Utah Retirement Systems Roth IRA Withdrawal Urs 2012-2026

Understanding the Utah Retirement Systems Roth IRA Withdrawal

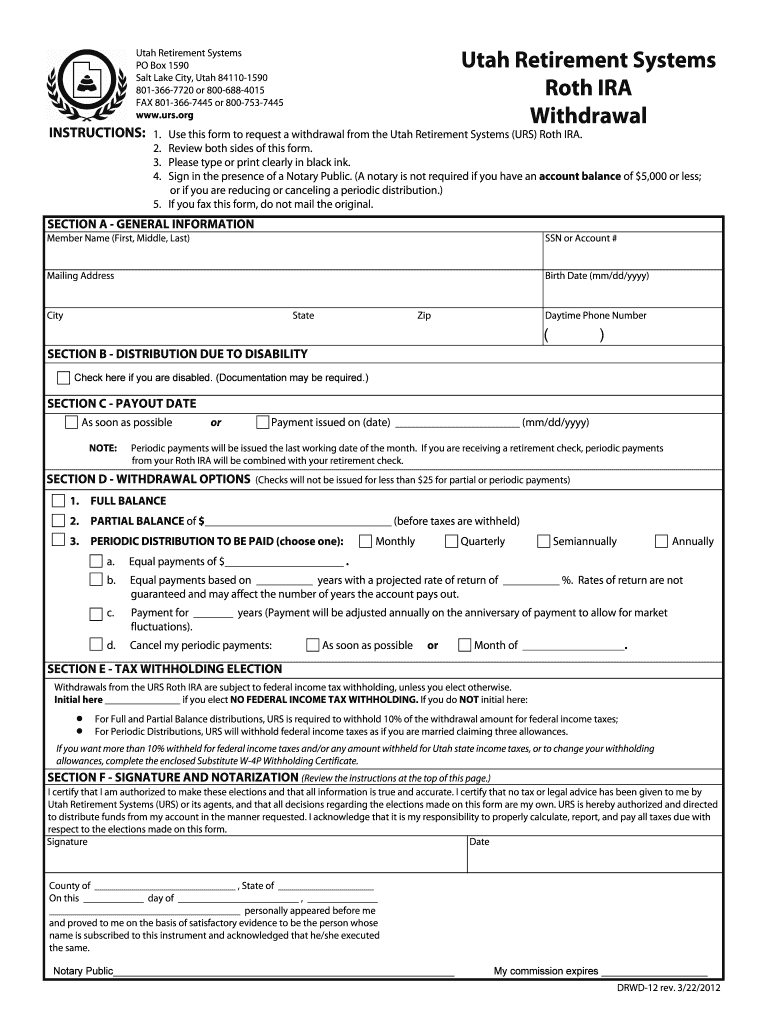

The Utah Retirement Systems (URS) Roth IRA withdrawal allows individuals to access their retirement savings under specific conditions. This type of account offers tax-free growth and tax-free withdrawals in retirement, provided certain criteria are met. To qualify for a tax-free withdrawal, the account holder must be at least fifty-nine and a half years old and have held the Roth IRA for at least five years. Understanding these requirements is crucial for effective retirement planning.

Steps to Complete the Utah Retirement Systems Roth IRA Withdrawal

Completing a Roth IRA withdrawal through the Utah Retirement Systems involves several key steps:

- Verify Eligibility: Ensure you meet the age and duration requirements for a tax-free withdrawal.

- Gather Required Documents: Collect necessary forms, including identification and any previous account statements.

- Access the URS Portal: Log in to the Utah Retirement Systems online portal to initiate the withdrawal process.

- Complete the Withdrawal Form: Fill out the required form accurately, specifying the amount you wish to withdraw.

- Submit the Form: Follow the submission guidelines, which may include online submission or mailing the completed form.

Required Documents for Utah Retirement Systems Roth IRA Withdrawal

When preparing to withdraw from a URS Roth IRA, specific documents are necessary to ensure a smooth process. These typically include:

- Proof of identity, such as a driver's license or state ID.

- Completed withdrawal form, which can be accessed through the URS online portal.

- Any prior account statements that may be required for verification.

Having these documents ready can expedite the withdrawal process and help avoid delays.

Legal Use of the Utah Retirement Systems Roth IRA Withdrawal

Understanding the legal implications of a Roth IRA withdrawal is essential. The IRS outlines specific guidelines that govern how and when withdrawals can be made. Following these regulations ensures that withdrawals are compliant and that account holders avoid unnecessary penalties. It is advisable to consult with a tax professional or financial advisor to navigate these legal requirements effectively.

State-Specific Rules for the Utah Retirement Systems Roth IRA Withdrawal

Utah may have additional rules that affect how Roth IRA withdrawals are processed. These can include state tax implications or unique requirements set by the Utah Retirement Systems. Familiarizing oneself with these state-specific guidelines can help account holders make informed decisions regarding their retirement funds.

Examples of Using the Utah Retirement Systems Roth IRA Withdrawal

Consider a scenario where an individual, aged sixty, wishes to withdraw funds from their URS Roth IRA to cover medical expenses. If they meet the eligibility criteria, they can withdraw funds tax-free. Another example is a retiree who wants to supplement their income during retirement; they can access their Roth IRA without incurring penalties, provided they follow the established guidelines.

Quick guide on how to complete utah retirement systems roth ira withdrawal urs

Complete Utah Retirement Systems Roth IRA Withdrawal Urs effortlessly on any device

Managing documents online has gained traction among organizations and individuals alike. It serves as an ideal sustainable alternative to conventional printed and signed papers, allowing you to obtain the correct format and securely save it in the cloud. airSlate SignNow offers you all the tools necessary to create, modify, and electronically sign your documents promptly without holdups. Handle Utah Retirement Systems Roth IRA Withdrawal Urs on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign Utah Retirement Systems Roth IRA Withdrawal Urs with ease

- Obtain Utah Retirement Systems Roth IRA Withdrawal Urs and then click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of the papers or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and carries the same legal significance as a traditional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets your requirements in document management in just a few clicks from any device you prefer. Modify and electronically sign Utah Retirement Systems Roth IRA Withdrawal Urs while ensuring excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I need help filling out this IRA form to withdraw money. How do I fill this out?

I am confused on the highlighted part.

-

I recently opened a Fidelity Roth IRA and it says my account is closed and I need to submit a W-9 form. Can anyone explain how this form relates to an IRA and why I need to fill it out?

Financial institutions are required to obtain tax ID numbers when opening an account, and the fact that it's an IRA doesn't exempt them from that requirement. They shouldn't have opened it without the W-9 in the first place, but apparently they did. So now they had to close it until they get the required documentation.

-

How else can I save for retirement if I have already maxed out my Roth IRA and I do not have access to a 401K?

Three alternatives, depending on your situation:If you are self-employed, or a Contractor receiving 1099 income, you can do a SEP IRA, Simple 401k or Solo 401k. SEPs are very easy to do---they amount to an IRA account with far more liberal contribution limits (up to 25% of your income, pre-tax)If you are an Employee, you are eligible for a Pre-Tax IRA too. In some tax years, you may be better off than with a Roth if reducing your taxable income drops you into a lower tax bracket. You can contribute to either or both, so long as your combined contribution does not exceed $5500 ($6500 if you're older than 50)If neither of these works, you can save for retirement pretty well in a taxable account. But you need to be strategic about it. Create a separate account for Retirement money, so you won't be tempted to touch it. In this account you should use only tax-efficient investments:Buy and hold individual stocksInvest in tax-efficient stock funds (e.g. Index funds)As an alternative to setting up a separate brokerage account, you can set up an auto-investment plan with a Mutual Fund company to pull a fixed amount out of your checking account every month. This enables you to make disciplined, consistent investments in a tax-efficient mutual fund. Relegate your tax-ineffient investments to your Roth (e.g. actively managed funds, trading accounts, Bond/CDs, bond funds, etc.)

-

Upon retirement, when you direct rollover a lump sum from a teacher retirement system to a Roth IRA in another investment company, will any part of the deposit be available to withdraw within a 5 yr period, or must you wait 5 years for seasoning?

First of all, is it after-tax money you’re rolling over? If not, it will become taxable, because Roths are after-tax retirememt accounts.You may withdraw your contributions at any time. Assuming you are over 59 1/2, you can withdraw interest at any time. However, the interest will not be tax exempt until the Roth has been in existence for 5 years.

-

For every dollar taken out in Roth IRAs, how much is tax-free, how much is taxable, and how much is subjected to a 10% penalty? How are contributions and earnings separated out upon early withdrawal of cash from Roth IRAs?

My recommendation, and hope is, you NEVER touch your retirement savings. If you must for some reason, while under the age of 59 1/2, you can withdraw the contributions you personally made anytime without tax or penalty.If you take a distribution of earnings before 59 1/2 AND have had the account for less than five years, the earnings (only) will be subject to tax and penalty unless it is used for purchase a first home, to pay for education, you are disabled, or the money will be used for medical expenses.Your broker can assist you in determining how much of the money was a contribution versus earnings, (or look at your statement) and your broker can take money out of the side you want.

-

If you can withdraw contributions you made to your Roth IRA anytime, tax- and penalty-free at age 71, does that include a rollover contribution from a tax deferred pension-teacher retirement plan? If not, how does that work?

When you make a rollover into a Roth IRA from a different type of retirement account (even a Roth account inside a 403(b) or other workplace plan), then even if you're older than 59 1/2, you'll have to wait till the fifth calendar year after the year of the rollover before the earnings on that rollover can be withdrawn tax-free. For example, if you make the rollover in 2019, you'll have to wait till 1/1/24. The rollover won't trigger a penalty tax (even if you're younger than 59 1/2), but unless the source of the rollover is another Roth account, any portion of the rollover that was tax-deferred up to that point will count as taxable income that year.Now, without knowing the specifics of your pension, I can't comment on the feasibility of rolling some of that money over to a Roth IRA. Check the pension’s summary plan description, which you should be able to find on your online benefits portal or get a copy of from your HR contact.

Create this form in 5 minutes!

How to create an eSignature for the utah retirement systems roth ira withdrawal urs

How to create an eSignature for your Utah Retirement Systems Roth Ira Withdrawal Urs in the online mode

How to create an eSignature for your Utah Retirement Systems Roth Ira Withdrawal Urs in Chrome

How to generate an eSignature for putting it on the Utah Retirement Systems Roth Ira Withdrawal Urs in Gmail

How to create an electronic signature for the Utah Retirement Systems Roth Ira Withdrawal Urs right from your mobile device

How to generate an eSignature for the Utah Retirement Systems Roth Ira Withdrawal Urs on iOS

How to generate an electronic signature for the Utah Retirement Systems Roth Ira Withdrawal Urs on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to Utah retirement plans?

airSlate SignNow provides an efficient way to manage document signing for various needs, including Utah retirement plans. With its electronic signature features, you can easily send and sign important retirement documents online, ensuring a smooth process.

-

How much does it cost to use airSlate SignNow for Utah retirement documents?

airSlate SignNow offers flexible pricing plans based on the features you need for managing your Utah retirement documents. Whether you're a solo user or a larger business, there are cost-effective solutions designed to fit your budget.

-

What features does airSlate SignNow offer for managing retirement documents in Utah?

Key features of airSlate SignNow include secure electronic signatures, customizable templates, and streamlined workflows for Utah retirement documents. These features help you save time and ensure compliance with legal requirements.

-

Can I integrate airSlate SignNow with other tools for my Utah retirement planning?

Yes, airSlate SignNow integrates seamlessly with a variety of popular applications, making it easy to enhance your Utah retirement planning process. This ensures that you can use your existing tools and workflows without disruptions.

-

How secure is airSlate SignNow for handling Utah retirement documents?

Security is a top priority for airSlate SignNow, especially when managing sensitive Utah retirement documents. The platform employs advanced encryption and authentication methods to protect your data, ensuring it remains confidential.

-

Is airSlate SignNow user-friendly for clients managing Utah retirement?

Absolutely! airSlate SignNow is designed to be user-friendly, allowing clients to easily navigate the platform while managing their Utah retirement documents. With intuitive interfaces and helpful tutorials, users can quickly adapt and start eSigning.

-

What are the benefits of using airSlate SignNow for Utah retirement planning?

Using airSlate SignNow for Utah retirement planning streamlines the document signing process and enhances efficiency. The ability to send, sign, and manage documents electronically helps in reducing physical paperwork and speeds up transactions.

Get more for Utah Retirement Systems Roth IRA Withdrawal Urs

- University supplementary form

- Third party at risk youth verification form

- Subrecipient qualifying questionnaire american form

- Instruction masters template form

- Which pd is right for me international baccalaureate form

- Request for laboratory study form uw school of dentistry dental washington

- Honcc emergency contact form

- Blue orblue form

Find out other Utah Retirement Systems Roth IRA Withdrawal Urs

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online