Form GST21 'Election or Revocation of an Election to Have 2020-2026

What is the Form GST21 'Election Or Revocation Of An Election To Have

The Form GST21, also known as the 'Election Or Revocation Of An Election To Have,' is a crucial document used by businesses in the United States to elect or revoke their election for a specific tax treatment under the Goods and Services Tax (GST) framework. This form is particularly relevant for entities that wish to opt for a joint election regarding the treatment of their GST liabilities. Understanding the purpose of this form is essential for compliance and ensuring that businesses are taxed appropriately.

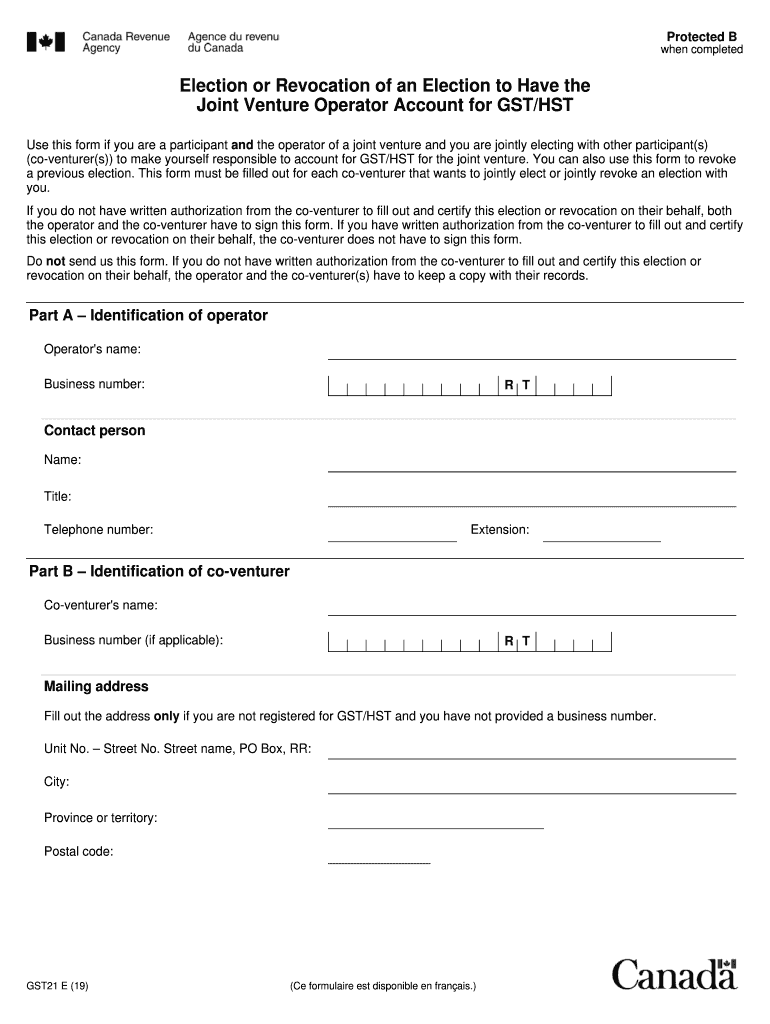

How to use the Form GST21 'Election Or Revocation Of An Election To Have

To effectively use the Form GST21, businesses must first determine their eligibility for making an election or revocation. The form requires specific information about the business, including its legal name, address, and GST registration number. After filling out the necessary sections, the form must be submitted to the appropriate tax authority. It is important to follow the instructions carefully to avoid delays or rejections. Additionally, businesses should keep a copy of the submitted form for their records.

Steps to complete the Form GST21 'Election Or Revocation Of An Election To Have

Completing the Form GST21 involves several key steps:

- Gather necessary information, such as your business name, address, and GST registration number.

- Clearly indicate whether you are making an election or revocation.

- Fill out all required fields accurately to avoid processing issues.

- Review the form for completeness and accuracy before submission.

- Submit the completed form to the designated tax authority by the specified deadline.

Legal use of the Form GST21 'Election Or Revocation Of An Election To Have

The legal use of the Form GST21 is governed by specific tax regulations that dictate how businesses can elect or revoke their GST treatment. Compliance with these regulations is crucial, as improper use of the form can lead to penalties or disputes with tax authorities. The form must be filled out in accordance with IRS guidelines and submitted within the required timeframes to ensure that the election or revocation is recognized legally.

Eligibility Criteria

Eligibility to use the Form GST21 is primarily determined by the type of business entity and its GST registration status. Generally, only businesses that are registered under the GST framework and meet specific criteria related to their revenue and operational structure can file this form. It is essential for businesses to review these criteria to confirm their eligibility before proceeding with the election or revocation process.

Filing Deadlines / Important Dates

Filing deadlines for the Form GST21 are critical to ensure compliance with tax regulations. Businesses must be aware of the specific dates by which the form must be submitted, which can vary based on the type of election or revocation being made. Missing these deadlines may result in the inability to make the desired election or revocation, leading to potential tax implications. Keeping a calendar of important dates related to GST filings can help businesses stay on track.

Quick guide on how to complete form gst21 ampquotelection or revocation of an election to have

Complete Form GST21 'Election Or Revocation Of An Election To Have effortlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle Form GST21 'Election Or Revocation Of An Election To Have on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form GST21 'Election Or Revocation Of An Election To Have with ease

- Obtain Form GST21 'Election Or Revocation Of An Election To Have and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select relevant portions of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form GST21 'Election Or Revocation Of An Election To Have and ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form gst21 ampquotelection or revocation of an election to have

Create this form in 5 minutes!

How to create an eSignature for the form gst21 ampquotelection or revocation of an election to have

How to make an eSignature for your PDF document in the online mode

How to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is gst21 in airSlate SignNow?

The term 'gst21' refers to a specific feature within airSlate SignNow that streamlines the process of sending and eSigning documents, enhancing user efficiency. This feature is designed to simplify document workflows, making it an attractive option for businesses looking to optimize their signing process.

-

How much does airSlate SignNow cost with gst21 features?

airSlate SignNow offers competitive pricing plans that include access to the gst21 feature. Pricing varies based on the plan selected, but it remains a cost-effective solution for businesses of all sizes looking to improve their document management and eSignature capabilities.

-

What advantages does gst21 offer for businesses?

By utilizing the gst21 feature in airSlate SignNow, businesses can benefit from faster document turnaround times, enhanced security for signature processes, and improved overall workflow efficiency. These advantages help streamline operations and save valuable time and resources.

-

Are there any integrations available for gst21?

Yes, airSlate SignNow with gst21 seamlessly integrates with various applications like Google Drive, Dropbox, and Salesforce. These integrations enable businesses to enhance their existing workflows by incorporating eSigning capabilities directly within their preferred tools.

-

How can gst21 improve the eSigning experience for users?

The gst21 feature within airSlate SignNow simplifies the eSigning process by providing a user-friendly interface that requires minimal training. This easy accessibility ensures that all users, regardless of technical proficiency, can quickly get up to speed and start signing documents effortlessly.

-

Is there a free trial available for airSlate SignNow with gst21?

Yes, airSlate SignNow offers a free trial that includes access to the gst21 features. This allows prospective customers to explore how the tool can cater to their document management needs before committing to a paid plan.

-

Can I customize my document templates using gst21?

Absolutely! With gst21 in airSlate SignNow, users can easily create and customize document templates to fit their specific requirements. This flexibility allows businesses to maintain consistency across documents while catering to unique workflows.

Get more for Form GST21 'Election Or Revocation Of An Election To Have

- Buyers request for accounting from seller under contract for deed wisconsin form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed wisconsin form

- General notice of default for contract for deed wisconsin form

- Wisconsin seller disclosure form

- Sellers disclosure of financing terms for residential property in connection with contract or agreement for deed aka land 497430451 form

- Wisconsin contract deed form

- Notice of default for past due payments in connection with contract for deed wisconsin form

- Final notice of default for past due payments in connection with contract for deed wisconsin form

Find out other Form GST21 'Election Or Revocation Of An Election To Have

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free