Personal Property Tax Waiver Application Bob Boyer 2024-2026

Understanding the Personal Property Tax Waiver Application

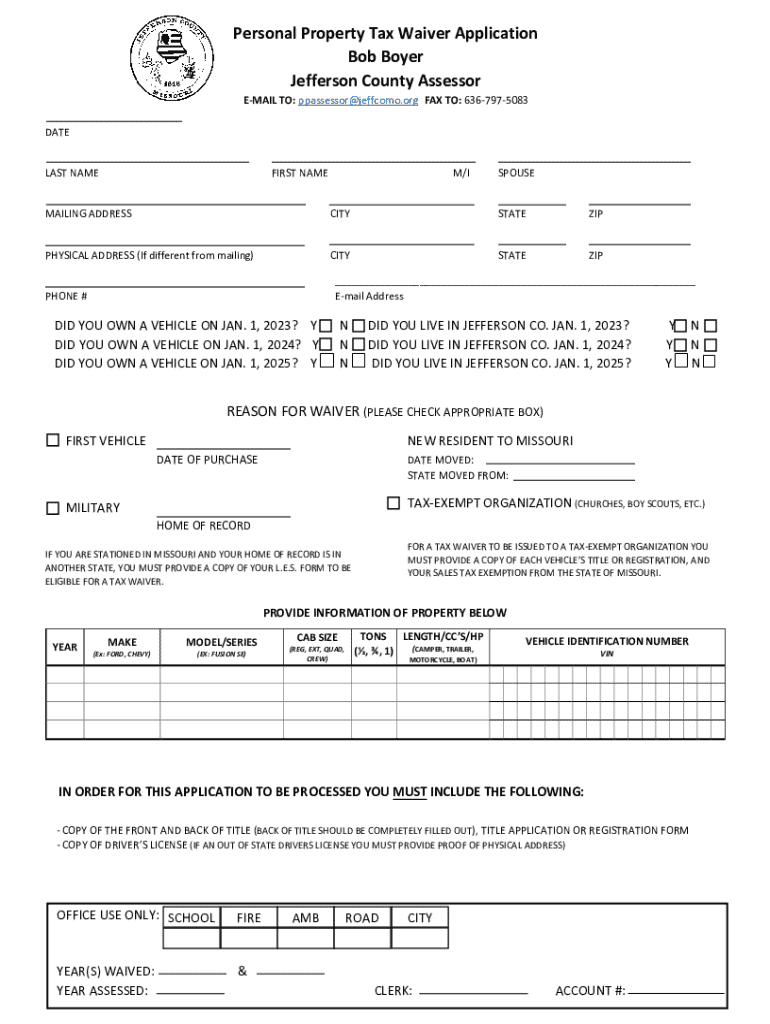

The Jefferson County personal property tax waiver application is a formal request that allows individuals or businesses to seek relief from personal property taxes under specific circumstances. This application is essential for those who may qualify due to financial hardship, changes in property status, or other qualifying factors. Understanding the criteria and process for this waiver can significantly impact your financial obligations.

Eligibility Criteria for the Waiver

To qualify for the personal property tax waiver in Jefferson County, applicants must meet certain eligibility requirements. Generally, these may include:

- Demonstrating financial hardship or inability to pay taxes.

- Providing proof of income and expenses.

- Meeting specific property ownership criteria.

- Filing the application within designated timeframes.

It is crucial to review these criteria thoroughly to ensure that you meet all requirements before submitting your application.

Steps to Complete the Application

Completing the Jefferson County personal property tax waiver application involves several key steps:

- Gather necessary documentation, including proof of income and property ownership.

- Fill out the application form accurately, providing all required information.

- Review the application for completeness and accuracy.

- Submit the application by the specified deadline, ensuring it is sent to the correct office.

Following these steps meticulously can help streamline the approval process and enhance your chances of receiving the waiver.

Required Documents for Submission

When applying for the personal property tax waiver, certain documents are typically required to support your application. These may include:

- Proof of income, such as recent pay stubs or tax returns.

- Documentation of any financial hardships, like medical bills or unemployment records.

- Identification documents, such as a driver's license or Social Security card.

- Any relevant property documentation, including ownership records.

Having these documents ready can facilitate a smoother application process and help substantiate your request for a waiver.

Submission Methods for the Application

The Jefferson County personal property tax waiver application can typically be submitted through various methods, including:

- Online submission via the county's official website.

- Mailing the completed application to the designated tax office.

- In-person submission at the local tax office.

Choosing the most convenient submission method can help ensure that your application is received on time and processed efficiently.

Approval Time and Process

The approval time for the personal property tax waiver application can vary based on several factors, including the volume of applications received and the completeness of submitted documents. Typically, applicants can expect a response within a few weeks to a couple of months. It is advisable to follow up with the tax office if you do not receive notification within the expected timeframe.

Potential Penalties for Non-Compliance

Failure to comply with the requirements for personal property taxes can lead to penalties. These may include:

- Accrued interest on unpaid taxes.

- Additional fines for late submissions.

- Potential legal action for unresolved tax obligations.

Understanding these consequences emphasizes the importance of timely and accurate submissions to avoid complications.

Create this form in 5 minutes or less

Find and fill out the correct personal property tax waiver application bob boyer

Create this form in 5 minutes!

How to create an eSignature for the personal property tax waiver application bob boyer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Jefferson County personal property tax waiver?

The Jefferson County personal property tax waiver is a legal document that allows property owners to request an exemption from certain personal property taxes. This waiver can signNowly reduce the financial burden on individuals and businesses in Jefferson County. Understanding how to apply for this waiver is crucial for maximizing your tax benefits.

-

How can airSlate SignNow help with the Jefferson County personal property tax waiver?

airSlate SignNow provides an efficient platform for preparing and signing the Jefferson County personal property tax waiver electronically. With our user-friendly interface, you can easily fill out the necessary forms and send them for eSignature, streamlining the entire process. This saves time and ensures that your waiver is submitted correctly.

-

What are the costs associated with obtaining a Jefferson County personal property tax waiver?

The costs for obtaining a Jefferson County personal property tax waiver can vary depending on the specific circumstances and any associated fees. However, using airSlate SignNow can help minimize costs by eliminating the need for physical paperwork and reducing administrative overhead. Our platform offers competitive pricing to ensure you get the best value.

-

Are there any specific eligibility requirements for the Jefferson County personal property tax waiver?

Yes, there are specific eligibility requirements for the Jefferson County personal property tax waiver, which typically include ownership of the property and compliance with local tax regulations. It's important to review these requirements carefully to ensure you qualify. airSlate SignNow can assist you in gathering the necessary documentation to support your application.

-

What features does airSlate SignNow offer for managing the Jefferson County personal property tax waiver?

airSlate SignNow offers a range of features for managing the Jefferson County personal property tax waiver, including customizable templates, secure eSigning, and document tracking. These features enhance the efficiency of your application process and ensure that all parties can easily access and sign the necessary documents. This makes it easier to manage your tax waiver applications.

-

Can I integrate airSlate SignNow with other tools for the Jefferson County personal property tax waiver process?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms, allowing you to streamline the Jefferson County personal property tax waiver process. Whether you use CRM systems, cloud storage, or other document management solutions, our integrations enhance your workflow and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for the Jefferson County personal property tax waiver?

Using airSlate SignNow for the Jefferson County personal property tax waiver offers numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform ensures that your documents are signed and stored securely, reducing the risk of errors and delays. This allows you to focus on other important aspects of your business or personal finances.

Get more for Personal Property Tax Waiver Application Bob Boyer

Find out other Personal Property Tax Waiver Application Bob Boyer

- How Can I Add eSign in WorkDay

- How To Install eSign in NetSuite

- Can I Add eSign in WorkDay

- How To Set Up eSign in Word

- How To Set Up eSign in PaperWise

- How To Install eSign in Egnyte

- Help Me With Set Up eSign in Word

- How To Add eSign in ServiceNow

- How Can I Add eSign in ServiceNow

- How To Set Up eSign in 1Password

- How Do I Set Up eSign in 1Password

- How To Set Up eSign in WebMerge

- Can I Install eSign in Egnyte

- Help Me With Set Up eSign in 1Password

- How Can I Set Up eSign in 1Password

- How Can I Set Up eSign in WebMerge

- Can I Set Up eSign in 1Password

- How To Set Up eSign in Zapier

- How To Set Up eSign in Jitterbit

- Can I Set Up eSign in Zapier