Claim for Refund of Sales and Use Tax, Form 7 Nebraska 2020-2026

What is the Claim For Refund Of Sales And Use Tax, Form 7 Nebraska

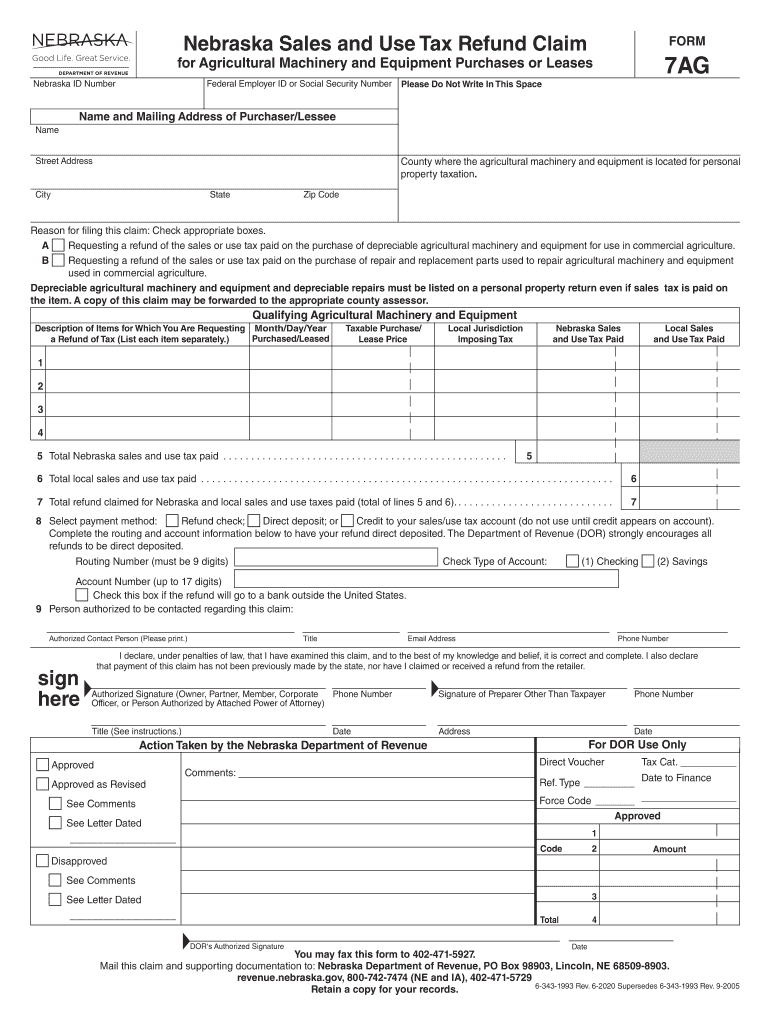

The Claim For Refund Of Sales And Use Tax, Form 7 Nebraska, is a document that allows taxpayers to request a refund for sales and use taxes that have been overpaid. This form is particularly relevant for businesses and individuals who have made purchases that qualify for a refund under Nebraska tax laws. It is essential for taxpayers to understand that this form is specifically designed to address situations where sales tax has been incorrectly charged or where exemptions apply but were not initially recognized during the transaction.

Steps to Complete the Claim For Refund Of Sales And Use Tax, Form 7 Nebraska

Completing the Claim For Refund Of Sales And Use Tax, Form 7 Nebraska requires careful attention to detail. Here are the steps to follow:

- Gather necessary documentation, including receipts and proof of payment.

- Fill out the form accurately, ensuring that all required fields are completed.

- Clearly state the reason for the refund request, citing specific exemptions or errors.

- Attach supporting documents that validate your claim.

- Review the form for accuracy before submission.

Once completed, the form can be submitted to the Nebraska Department of Revenue for processing.

Eligibility Criteria for Claiming a Refund

To be eligible for a refund using the Claim For Refund Of Sales And Use Tax, Form 7 Nebraska, taxpayers must meet specific criteria. These include:

- The taxpayer must have paid sales or use tax on the purchases in question.

- The items purchased must qualify for a refund based on Nebraska tax regulations.

- The claim must be filed within the designated timeframe set by the Nebraska Department of Revenue.

Understanding these eligibility criteria is crucial for a successful refund claim.

Required Documents for Submission

When submitting the Claim For Refund Of Sales And Use Tax, Form 7 Nebraska, certain documents are required to support the claim. These typically include:

- Receipts or invoices that show the sales tax paid.

- Any relevant exemption certificates if applicable.

- Proof of payment, such as bank statements or credit card statements.

Providing complete documentation helps expedite the review process and increases the likelihood of a successful refund.

Filing Deadlines for the Claim

Timeliness is essential when filing the Claim For Refund Of Sales And Use Tax, Form 7 Nebraska. Taxpayers must adhere to specific filing deadlines to ensure their claims are considered. Generally, claims must be filed within three years from the date of the purchase or payment. It is advisable to check with the Nebraska Department of Revenue for any updates or changes to these deadlines.

Form Submission Methods

The Claim For Refund Of Sales And Use Tax, Form 7 Nebraska can be submitted through various methods. Taxpayers have the option to:

- Submit the form online through the Nebraska Department of Revenue’s website.

- Mail the completed form to the appropriate address provided on the form.

- Deliver the form in person at designated Department of Revenue offices.

Choosing the right submission method can affect the processing time of the refund claim.

Quick guide on how to complete claim for refund of sales and use tax form 7 nebraska

Complete Claim For Refund Of Sales And Use Tax, Form 7 Nebraska effortlessly on any gadget

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without any hold-ups. Handle Claim For Refund Of Sales And Use Tax, Form 7 Nebraska on any gadget using airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign Claim For Refund Of Sales And Use Tax, Form 7 Nebraska with ease

- Locate Claim For Refund Of Sales And Use Tax, Form 7 Nebraska and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with features that airSlate SignNow supplies specifically for this task.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet signature.

- Review all the details and click on the Done button to secure your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Claim For Refund Of Sales And Use Tax, Form 7 Nebraska and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct claim for refund of sales and use tax form 7 nebraska

Create this form in 5 minutes!

How to create an eSignature for the claim for refund of sales and use tax form 7 nebraska

The best way to create an eSignature for a PDF in the online mode

The best way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the Nebraska 7AG exemption?

The Nebraska 7AG exemption is a tax exemption applicable to certain agricultural activities in Nebraska. It allows eligible entities to purchase specific farming equipment and supplies without paying sales tax. This exemption can dramatically reduce operational costs for farmers and agribusinesses.

-

How can airSlate SignNow help with the Nebraska 7AG exemption paperwork?

airSlate SignNow simplifies the signing and submission process for documents related to the Nebraska 7AG exemption. Our platform allows you to electronically sign and send necessary paperwork quickly, ensuring that you stay compliant and avoid delays in your transactions. Experience a hassle-free solution tailored for agricultural businesses.

-

What features does airSlate SignNow offer to assist with managing the Nebraska 7AG exemption?

With airSlate SignNow, you gain access to features like custom templates, team collaboration tools, and secure cloud storage. These tools are designed to help you efficiently manage and streamline the documentation process associated with the Nebraska 7AG exemption. You can easily track document statuses and ensure timely approvals.

-

Is there a cost associated with using airSlate SignNow for the Nebraska 7AG exemption?

Yes, while airSlate SignNow offers various pricing plans, we provide cost-effective solutions that can save you money, especially for businesses leveraging the Nebraska 7AG exemption. Our pricing is designed to accommodate businesses of all sizes while providing the essential features needed for efficient document management.

-

Can I integrate airSlate SignNow with other software for the Nebraska 7AG exemption?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, including CRM and ERP systems, making it easier to manage documents related to the Nebraska 7AG exemption. This integration increases efficiency by centralizing your processes and reducing data entry errors.

-

What are the benefits of using airSlate SignNow for the Nebraska 7AG exemption?

Using airSlate SignNow for the Nebraska 7AG exemption comes with numerous benefits, including increased efficiency, reduced paperwork errors, and enhanced compliance. Our user-friendly interface and mobile accessibility allow you to manage documents on-the-go, ensuring you can take advantage of your exemption without delays.

-

How secure is airSlate SignNow for managing documents related to the Nebraska 7AG exemption?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents such as those related to the Nebraska 7AG exemption. We employ industry-leading encryption standards and compliance protocols to protect your data, ensuring that your documents remain secure throughout the signing process.

Get more for Claim For Refund Of Sales And Use Tax, Form 7 Nebraska

Find out other Claim For Refund Of Sales And Use Tax, Form 7 Nebraska

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy