Application for GSTHST Public Service Bodies' Rebate and General GSTHST Rebate Application Canada CaGeneral GSTHST Rebate Applic 2019-2026

Understanding the GST Rebate Application Process

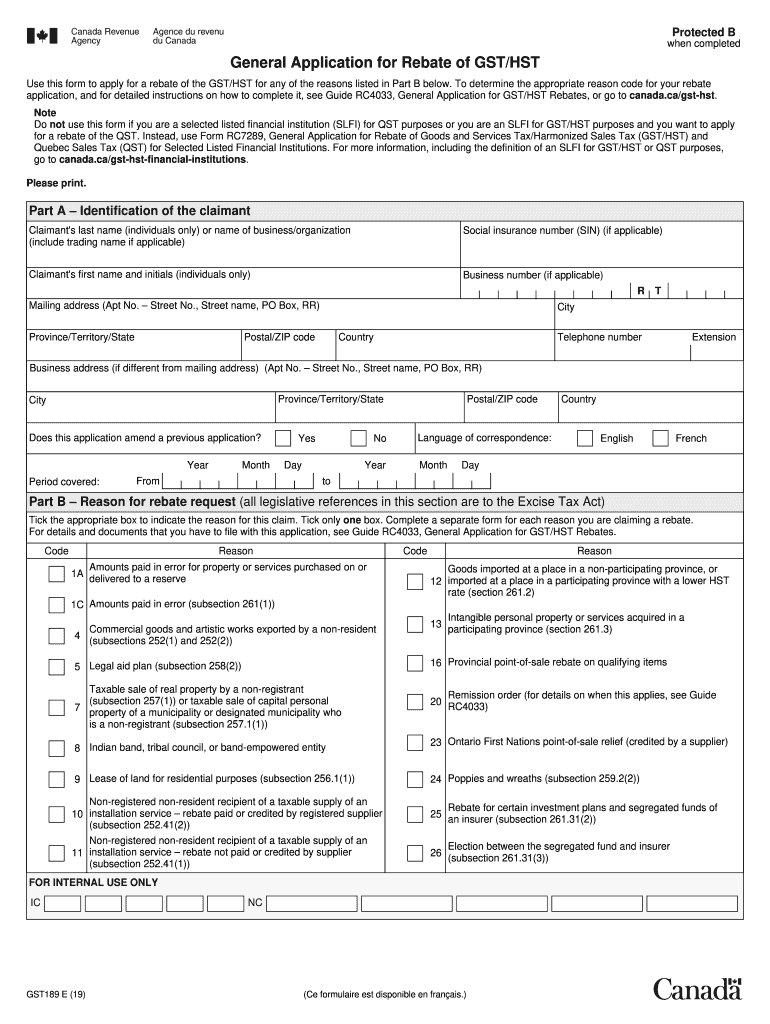

The application for the GST rebate involves several key steps to ensure that businesses and organizations can effectively claim their entitled rebates. The process typically includes gathering necessary documentation, completing the appropriate forms, and submitting them to the relevant tax authorities. It is essential to understand the specific requirements based on the type of rebate being claimed, whether it is for public service bodies or general GST rebates.

Eligibility Criteria for GST Rebate

To qualify for the GST rebate, applicants must meet specific eligibility criteria. These criteria may vary depending on the type of organization and the nature of the expenses incurred. Generally, eligible entities include non-profit organizations, charities, and certain public service bodies. It is crucial to review the detailed requirements to ensure compliance and avoid delays in processing the application.

Required Documents for GST Rebate Application

When applying for the GST rebate, it is important to prepare and submit all required documents. Commonly required documents include receipts for eligible expenses, proof of organization status, and completed application forms. Ensuring that all documentation is accurate and complete helps facilitate a smoother application process and reduces the likelihood of requests for additional information.

Steps to Complete the GST Rebate Application

Completing the GST rebate application involves a series of steps:

- Gather all necessary documents, including receipts and organizational proof.

- Complete the GST189 form accurately, ensuring all sections are filled out.

- Review the application for completeness and accuracy.

- Submit the application either online or via mail, depending on the preferred method.

Form Submission Methods for GST Rebate

Applicants have multiple options for submitting the GST rebate application. The form can typically be submitted online through the official tax authority portal, which often allows for quicker processing. Alternatively, applicants may choose to mail the completed form to the designated address. In-person submissions may also be available at local tax offices, depending on the jurisdiction.

IRS Guidelines for GST Rebate

Understanding the IRS guidelines related to the GST rebate is essential for compliance. These guidelines outline the necessary procedures, eligibility requirements, and documentation standards that must be followed. Staying informed about any updates or changes in the guidelines can help ensure that applications are submitted correctly and on time.

Filing Deadlines for GST Rebate Applications

Filing deadlines for GST rebate applications are critical to ensure timely processing. Applicants should be aware of the specific dates by which applications must be submitted to avoid penalties or delays. Keeping a calendar of important dates related to the GST rebate can help organizations stay organized and compliant with filing requirements.

Quick guide on how to complete application for gsthst public service bodies rebate and general gsthst rebate application canadacageneral gsthst rebate

Complete Application For GSTHST Public Service Bodies' Rebate And General GSTHST Rebate Application Canada caGeneral GSTHST Rebate Applic effortlessly on any device

Digital document management has increasingly gained traction among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to access the required form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Handle Application For GSTHST Public Service Bodies' Rebate And General GSTHST Rebate Application Canada caGeneral GSTHST Rebate Applic on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Application For GSTHST Public Service Bodies' Rebate And General GSTHST Rebate Application Canada caGeneral GSTHST Rebate Applic with ease

- Locate Application For GSTHST Public Service Bodies' Rebate And General GSTHST Rebate Application Canada caGeneral GSTHST Rebate Applic and click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to finalize your adjustments.

- Choose your preferred delivery method for your form—via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow simplifies all your document management needs in just a few clicks from your chosen device. Alter and electronically sign Application For GSTHST Public Service Bodies' Rebate And General GSTHST Rebate Application Canada caGeneral GSTHST Rebate Applic to guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application for gsthst public service bodies rebate and general gsthst rebate application canadacageneral gsthst rebate

Create this form in 5 minutes!

How to create an eSignature for the application for gsthst public service bodies rebate and general gsthst rebate application canadacageneral gsthst rebate

The best way to generate an eSignature for a PDF online

The best way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

How to create an eSignature for a PDF on Android

People also ask

-

What is a rebate GST?

A rebate GST refers to the amount of Goods and Services Tax that can be claimed back on eligible purchases. Businesses that use airSlate SignNow can more easily manage their documentation for rebate GST applications by ensuring all forms are correctly filled and signed.

-

How can airSlate SignNow help with rebate GST documentation?

airSlate SignNow simplifies the process of preparing and signing documents necessary for rebate GST claims. Our platform provides a user-friendly interface that allows for efficient document management, ensuring that your rebate GST submissions are accurate and timely.

-

Is airSlate SignNow cost-effective for managing rebate GST?

Yes, airSlate SignNow offers a cost-effective solution for handling rebate GST. Our competitive pricing plans are designed to accommodate businesses of all sizes, helping you save on time and resources while ensuring compliance with GST regulations.

-

What features does airSlate SignNow offer for rebate GST claims?

airSlate SignNow includes advanced features such as document templates, electronic signatures, and real-time tracking, ensuring smooth and efficient handling of rebate GST claims. These features help businesses streamline their processes and reduce errors in submission.

-

Can I integrate airSlate SignNow with my accounting software for rebate GST management?

Absolutely! airSlate SignNow supports integrations with various accounting software that can enhance your rebate GST management. By connecting our platform with your existing tools, you can automate the documentation process and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for rebate GST?

Using airSlate SignNow for rebate GST provides several benefits, including faster processing times, reduced paperwork, and enhanced security. Our e-signature solution ensures that all agreements are legally binding, which is essential for rebate GST compliance.

-

How does airSlate SignNow ensure the security of my rebate GST documents?

airSlate SignNow prioritizes the security of your rebate GST documents by employing industry-standard encryption and secure cloud storage. This ensures that sensitive information remains protected while allowing authorized users to access necessary documents easily.

Get more for Application For GSTHST Public Service Bodies' Rebate And General GSTHST Rebate Application Canada caGeneral GSTHST Rebate Applic

Find out other Application For GSTHST Public Service Bodies' Rebate And General GSTHST Rebate Application Canada caGeneral GSTHST Rebate Applic

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word