Balance Sheet Information and Later Tax Years 2018-2026

Understanding the Balance Sheet Information for t2sch100

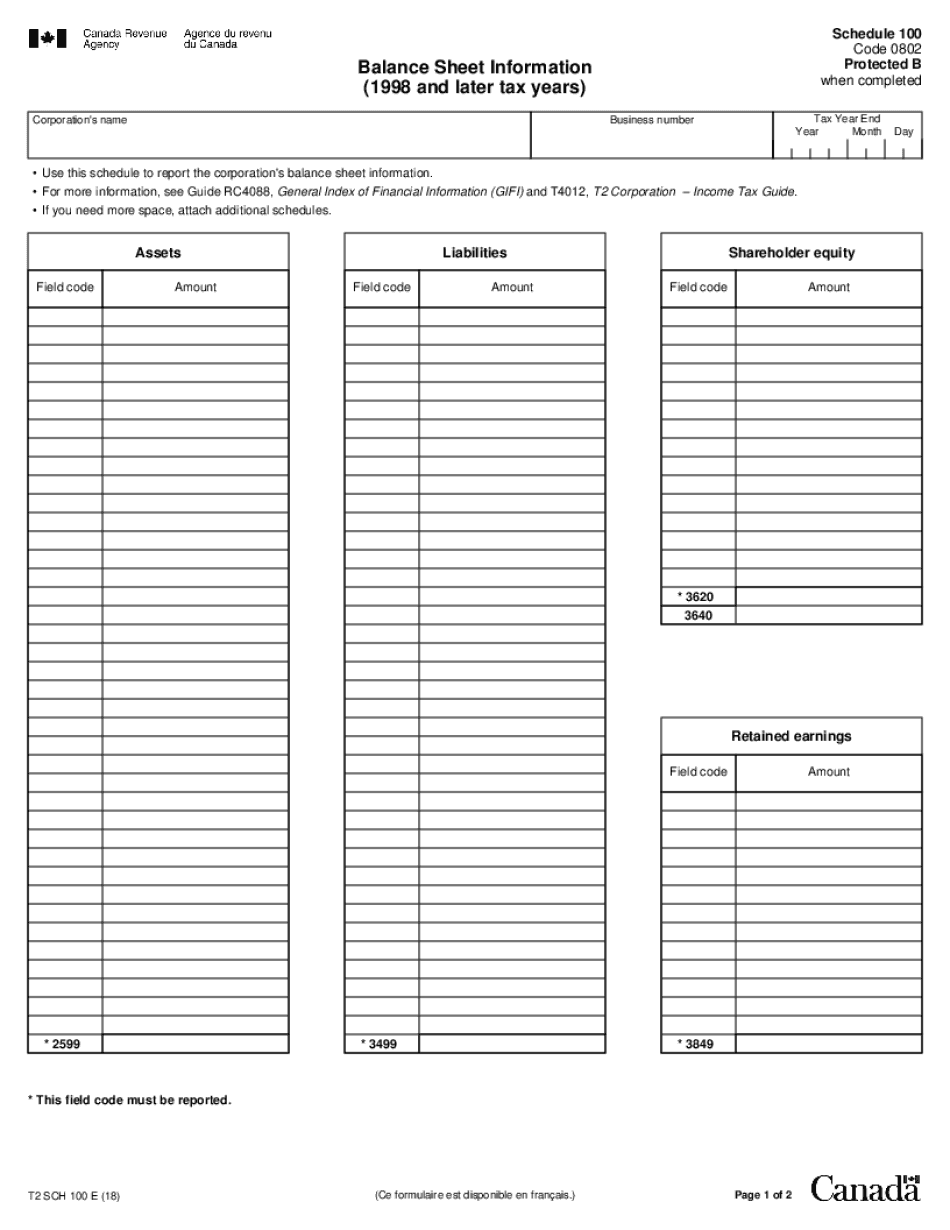

The balance sheet information in the t2sch100 form provides a comprehensive overview of a corporation's financial position at a specific point in time. It includes key components such as assets, liabilities, and equity, which are essential for assessing the financial health of the business. This information is crucial for tax purposes and helps ensure compliance with IRS regulations. The balance sheet must accurately reflect the corporation's financial status to avoid potential penalties or issues during audits.

Steps to Complete the t2sch100 Balance Sheet

Completing the t2sch100 balance sheet involves several important steps:

- Gather financial records, including bank statements, invoices, and receipts.

- List all assets, categorizing them into current and non-current assets.

- Detail all liabilities, distinguishing between current and long-term liabilities.

- Calculate equity by subtracting total liabilities from total assets.

- Ensure all figures are accurate and reflect the financial position as of the reporting date.

Following these steps will help ensure that the balance sheet is complete and accurate, which is vital for tax reporting and compliance.

Legal Use of the t2sch100 Balance Sheet Information

The balance sheet information provided in the t2sch100 is legally binding when completed accurately and submitted to the IRS. It must comply with relevant tax laws and regulations, including adherence to the Generally Accepted Accounting Principles (GAAP). Accurate reporting is essential to avoid legal repercussions, such as fines or audits. Businesses should maintain thorough records to support the information presented in the t2sch100.

Required Documents for t2sch100 Submission

When filing the t2sch100, certain documents are necessary to support the information provided on the balance sheet. These documents may include:

- Financial statements, including income statements and cash flow statements.

- Bank statements that verify asset balances.

- Loan agreements and other documentation for liabilities.

- Tax returns from previous years for reference and consistency.

Having these documents ready can streamline the filing process and enhance the accuracy of the submitted information.

Filing Deadlines for t2sch100

It is important to be aware of the filing deadlines associated with the t2sch100. Typically, the form must be submitted by the end of the corporation's fiscal year. Failure to file on time can result in penalties or interest charges. Corporations should mark their calendars and prepare the necessary documentation well in advance to ensure timely submission.

IRS Guidelines for t2sch100 Compliance

The IRS provides specific guidelines for completing and submitting the t2sch100. These guidelines include instructions on how to report various types of assets and liabilities, as well as the required format for the balance sheet. It is essential for businesses to review these guidelines thoroughly to ensure compliance and avoid errors that could lead to audits or penalties. Keeping abreast of any changes in IRS regulations is also advisable.

Quick guide on how to complete balance sheet information 1998 and later tax years

Effortlessly prepare Balance Sheet Information And Later Tax Years on any device

The management of online documents has gained popularity among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage Balance Sheet Information And Later Tax Years on any platform with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The easiest way to modify and electronically sign Balance Sheet Information And Later Tax Years without effort

- Locate Balance Sheet Information And Later Tax Years and click on Get Form to begin.

- Utilize the tools available to submit your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your adjustments.

- Choose how you wish to send your form, either by email, SMS, invitation link, or download it to your computer.

Disregard concerns about lost or misplaced documents, tedious form searches, or errors that require new copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Balance Sheet Information And Later Tax Years and ensure outstanding communication at each stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct balance sheet information 1998 and later tax years

Create this form in 5 minutes!

How to create an eSignature for the balance sheet information 1998 and later tax years

How to make an electronic signature for a PDF file in the online mode

How to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What is a balance sheet example PDF, and how can it help my business?

A balance sheet example PDF provides a clear template that shows your company's financial position at a specific time. By utilizing this template, businesses can easily organize their assets, liabilities, and equity, making financial analysis more straightforward. It's crucial for ensuring accurate reporting and decision-making.

-

How can I create a balance sheet example PDF using airSlate SignNow?

Creating a balance sheet example PDF with airSlate SignNow is easy. You can start by selecting a pre-designed template or upload your document. Then, simply add your financial details, and our platform will convert it into a professional PDF, ready for eSignature and sharing.

-

What features does airSlate SignNow offer for managing balance sheet example PDFs?

airSlate SignNow offers features like document editing, electronic signatures, and customizable templates. You can securely manage your balance sheet example PDFs with advanced tracking and compliance options, ensuring your business meets all legal requirements for document sign-offs.

-

Is airSlate SignNow a cost-effective solution for handling balance sheet example PDFs?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our competitive pricing plans allow you to access essential features for managing balance sheet example PDFs without breaking the bank. You can choose a plan that fits your budget and needs.

-

Can I integrate airSlate SignNow with other software for managing balance sheet example PDFs?

Absolutely! airSlate SignNow offers seamless integrations with various software applications such as accounting software and cloud storage services. This allows you to streamline the management of your balance sheet example PDFs and enhance your overall workflow.

-

What benefits can I expect from using airSlate SignNow for balance sheet example PDFs?

Using airSlate SignNow for your balance sheet example PDFs provides signNow benefits, including time savings, improved accuracy, and enhanced security. You can quickly send, sign, and organize your documents, keeping your financial information safe and easily accessible.

-

How secure is my financial data when using airSlate SignNow with balance sheet example PDFs?

Your financial data's security is a top priority for airSlate SignNow. We employ industry-standard encryption protocols to protect your balance sheet example PDFs and ensure that only authorized users can access them. Trust in our platform for reliable data protection.

Get more for Balance Sheet Information And Later Tax Years

- Wpf ps 120300 response to petition for rescission of denial of paternity within 60 days washington form

- Findings fact conclusions form

- Denial paternity form

- Wpf ps 130100 petition for challenge to acknowledgment of paternity washington form

- Wpf ps 130200 summons challenge to acknowledgment of paternity washington form

- Washington order court form

- Wpf ps 140100 petition for challenge to denial of paternity washington form

- Wpf ps 140200 summons challenge to denial of paternity washington form

Find out other Balance Sheet Information And Later Tax Years

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself