Form 1042 Annual Withholding Tax Return for U S Source Income of Foreign Persons

What is the Form 1042 Annual Withholding Tax Return For U.S. Source Income Of Foreign Persons

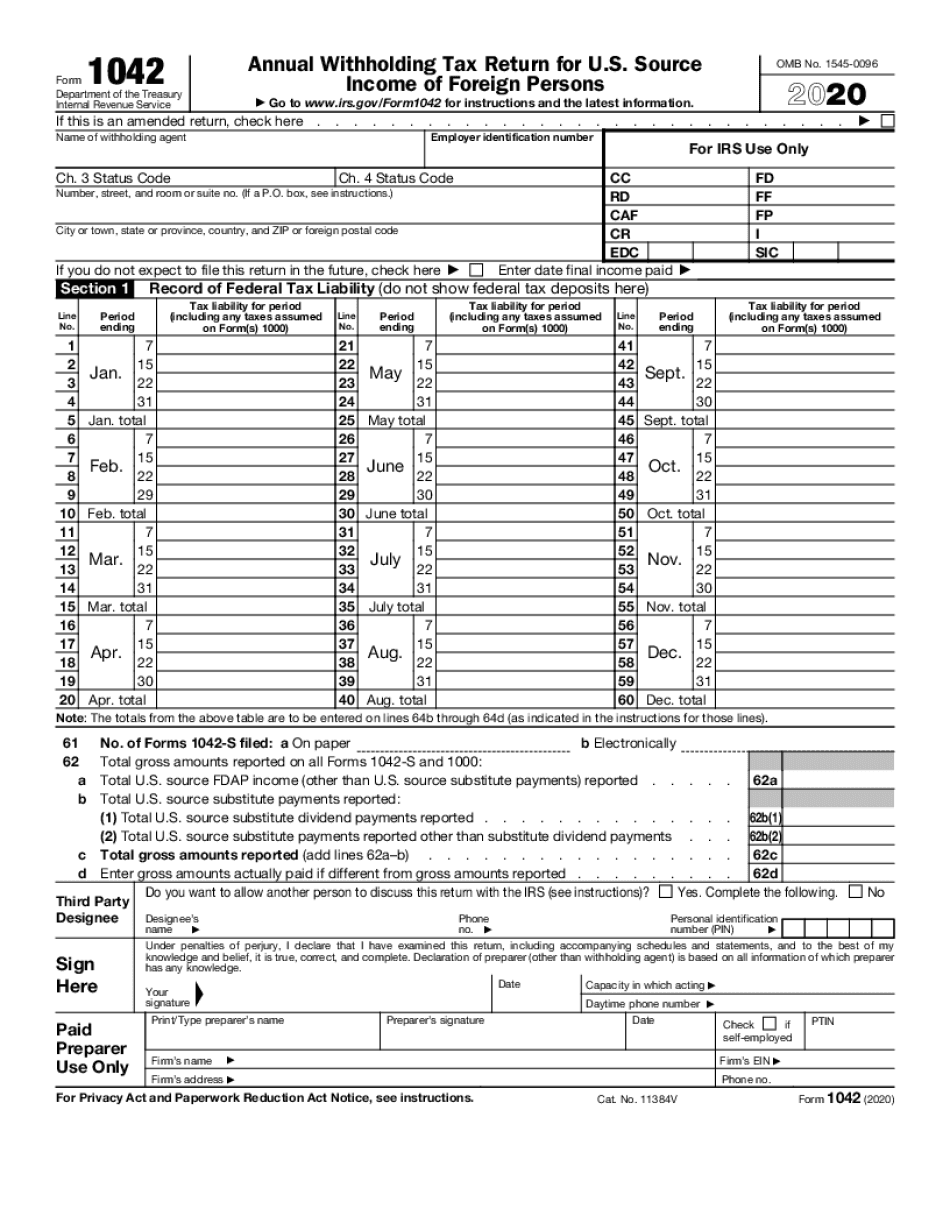

The Form 1042 is a crucial document used by withholding agents to report and pay taxes on U.S. source income paid to foreign persons. This form is essential for compliance with U.S. tax laws, ensuring that foreign individuals and entities fulfill their tax obligations on income derived from U.S. sources. The 1042 form is specifically designed for reporting various types of income, including interest, dividends, royalties, and other payments subject to withholding tax. Understanding the purpose of this form is vital for both the payer and the recipient to avoid penalties and ensure proper tax treatment.

How to use the Form 1042 Annual Withholding Tax Return For U.S. Source Income Of Foreign Persons

Using the Form 1042 involves several steps that ensure accurate reporting of income and withholding taxes. First, the withholding agent must gather all relevant information about the payments made to foreign persons. This includes details about the recipients, the type of income, and the amounts paid. Once this information is compiled, the agent can complete the form by entering the required data in the appropriate sections. After filling out the form, it must be submitted to the IRS by the designated deadline, along with any required payments for withholding taxes. Proper use of this form helps maintain compliance with tax regulations and avoids potential fines.

Steps to complete the Form 1042 Annual Withholding Tax Return For U.S. Source Income Of Foreign Persons

Completing the Form 1042 involves a series of organized steps:

- Gather all necessary information about the foreign recipients, including their names, addresses, and taxpayer identification numbers.

- Identify the types of income being reported, such as interest, dividends, or royalties.

- Calculate the total amounts paid to each foreign person and the corresponding withholding tax.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the form for any errors before submission.

- File the completed Form 1042 with the IRS by the deadline, ensuring any taxes withheld are paid accordingly.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1042 are critical to ensure compliance and avoid penalties. Typically, the form must be filed annually by March 15 of the year following the calendar year in which the income was paid. If this date falls on a weekend or holiday, the deadline may be adjusted. It is essential for withholding agents to mark their calendars and prepare the necessary documentation in advance to meet these deadlines. Additionally, any payments for withholding taxes must also be made timely to avoid interest and penalties.

Penalties for Non-Compliance

Failure to comply with the requirements of the Form 1042 can result in significant penalties. These penalties may include fines for late filing, inaccuracies in reporting, or failure to withhold the appropriate taxes. The IRS imposes these penalties to encourage compliance and ensure that foreign individuals and entities meet their tax obligations. It is crucial for withholding agents to understand these potential penalties and take proactive measures to avoid them, such as maintaining accurate records and filing on time.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 1042. These guidelines include detailed instructions on the information required, the proper format for reporting income, and the necessary calculations for withholding taxes. It is essential for withholding agents to familiarize themselves with these guidelines to ensure compliance and avoid errors. The IRS also offers resources and support for any questions or clarifications regarding the form and its requirements, making it easier for agents to navigate the process.

Quick guide on how to complete 2020 form 1042 annual withholding tax return for us source income of foreign persons

Complete Form 1042 Annual Withholding Tax Return For U S Source Income Of Foreign Persons effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Form 1042 Annual Withholding Tax Return For U S Source Income Of Foreign Persons on any device using airSlate SignNow's Android or iOS applications and streamline your document-based processes today.

The easiest way to alter and eSign Form 1042 Annual Withholding Tax Return For U S Source Income Of Foreign Persons without stress

- Locate Form 1042 Annual Withholding Tax Return For U S Source Income Of Foreign Persons and select Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional ink signature.

- Review the details and click on the Done button to save your alterations.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and eSign Form 1042 Annual Withholding Tax Return For U S Source Income Of Foreign Persons to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1042 annual withholding tax return for us source income of foreign persons

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

How to make an eSignature for a PDF document on Android OS

People also ask

-

What is a 2020 income tax calculator?

A 2020 income tax calculator is an online tool designed to help individuals estimate their tax liabilities based on their income for the year 2020. By inputting relevant financial information, users can receive an approximate calculation of their taxes, helping them plan their finances more effectively.

-

How can I benefit from using a 2020 income tax calculator?

Using a 2020 income tax calculator can streamline your tax preparation process by providing you with an estimate of your tax obligations. This allows you to better budget your finances and take necessary actions throughout the year to minimize your tax bill, ensuring you are well-prepared when tax season arrives.

-

Is the 2020 income tax calculator free to use?

Many online 2020 income tax calculators are available for free, allowing users to estimate their taxes without any associated costs. However, some premium calculators offer additional features that might require a subscription or one-time payment.

-

What features should I look for in a good 2020 income tax calculator?

A good 2020 income tax calculator should provide features like user-friendly input options, real-time calculations, detailed breakdowns of tax liabilities, and updates aligned with tax law changes. Additionally, features such as integration with tax filing services can enhance the overall user experience.

-

Can I use a 2020 income tax calculator to file my taxes?

While a 2020 income tax calculator can help estimate your taxes, it is not a substitute for actual tax filing software or services. Many users utilize calculators for preliminary estimates before using tax filing software to ensure compliance and accuracy in their actual tax returns.

-

Are there mobile-friendly 2020 income tax calculators available?

Yes, there are many mobile-friendly 2020 income tax calculators that allow users to access the tool on their smartphones or tablets. These calculators maintain responsive designs, ensuring ease of use and convenience while you're on the go.

-

How accurate is the 2020 income tax calculator?

The accuracy of a 2020 income tax calculator largely depends on the quality of the tool and the information provided by the user. While calculators can give a reliable estimate, it’s essential to ensure that the entered data is correct and reflective of your financial situation for more precise results.

Get more for Form 1042 Annual Withholding Tax Return For U S Source Income Of Foreign Persons

- Request for setting wyoming 497432485 form

- Trial pretrial form

- Pretrial disclosures for defendant with children wyoming form

- Overview divorce with minor children plaintiff wyoming form

- Wyoming civil cover sheet form

- Wy divorce form 497432490

- Divorce with children wyoming form

- Wyoming child support 497432492 form

Find out other Form 1042 Annual Withholding Tax Return For U S Source Income Of Foreign Persons

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template