Maryland W4 2019

What is the Maryland W-4?

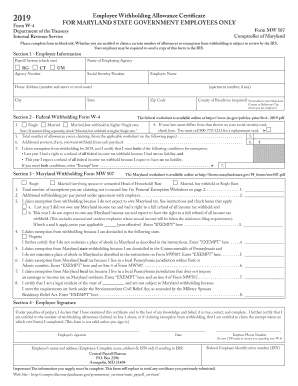

The Maryland W-4, officially known as the state of Maryland employee withholding allowance form, is a crucial document for employees working in Maryland. This form is used to determine the amount of state income tax that should be withheld from an employee's paycheck. By accurately completing the Maryland W-4, employees can ensure that the correct amount of tax is deducted, which helps in avoiding underpayment or overpayment of state taxes. The form allows individuals to claim allowances based on their personal circumstances, such as marital status and number of dependents, which can significantly affect their tax liability.

Steps to Complete the Maryland W-4

Completing the Maryland W-4 involves several key steps to ensure accuracy and compliance. First, gather necessary personal information, including your Social Security number, marital status, and details about any dependents. Next, follow these steps:

- Section 1: Provide your name, address, and Social Security number.

- Section 2: Indicate your filing status (single, married, etc.).

- Section 3: Claim allowances based on your personal situation. The more allowances you claim, the less tax will be withheld.

- Section 4: Sign and date the form to validate it.

Once completed, submit the form to your employer, who will use it to adjust your state tax withholdings accordingly.

Legal Use of the Maryland W-4

The Maryland W-4 is legally recognized as a valid document for determining state tax withholdings. To ensure its legal standing, it must be completed accurately and submitted to your employer. The form must also adhere to relevant state tax laws and regulations. Utilizing a reliable platform for electronic signatures, such as signNow, can enhance the legal validity of your completed W-4 by providing a digital certificate and ensuring compliance with eSignature laws.

How to Obtain the Maryland W-4

The Maryland W-4 can be easily obtained through various channels. Employees can download a printable version of the form from the official Maryland state government website or request a physical copy from their employer. Many employers provide the form as part of their onboarding process. Additionally, accessing the form digitally allows for convenient completion and submission, streamlining the process for both employees and employers.

State-Specific Rules for the Maryland W-4

Maryland has specific rules governing the use of the W-4 form. Employees must be aware of the following:

- Employees can claim allowances based on their personal circumstances, which directly impacts the withholding amount.

- It is important to update the form whenever there are significant changes in personal circumstances, such as marriage, divorce, or the birth of a child.

- Employers are required to keep the W-4 on file and use it to calculate the appropriate state tax withholdings.

Understanding these rules helps ensure compliance and accurate tax withholding throughout the year.

Examples of Using the Maryland W-4

Using the Maryland W-4 effectively can lead to proper tax withholding. For instance, a single employee with no dependents might claim one allowance, resulting in higher tax withholding. Conversely, a married employee with children may claim multiple allowances, reducing the amount withheld. It is essential to evaluate personal financial situations annually or after significant life events to adjust the number of allowances claimed, ensuring optimal tax withholding throughout the year.

Quick guide on how to complete maryland 2020 w4

Complete Maryland W4 seamlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents quickly without delays. Handle Maryland W4 on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Maryland W4 effortlessly

- Obtain Maryland W4 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Modify and eSign Maryland W4 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maryland 2020 w4

Create this form in 5 minutes!

How to create an eSignature for the maryland 2020 w4

The best way to generate an electronic signature for a PDF online

The best way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

The way to make an eSignature for a PDF document on Android

People also ask

-

What are the w4 for state of maryland 2019 printable forms?

The w4 for state of maryland 2019 printable forms are official tax withholding forms used by employees in Maryland to specify their tax situation. These forms help determine the amount of state tax to withhold from your paycheck. They are essential for ensuring the correct tax amount is taken out to avoid underpayment or overpayment.

-

How can I obtain the w4 for state of maryland 2019 printable forms?

You can easily download the w4 for state of maryland 2019 printable forms directly from our website. Simply navigate to the forms section, and you'll find the relevant documents available for printing. With airSlate SignNow, you can also eSign these forms for a quicker submission process.

-

Are there any fees associated with using airSlate SignNow for the w4 for state of maryland 2019 printable forms?

airSlate SignNow offers a cost-effective solution for eSigning and sending documents, including the w4 for state of maryland 2019 printable forms. Our pricing plans are designed to accommodate businesses of all sizes, ensuring you can access essential features without breaking the bank.

-

What features does airSlate SignNow offer for the w4 for state of maryland 2019 printable forms?

With airSlate SignNow, you can easily fill out, eSign, and send the w4 for state of maryland 2019 printable forms. Our platform allows for real-time collaboration, secure document storage, and easy integration with various applications to streamline your document management processes.

-

Can I store my w4 for state of maryland 2019 printable forms securely with airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your documents, including the w4 for state of maryland 2019 printable forms. We implement industry-standard encryption protocols to ensure your sensitive information remains protected.

-

Is it easy to integrate airSlate SignNow with other software for handling w4 for state of maryland 2019 printable forms?

Yes, airSlate SignNow seamlessly integrates with various software solutions, making it easy to manage your w4 for state of maryland 2019 printable forms. Our platform supports integrations with popular tools like CRMs, payroll systems, and more to enhance your workflow efficiency.

-

What are the benefits of using airSlate SignNow for my w4 for state of maryland 2019 printable forms?

Using airSlate SignNow for your w4 for state of maryland 2019 printable forms provides numerous benefits, including time savings, improved accuracy, and enhanced compliance. With our easy-to-use platform, you can efficiently manage your tax forms, ensuring they are completed and submitted correctly.

Get more for Maryland W4

Find out other Maryland W4

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe