Corporate Income Tax FAQs Division of Revenue State of 2020-2026

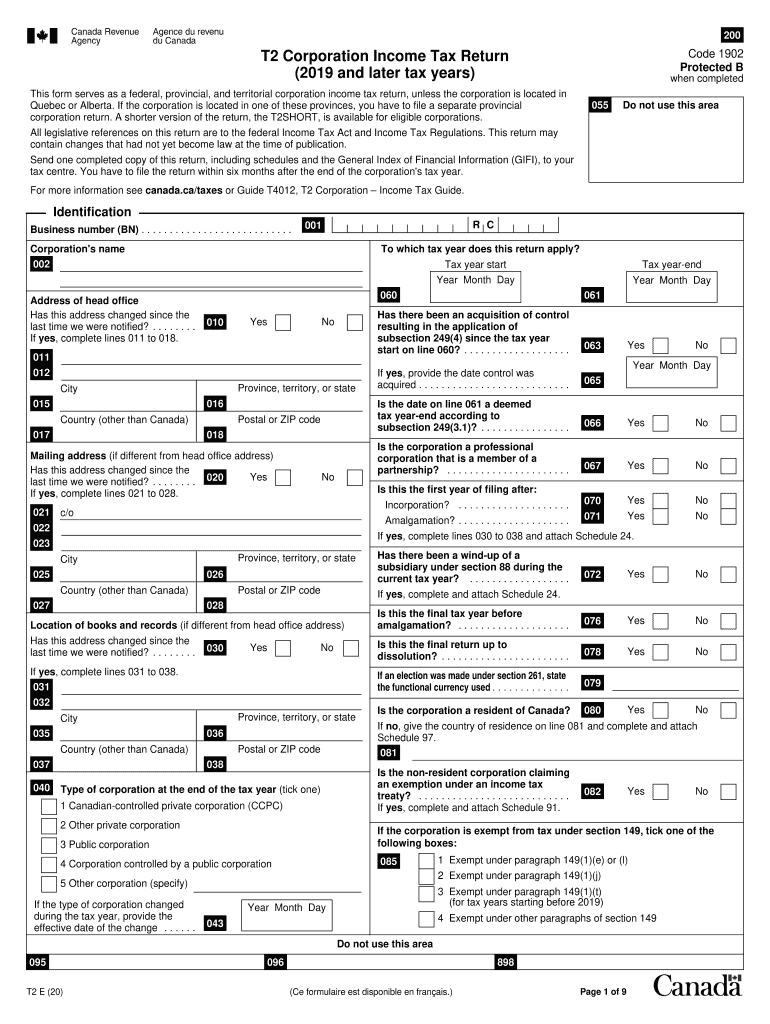

Understanding the Form T2

The Form T2 is the Canadian corporate income tax return that corporations operating in Canada must file annually. It is essential for reporting a corporation's income, deductions, and taxes owed to the Canada Revenue Agency (CRA). The form is designed to ensure compliance with Canadian tax laws and to provide a clear picture of a corporation's financial activities over the fiscal year. Understanding the requirements and components of the Form T2 is crucial for accurate filing and to avoid penalties.

Steps to Complete the Form T2

Completing the Form T2 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, balance sheets, and previous tax returns. Next, accurately report your corporation's income, including revenue from sales and other sources. Deduct allowable expenses such as salaries, rent, and utilities to determine your taxable income. After calculating the total tax owed, ensure that all sections of the form are filled out completely, including any schedules that may apply to your corporation's specific situation. Finally, review the completed form for accuracy before submission.

Filing Deadlines for Form T2

Corporations in Canada must adhere to specific filing deadlines for the Form T2. Generally, the due date for filing the T2 is six months after the end of the corporation's fiscal year. For instance, if a corporation's fiscal year ends on December 31, the T2 must be filed by June 30 of the following year. It is important to note that late submissions may incur penalties and interest on any unpaid taxes. Therefore, keeping track of these deadlines is vital for maintaining compliance with CRA regulations.

Required Documents for Form T2 Submission

When preparing to submit the Form T2, it is essential to gather all required documents to support the information reported. Key documents include financial statements, such as the income statement and balance sheet, as well as any supporting schedules that detail specific deductions or credits claimed. Additionally, corporations should have records of any previous tax filings and correspondence with the CRA. Ensuring all documentation is complete and accurate will facilitate a smoother filing process and reduce the likelihood of audits or inquiries from the CRA.

Penalties for Non-Compliance with Form T2

Failing to comply with the filing requirements for the Form T2 can result in significant penalties for corporations. Late filing penalties can amount to five percent of the unpaid tax, plus an additional one percent for each month the return is late, up to a maximum of twelve months. Furthermore, corporations that fail to pay their taxes on time may incur interest on the outstanding balance. Understanding these penalties emphasizes the importance of timely and accurate filing to avoid unnecessary financial burdens.

Digital vs. Paper Version of Form T2

Corporations have the option to file the Form T2 either digitally or via paper submission. Filing electronically is often more efficient, as it allows for quicker processing and confirmation of receipt by the CRA. Additionally, electronic filing can reduce the risk of errors and streamline the submission process. However, some corporations may prefer to file a paper version for various reasons, including comfort with traditional methods or specific requirements. Regardless of the chosen method, ensuring that all information is accurate and complete is paramount.

Quick guide on how to complete corporate income tax faqs division of revenue state of

Complete Corporate Income Tax FAQs Division Of Revenue State Of effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly without holdups. Handle Corporate Income Tax FAQs Division Of Revenue State Of on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and electronically sign Corporate Income Tax FAQs Division Of Revenue State Of with ease

- Obtain Corporate Income Tax FAQs Division Of Revenue State Of and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, monotonous form searching, or errors that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs with just a few clicks from your preferred device. Modify and electronically sign Corporate Income Tax FAQs Division Of Revenue State Of to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct corporate income tax faqs division of revenue state of

Create this form in 5 minutes!

How to create an eSignature for the corporate income tax faqs division of revenue state of

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is form t2 and how does it work with airSlate SignNow?

Form t2 refers to a specific type of document that can be created, edited, and signed using airSlate SignNow. The platform simplifies the process by allowing users to upload their form t2, customize it with fields for signatures and data entry, and easily send it to recipients for eSignature.

-

Is there a cost associated with creating form t2 using airSlate SignNow?

Yes, airSlate SignNow offers a variety of pricing plans that accommodate different needs, including the creation and management of form t2. Each plan provides access to unique features, making it cost-effective for businesses of all sizes to utilize the platform for their document signing needs.

-

What features does airSlate SignNow offer for managing form t2?

airSlate SignNow provides a robust set of features specifically designed for form t2, including customizable templates, real-time tracking, and automatic reminders for signers. This ensures a smooth process from creation to completion, enhancing efficiency in document management.

-

How can I integrate form t2 into my existing software with airSlate SignNow?

airSlate SignNow supports various integrations that allow you to seamlessly incorporate form t2 into your existing software systems. Whether using CRM solutions or document management tools, you can find integration options that automate workflows and enhance document collaboration.

-

What benefits does eSigning form t2 provide for businesses?

ESigning form t2 offers numerous benefits, including faster turnaround times, improved accuracy, and enhanced security compared to traditional paper methods. By using airSlate SignNow, businesses can streamline their processes and reduce the environmental impact associated with printing and mailing documents.

-

Can I customize form t2 templates in airSlate SignNow?

Absolutely! airSlate SignNow allows users to fully customize form t2 templates to suit specific business needs. You can add various fields, such as text boxes, checkboxes, and signature lines, ensuring that the form meets all your requirements.

-

Is airSlate SignNow compliant with legal regulations when using form t2?

Yes, airSlate SignNow is designed to comply with various legal standards, making it a secure choice for handling form t2. This compliance ensures that your eSignature and document management processes are legally binding and recognized in many jurisdictions.

Get more for Corporate Income Tax FAQs Division Of Revenue State Of

Find out other Corporate Income Tax FAQs Division Of Revenue State Of

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online