an eSignature for your PDF file in the online mode

The way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is personal property in Jefferson County, MO?

Personal property in Jefferson County, MO, refers to movable assets that are not affixed to land or buildings. This includes items like furniture, vehicles, and equipment. Understanding what constitutes personal property can help you manage your assets more effectively.

-

How does airSlate SignNow help with personal property transactions in Jefferson County, MO?

airSlate SignNow provides an efficient platform to send and eSign documents related to personal property transactions in Jefferson County, MO. This simplifies the process, ensuring that all necessary paperwork is completed quickly and securely, allowing you to focus on your property dealings.

-

What are the pricing options for airSlate SignNow for managing personal property documents?

airSlate SignNow offers several pricing plans tailored to fit your needs when dealing with personal property in Jefferson County, MO. Depending on the volume of documents and features you require, you can select a plan that ensures cost-effectiveness while enhancing your document management efficiency.

-

Are there integrations available with airSlate SignNow for personal property management?

Yes, airSlate SignNow integrates seamlessly with various applications that can assist in managing personal property in Jefferson County, MO. This includes integration with CRM systems, cloud storage services, and other tools that streamline your workflows and document handling.

-

What security features does airSlate SignNow provide for personal property documents?

airSlate SignNow employs robust security protocols to protect personal property documents in Jefferson County, MO. With features like encryption, two-factor authentication, and secure cloud storage, your sensitive information remains safe throughout the signing and storing processes.

-

How user-friendly is airSlate SignNow for managing personal property documents?

airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage personal property documents in Jefferson County, MO. The intuitive interface allows users to send, sign, and store documents without requiring advanced technical skills.

-

Can airSlate SignNow facilitate remote signing for personal property transactions?

Absolutely! airSlate SignNow allows for remote eSigning of personal property documents in Jefferson County, MO. This offers flexibility for all parties involved, ensuring that transactions can be completed quickly, even if signers are not physically present.

Get more for Personal Property Tax Jefferson County Mo

- Wpf garn 010500 exemption claim washington form

- Claim exemption form 497429541

- Wpf garn 010570 notice to defendant of non responsive exemption claim washington form

- Wpf garn 010570 note on usage notice to defendant of non responsive exemption claim washington form

- Wpf garn 010600 motion and certification for default against garnishee washington form

- Wpf garn 010620 notice of default against garnishee washington form

- Default order form

- Wa writ form

Find out other Personal Property Tax Jefferson County Mo

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter