T2 Tax Returns 2020

What is the T2 Tax Returns

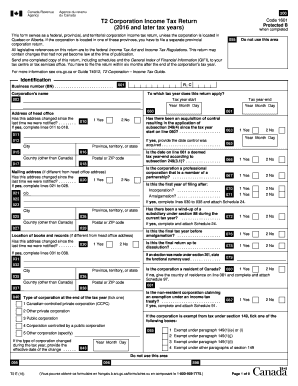

The T2 corporation tax return is a form used by Canadian corporations to report their income, deductions, and taxes owed to the Canada Revenue Agency (CRA). This form is essential for corporations operating in Canada, including those that are Canadian-controlled private corporations (CCPCs). The T2 tax return must be filed annually, and it includes various schedules that provide detailed information regarding the corporation's financial activities.

Steps to complete the T2 Tax Returns

Completing the T2 corporation tax return involves several key steps:

- Gather financial records: Collect all necessary documentation, including income statements, balance sheets, and receipts for expenses.

- Determine the fiscal year: Identify the corporation's fiscal year-end date, as this will dictate the reporting period.

- Complete the T2 form: Fill out the T2 form accurately, ensuring all income, deductions, and credits are reported.

- Attach required schedules: Include any relevant schedules, such as Schedule 1 for net income, and ensure they are completed correctly.

- Review for accuracy: Double-check all entries for accuracy and completeness to avoid errors.

- Submit the return: File the completed T2 return with the CRA by the deadline.

Legal use of the T2 Tax Returns

The T2 corporation tax return is legally binding and must be completed in compliance with the Income Tax Act. Corporations are required to file their T2 returns by the due date to avoid penalties. The information provided on the T2 form is used by the CRA to assess tax liabilities and ensure compliance with tax laws. Accurate reporting is crucial, as discrepancies can lead to audits or further scrutiny.

Required Documents

To complete the T2 corporation tax return, several documents are necessary:

- Financial statements: Income statement and balance sheet for the fiscal year.

- Receipts: Documentation for all business expenses claimed.

- Previous tax returns: Copies of previous T2 returns may be helpful for reference.

- Schedules: Any required schedules that accompany the T2 form.

Filing Deadlines / Important Dates

The filing deadline for the T2 corporation tax return depends on the corporation's fiscal year-end. Generally, the return must be filed within six months after the fiscal year-end. For example, if a corporation's fiscal year ends on December 31, the T2 return is due by June 30 of the following year. It is important to mark these dates on your calendar to ensure timely filing and avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The T2 corporation tax return can be submitted in several ways:

- Online: Corporations can file their T2 returns electronically using the CRA's online services.

- Mail: The completed T2 form can be printed and mailed to the appropriate CRA office.

- In-Person: Corporations may also deliver their T2 returns in person at a CRA office, although this method is less common.

Quick guide on how to complete t2 tax returns

Accomplish T2 Tax Returns effortlessly on any device

Online document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents swiftly without delays. Manage T2 Tax Returns on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The simplest way to modify and eSign T2 Tax Returns with ease

- Obtain T2 Tax Returns and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and eSign T2 Tax Returns and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t2 tax returns

Create this form in 5 minutes!

How to create an eSignature for the t2 tax returns

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What are T2 corporation tax returns 2016 later fillable?

T2 corporation tax returns 2016 later fillable refer to the forms businesses use to file their corporate taxes for the year 2016, which can be filled out electronically. This format allows for easy data entry and submissions, streamlining the process for businesses looking to file correctly and efficiently. Using fillable forms can greatly reduce paperwork errors and save time.

-

How can airSlate SignNow assist with T2 corporation tax returns 2016 later fillable?

airSlate SignNow provides an easy-to-use platform to send and eSign your T2 corporation tax returns 2016 later fillable. Our solution allows for seamless document management, ensuring that your tax returns are signed and submitted swiftly. By using our platform, you can facilitate collaboration among your team, ensuring everyone reviews the document before submission.

-

Is there a cost associated with using airSlate SignNow for T2 corporation tax returns 2016 later fillable?

Yes, there is a cost associated with using airSlate SignNow, but we offer competitive pricing that is designed to be cost-effective for businesses of all sizes. Our plans include various features tailored to meet your needs, whether you are a small business or a large corporation. Visit our pricing page for specific details on plans suitable for filing T2 corporation tax returns 2016 later fillable.

-

What features does airSlate SignNow offer for T2 corporation tax returns 2016 later fillable?

airSlate SignNow offers several features for T2 corporation tax returns 2016 later fillable, including eSignature capabilities, document tracking, and templates for quick reuse. These tools help speed up the filing process and ensure documents are completed accurately. Additionally, the platform provides a secure environment for storing sensitive tax information.

-

Are there any integrations available for airSlate SignNow that complement T2 corporation tax returns 2016 later fillable?

Yes, airSlate SignNow supports various integrations with popular software tools that streamline the filing of T2 corporation tax returns 2016 later fillable. We integrate with accounting software, CRMs, and other document management systems ensuring a smooth workflow. This allows you to automatically pull data, reducing manual entry and potential errors.

-

How do I get started with airSlate SignNow for T2 corporation tax returns 2016 later fillable?

To get started with airSlate SignNow for T2 corporation tax returns 2016 later fillable, simply sign up for an account on our website. Once registered, you can upload your tax forms, customize templates, and begin the eSigning process. Our user-friendly interface makes it easy for you to manage your documents efficiently.

-

Can I track the status of my T2 corporation tax returns 2016 later fillable with airSlate SignNow?

Absolutely! With airSlate SignNow, you can track the status of your T2 corporation tax returns 2016 later fillable in real time. Our platform provides updates on when documents are viewed and signed, offering peace of mind that your tax returns are processed timely and accurately.

Get more for T2 Tax Returns

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for nonresidential property 497430670 form

- Unconditional waiver form

- Conditional waiver and release of claim of lien upon final payment wisconsin form

- Wisconsin lien form

- Prime contractors notice of intention to file claim of lien individual wisconsin form

- Contractor notice lien form

- Wisconsin prime form

- Business credit application wisconsin form

Find out other T2 Tax Returns

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now