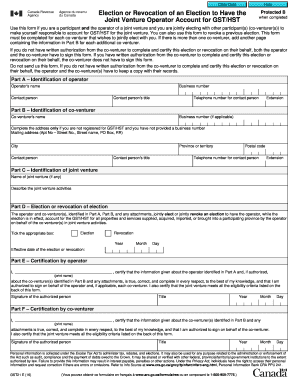

Gst21 2016

What is the gst21e?

The gst21e form is a specific document used for reporting tax information in the United States. It is essential for individuals and businesses to accurately complete this form to ensure compliance with federal tax regulations. The gst21e serves as a means for taxpayers to report various financial details, including income, deductions, and credits, which are necessary for calculating tax liabilities. Understanding the purpose and requirements of the gst21e is crucial for effective tax management.

Steps to complete the gst21e

Completing the gst21e involves several important steps to ensure accuracy and compliance. Here is a straightforward guide:

- Gather necessary documentation, including income statements, previous tax returns, and relevant financial records.

- Carefully read the instructions provided with the gst21e form to understand the specific requirements.

- Fill out the form accurately, ensuring all required fields are completed. Double-check for any errors or omissions.

- Review the completed form to ensure all information is correct and consistent with your supporting documents.

- Sign and date the form, as required, to validate your submission.

- Submit the form through the appropriate channels, whether electronically or by mail, based on your preference and the guidelines provided.

Legal use of the gst21e

The gst21e form must be used in accordance with U.S. tax laws to be considered legally valid. This includes ensuring that all information reported is truthful and accurate. Misrepresentation or failure to file the gst21e can result in penalties or legal repercussions. It is advisable to keep copies of submitted forms and any supporting documentation for your records, as this can be helpful in case of audits or inquiries from tax authorities.

Filing Deadlines / Important Dates

Timely submission of the gst21e is crucial to avoid penalties. The general deadline for filing this form is typically April 15 of each year, though this may vary based on specific circumstances, such as weekends or holidays. It is important to stay informed about any changes to deadlines that may arise from tax law adjustments or extensions provided by the IRS. Marking these dates on your calendar can help ensure compliance.

Required Documents

To complete the gst21e form accurately, certain documents are necessary. These typically include:

- W-2 forms from employers, detailing annual wages and taxes withheld.

- 1099 forms for any additional income received, such as freelance or contract work.

- Records of deductible expenses, such as receipts and invoices.

- Previous tax returns, which can provide a useful reference for completing the current form.

Having these documents organized and readily available can streamline the completion process and enhance accuracy.

Who Issues the Form

The gst21e form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers have the necessary information to fulfill their tax obligations. It is important to obtain the most current version of the gst21e directly from the IRS to ensure compliance with any updates or changes in tax law.

Quick guide on how to complete gst21

Handle Gst21 seamlessly on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed forms, allowing you to obtain the necessary document and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly and without delays. Manage Gst21 on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

How to modify and eSign Gst21 effortlessly

- Locate Gst21 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to confirm your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Gst21 and guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct gst21

Create this form in 5 minutes!

How to create an eSignature for the gst21

The best way to make an eSignature for your PDF document in the online mode

The best way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is gst21e in the context of airSlate SignNow?

The term 'gst21e' refers to a specific feature within airSlate SignNow that enhances document management efficiency. By using gst21e, businesses can streamline their eSigning and document processing workflows, ensuring compliance and speed in transactions.

-

How can gst21e improve my business operations?

Implementing the gst21e feature in airSlate SignNow allows businesses to automate repetitive tasks, saving time and reducing errors in document handling. This results in quicker turnaround times and increased productivity, making your operations more efficient.

-

What are the pricing options for airSlate SignNow that includes the gst21e feature?

AirSlate SignNow offers flexible pricing plans that incorporate the gst21e feature, catering to businesses of all sizes. You can choose between monthly or annual subscriptions, ensuring that you only pay for what your business needs without any hidden costs.

-

Does gst21e integrate with other software platforms?

Yes, the gst21e functionality is designed to seamlessly integrate with various third-party applications. This ensures that your existing workflow systems can work in harmony with airSlate SignNow, enhancing overall productivity and user experience.

-

What are the main benefits of using the gst21e feature?

The gst21e feature provides numerous benefits, including enhanced document security, compliance with legal standards, and user-friendly interfaces. These advantages make it easier for teams to collaborate on documents efficiently while maintaining high security.

-

Is there any customer support available for gst21e users?

Absolutely! AirSlate SignNow offers comprehensive customer support for all users, including those utilizing the gst21e feature. You can access help via live chat, email, or phone to address any questions or issues you may encounter.

-

Can I try gst21e before committing to a subscription?

Yes, airSlate SignNow provides a free trial that includes access to the gst21e feature. This allows you to experience the benefits firsthand and determine how it can fit into your business operations before making a financial commitment.

Get more for Gst21

Find out other Gst21

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement