State of Wisconsin Form Cc 2020

What is the State of Wisconsin Form CC?

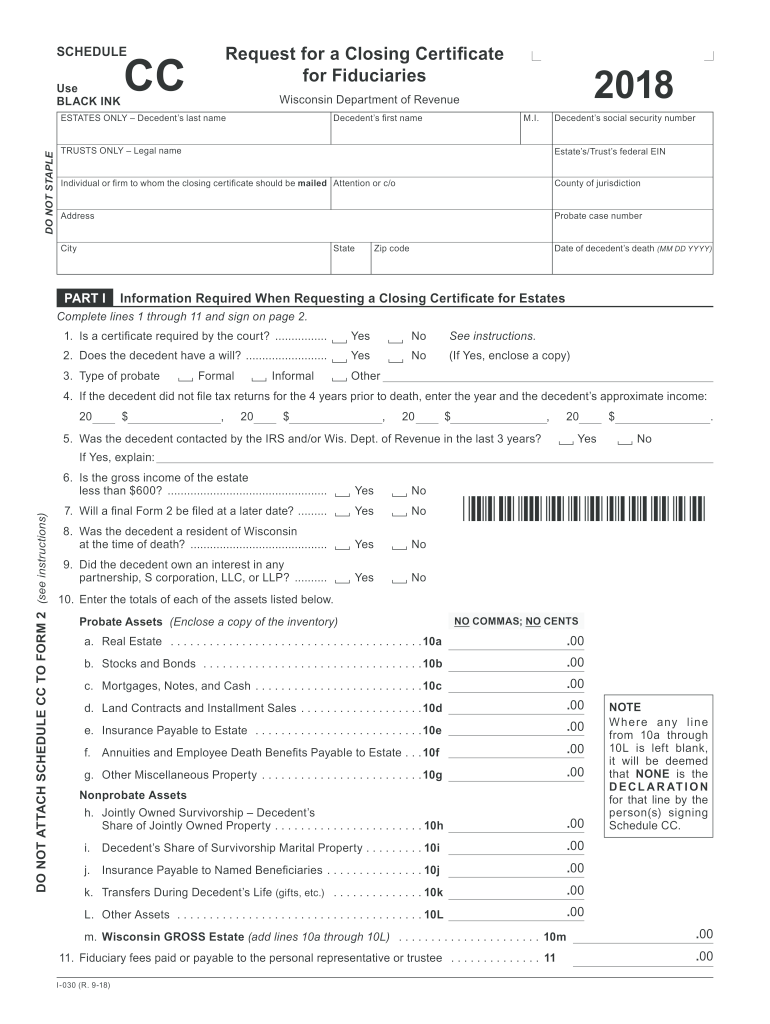

The State of Wisconsin Form CC, commonly referred to as the Wisconsin Department of Revenue Schedule CC, is a tax form used primarily by fiduciaries to report the income and deductions of estates or trusts. This form is essential for ensuring compliance with state tax obligations and is specifically designed to facilitate the proper reporting of income generated from the assets held in the estate or trust. Understanding the purpose and requirements of the Schedule CC is crucial for fiduciaries managing these financial entities.

Steps to Complete the State of Wisconsin Form CC

Completing the Wisconsin Schedule CC involves several important steps to ensure accuracy and compliance. Here is a general outline of the process:

- Gather necessary documentation, including income statements, expense records, and any relevant tax documents related to the estate or trust.

- Fill out the identifying information at the top of the form, including the name of the estate or trust, the fiduciary's name, and contact details.

- Report the income generated by the estate or trust in the designated sections, ensuring that all figures are accurate and substantiated by the gathered documentation.

- Detail any deductions that apply, such as administrative expenses or distributions made to beneficiaries.

- Review the completed form for accuracy and completeness, ensuring all required fields are filled.

- Sign and date the form, as required, to validate the submission.

Legal Use of the State of Wisconsin Form CC

The legal use of the Wisconsin Schedule CC is governed by state tax laws and regulations. This form serves as an official document for reporting income and deductions related to estates and trusts. When completed correctly, it provides a legal basis for the fiduciary's tax reporting and can be used in case of audits or inquiries from the Wisconsin Department of Revenue. Adhering to the guidelines set forth by the state ensures that the form is recognized as valid and enforceable.

Required Documents for the State of Wisconsin Form CC

To successfully complete the Wisconsin Schedule CC, several documents are typically required. These documents help substantiate the income and deductions reported on the form:

- Income statements from the estate or trust, including interest, dividends, and rental income.

- Records of expenses incurred in managing the estate or trust, such as legal fees, accounting fees, and maintenance costs.

- Documentation of distributions made to beneficiaries during the tax year.

- Any prior year tax returns related to the estate or trust, if applicable.

Form Submission Methods for the State of Wisconsin Form CC

The Wisconsin Schedule CC can be submitted through various methods, providing flexibility for fiduciaries. The available submission methods include:

- Online e-filing through the Wisconsin Department of Revenue's electronic filing system, which allows for quicker processing.

- Mailing a paper copy of the completed form to the appropriate address provided by the Wisconsin Department of Revenue.

- In-person submission at designated state tax offices, if preferred.

Filing Deadlines for the State of Wisconsin Form CC

Filing deadlines for the Wisconsin Schedule CC are crucial for compliance. Typically, the form must be filed by the due date of the estate or trust's income tax return. It is essential to check the specific deadlines for the tax year in question, as they may vary. Late submissions can result in penalties or interest, so timely filing is recommended to avoid complications.

Quick guide on how to complete state of wisconsin form cc

Complete State Of Wisconsin Form Cc effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you require to create, alter, and eSign your documents quickly and without complications. Manage State Of Wisconsin Form Cc on any device using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign State Of Wisconsin Form Cc effortlessly

- Find State Of Wisconsin Form Cc and then click Get Form to begin.

- Employ the tools we offer to finish your document.

- Annotate relevant sections of your documents or hide sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Modify and eSign State Of Wisconsin Form Cc and guarantee clear communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of wisconsin form cc

Create this form in 5 minutes!

How to create an eSignature for the state of wisconsin form cc

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is the Wisconsin Department of Revenue Schedule CC?

The Wisconsin Department of Revenue Schedule CC is a form used by businesses and individuals to report and claim certain tax credits and deductions. Understanding how to fill out this schedule properly is crucial for maximizing tax benefits. Using airSlate SignNow can simplify the process by allowing you to eSign and send documents directly related to your Schedule CC submission.

-

How can airSlate SignNow help with the Wisconsin Department of Revenue Schedule CC?

airSlate SignNow provides an efficient platform for businesses to electronically sign and send documents necessary for the Wisconsin Department of Revenue Schedule CC. Our solution streamlines the paperwork process, ensuring you meet deadlines and maintain compliance with state requirements. With easy navigation, you can have your Schedule CC processed swiftly and securely.

-

Is there a cost associated with filing the Wisconsin Department of Revenue Schedule CC using airSlate SignNow?

The use of airSlate SignNow to file your Wisconsin Department of Revenue Schedule CC involves a subscription fee based on the features you choose. However, the efficiency and time saved by using our service can outweigh the costs, making it a cost-effective solution for your documentation needs. You can explore various plans that cater to different business sizes and requirements.

-

What features does airSlate SignNow offer for handling the Wisconsin Department of Revenue Schedule CC?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking to assist with the Wisconsin Department of Revenue Schedule CC. These features ensure that your documents are not only completed accurately but also handled securely throughout the process. With our user-friendly interface, managing your Schedule CC has never been easier.

-

Can airSlate SignNow integrate with other software used for financial reporting?

Yes, airSlate SignNow can integrate seamlessly with various accounting and financial reporting software, enhancing your ability to manage documents related to the Wisconsin Department of Revenue Schedule CC. Whether it's cloud storage services or financial management tools, our integrations facilitate a smooth workflow. This streamlines the document preparation and submission processes for your Schedule CC.

-

What benefits does using airSlate SignNow provide for tax preparation related to the Wisconsin Department of Revenue Schedule CC?

Using airSlate SignNow can signNowly enhance your tax preparation process, particularly for the Wisconsin Department of Revenue Schedule CC. The platform offers speed, efficiency, and compliance, ensuring that you can submit all required documentation without hassle. Additionally, the ability to track document status helps alleviate the stress of last-minute submissions.

-

How secure is airSlate SignNow when dealing with sensitive documents like the Wisconsin Department of Revenue Schedule CC?

airSlate SignNow prioritizes the security of your documents, including those related to the Wisconsin Department of Revenue Schedule CC. We employ advanced encryption protocols and secure servers to protect your information. Our commitment to security ensures that your sensitive tax documents are kept confidential and safe from unauthorized access.

Get more for State Of Wisconsin Form Cc

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles washington form

- Motion declaration form

- Letter from tenant to landlord about landlords failure to make repairs washington form

- Notice motion order form

- Wa landlord rent form

- Misdemeanor 497429601 form

- Statutory warranty deed with representative acknowledgment washington form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession washington form

Find out other State Of Wisconsin Form Cc

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast