Income Tax Guide for Individuals City of Grand Rapids 2019-2026

What is the Income Tax Guide for Individuals in the City of Grand Rapids?

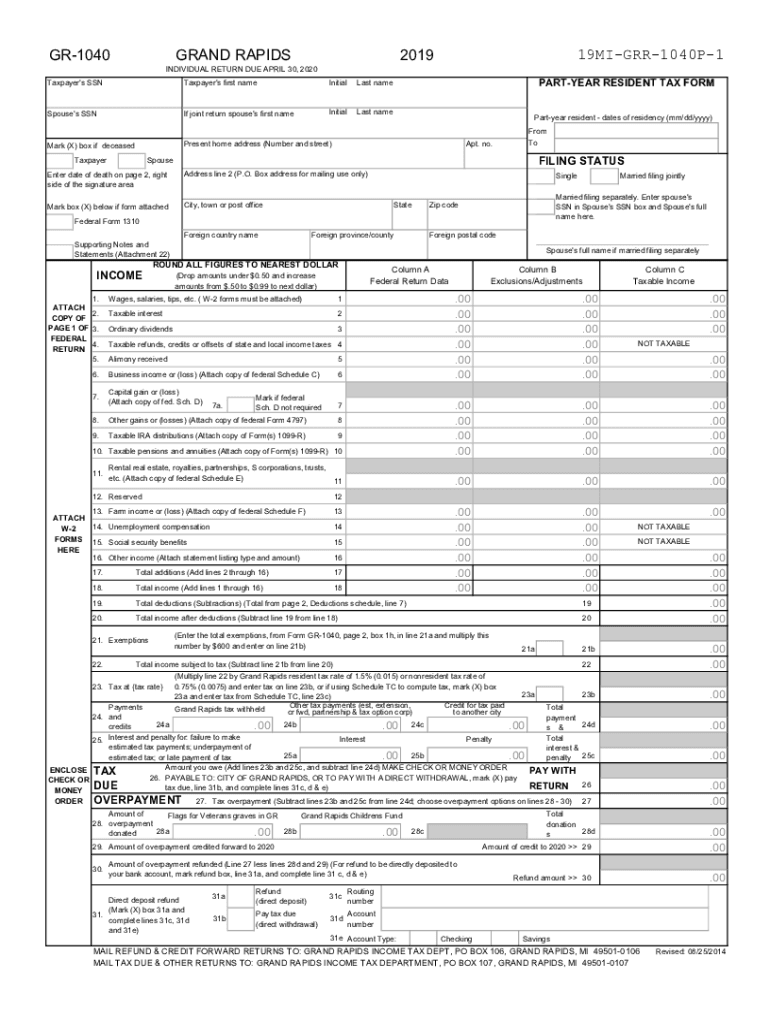

The Income Tax Guide for Individuals in the City of Grand Rapids provides essential information for residents and non-residents regarding their income tax obligations. It outlines the specific tax rates, applicable deductions, and credits available to taxpayers. This guide is crucial for understanding how to accurately report income earned within the city and ensures compliance with local tax laws.

Steps to Complete the Income Tax Guide for Individuals in the City of Grand Rapids

Completing the Income Tax Guide involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Review the tax rates and brackets applicable to your income level as specified in the guide.

- Fill out the required forms accurately, ensuring all income sources are reported.

- Calculate any eligible deductions or credits that may apply to your situation.

- Double-check your calculations and ensure all forms are signed where required.

Form Submission Methods for the Income Tax Guide in the City of Grand Rapids

Taxpayers in Grand Rapids have multiple options for submitting their completed tax forms:

- Online: Utilize the city's online tax filing system for a quick and efficient submission.

- Mail: Send the completed forms to the designated tax office address, ensuring they are postmarked by the filing deadline.

- In-Person: Visit the local tax office to submit forms directly and receive immediate assistance if needed.

Required Documents for the Income Tax Guide in the City of Grand Rapids

To complete the Income Tax Guide, taxpayers must prepare several key documents:

- W-2 forms from employers detailing wages and tax withheld.

- 1099 forms for any freelance or contract work performed.

- Records of other income sources, such as rental income or dividends.

- Documentation for any deductions claimed, including receipts and statements.

Filing Deadlines for the Income Tax Guide in the City of Grand Rapids

It is important to be aware of the filing deadlines to avoid penalties:

- The typical deadline for filing individual income tax returns is April 15 of each year.

- Extensions may be available, but they must be requested before the original deadline.

- Late submissions may incur penalties and interest on any unpaid taxes.

Penalties for Non-Compliance with the Income Tax Guide in the City of Grand Rapids

Failure to comply with the tax regulations outlined in the Income Tax Guide can result in various penalties:

- Late filing penalties can accrue if returns are not submitted by the deadline.

- Failure to pay taxes owed may lead to additional interest charges.

- In severe cases, non-compliance can result in legal action or liens against property.

Quick guide on how to complete income tax guide for individuals city of grand rapids

Effortlessly prepare Income Tax Guide For Individuals City Of Grand Rapids on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can access the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Income Tax Guide For Individuals City Of Grand Rapids on any platform using airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to edit and eSign Income Tax Guide For Individuals City Of Grand Rapids with ease

- Obtain Income Tax Guide For Individuals City Of Grand Rapids and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your liking. Modify and eSign Income Tax Guide For Individuals City Of Grand Rapids and ensure excellent communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income tax guide for individuals city of grand rapids

Create this form in 5 minutes!

How to create an eSignature for the income tax guide for individuals city of grand rapids

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The way to create an eSignature for a PDF on Android devices

People also ask

-

What is the grand rapids city tax form and why is it important?

The grand rapids city tax form is a document required for filing local taxes in Grand Rapids. It ensures that residents and businesses comply with city tax regulations, providing necessary information for accurate tax calculations and payments.

-

How does airSlate SignNow help with the grand rapids city tax form?

airSlate SignNow simplifies the process of filling out and signing the grand rapids city tax form. With our user-friendly platform, you can complete your form electronically, ensuring it is filed accurately and on time.

-

Is there a cost associated with using airSlate SignNow for the grand rapids city tax form?

Yes, there is a subscription fee for using airSlate SignNow, but we offer various pricing plans to fit different budgets. Our cost-effective solutions streamline the completion of the grand rapids city tax form, saving you both time and money.

-

Can I integrate airSlate SignNow with other software for the grand rapids city tax form?

Absolutely! airSlate SignNow offers seamless integration with various software applications, enhancing your workflow when dealing with the grand rapids city tax form. This integration allows for easier document management and sharing.

-

What features does airSlate SignNow provide for managing the grand rapids city tax form?

airSlate SignNow provides features like eSignature, document templates, and automated workflows that facilitate managing the grand rapids city tax form. These tools make it easy to prepare, sign, and send your forms securely.

-

How secure is airSlate SignNow when handling the grand rapids city tax form?

Security is a top priority for airSlate SignNow. We implement advanced encryption and compliance measures to ensure that your grand rapids city tax form and other documents are protected from unauthorized access.

-

What are the benefits of using airSlate SignNow for the grand rapids city tax form?

Using airSlate SignNow for the grand rapids city tax form allows for enhanced convenience and efficiency. You can complete and sign your forms electronically, reducing paperwork and the risk of errors, while also expediting the submission process.

Get more for Income Tax Guide For Individuals City Of Grand Rapids

- Assault 497430317 form

- Enforcement sheet form

- Washington confidential information

- Sa 1061 addendum to confidential information form washington

- Sa 2015 temporary sexual assault protection order and notice of hearing washington form

- Sa 3015 sexual assault protection order washington form

- Sa 3070 appendix a school transfer washington form

- Sa 4020 return of service washington form

Find out other Income Tax Guide For Individuals City Of Grand Rapids

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors