About Form 8858, Information Return of U S Persons with 2020-2026

What is Form 8858?

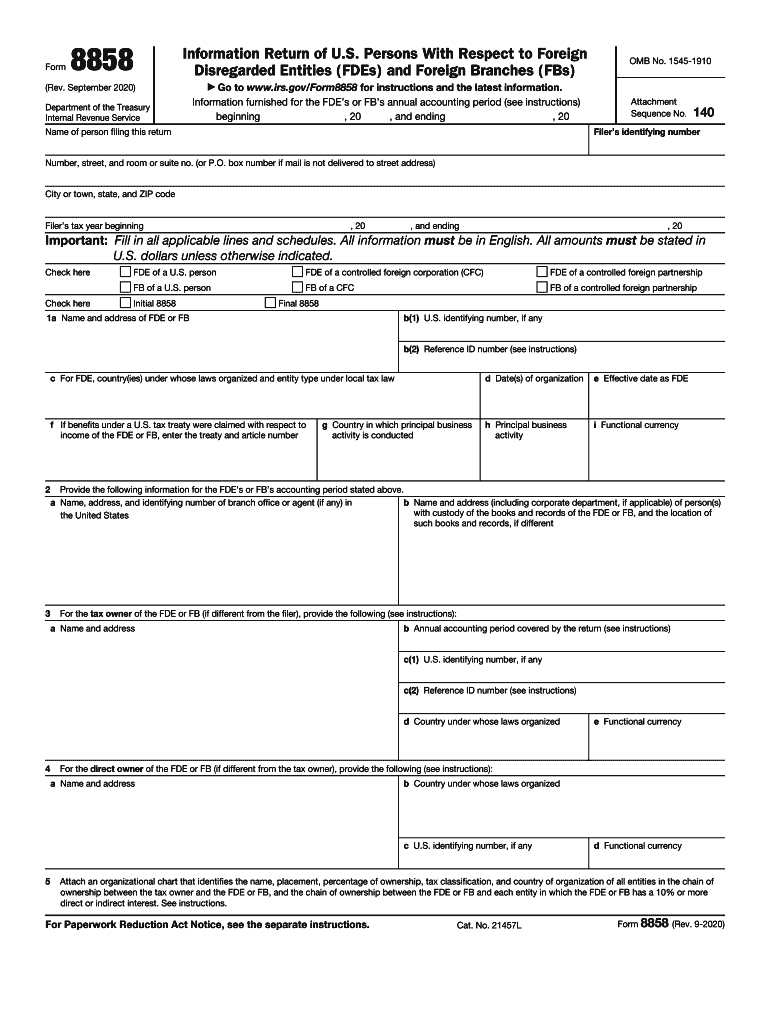

Form 8858, officially known as the Information Return of U.S. Persons With Respect to Foreign Disregarded Entities, is a tax form used by U.S. taxpayers to report information regarding foreign disregarded entities. This form is crucial for individuals and businesses that own foreign entities treated as disregarded for U.S. tax purposes. The primary aim of Form 8858 is to ensure compliance with U.S. tax laws and to provide the IRS with detailed information about these foreign entities, including their financial status and operations.

Steps to Complete Form 8858

Completing Form 8858 requires careful attention to detail. Here are the essential steps to follow:

- Gather necessary information about the foreign disregarded entity, including its name, address, and Employer Identification Number (EIN).

- Provide details regarding the ownership structure, including the percentage of ownership held by the U.S. taxpayer.

- Report financial information, including income, expenses, and assets of the foreign entity.

- Complete the necessary sections of the form, ensuring that all information is accurate and up to date.

- Review the form for any errors or omissions before submission.

Filing Deadlines for Form 8858

Form 8858 must be filed annually, and it is typically due on the same date as the U.S. taxpayer's income tax return. For most individuals and businesses, this means the form is due by April 15 of each year. However, if an extension is filed for the income tax return, Form 8858 can also be submitted by the extended deadline. It is essential to keep track of these deadlines to avoid penalties for late filing.

Legal Use of Form 8858

Form 8858 serves a legal purpose by ensuring that U.S. taxpayers comply with the Internal Revenue Code regarding foreign entities. Failure to file this form or providing inaccurate information can lead to significant penalties. The IRS uses the information reported on Form 8858 to assess the tax obligations of U.S. taxpayers with foreign interests, making it a vital component of international tax compliance.

Penalties for Non-Compliance

Non-compliance with Form 8858 filing requirements can result in severe penalties. The IRS may impose a penalty of up to $10,000 for failing to file the form or for filing it late. Additionally, if the failure to file is deemed to be intentional or if there is a substantial understatement of income, the penalties can increase significantly. It is crucial for taxpayers to understand these risks and ensure timely and accurate filing of Form 8858.

Who Issues Form 8858?

Form 8858 is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax administration. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers understand their obligations when it comes to reporting foreign disregarded entities. Taxpayers can access the form and its instructions directly from the IRS website or through tax preparation software that complies with IRS regulations.

Quick guide on how to complete about form 8858 information return of us persons with

Handle About Form 8858, Information Return Of U S Persons With effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents promptly without delays. Manage About Form 8858, Information Return Of U S Persons With on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to alter and electronically sign About Form 8858, Information Return Of U S Persons With effortlessly

- Locate About Form 8858, Information Return Of U S Persons With and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Modify and electronically sign About Form 8858, Information Return Of U S Persons With and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8858 information return of us persons with

Create this form in 5 minutes!

How to create an eSignature for the about form 8858 information return of us persons with

The best way to generate an eSignature for your PDF document in the online mode

The best way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the 2020 8858 form?

The 2020 8858 form is used to report the information of foreign entities that are controlled by U.S. taxpayers. Businesses must file this form to disclose their interests in foreign corporations. Understanding the 2020 8858 is crucial for compliance with IRS regulations, helping organizations avoid potential penalties.

-

How does airSlate SignNow assist with filing the 2020 8858?

airSlate SignNow streamlines the document signing process, making it easier to manage and submit the 2020 8858 form. With our secure eSignature solution, you can quickly gather the necessary signatures from stakeholders. This efficiency reduces the time spent on filing and ensures you meet the filing deadlines.

-

What are the pricing plans for using airSlate SignNow for the 2020 8858?

airSlate SignNow offers various pricing plans tailored to different business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your requirements. Our cost-effective solutions make it easy to manage documentation, including the 2020 8858 form, within your budget.

-

What features should I look for to manage the 2020 8858 efficiently?

When managing the 2020 8858, look for features like customizable templates, bulk sending, and secure storage. AirSlate SignNow provides these features, allowing you to create, send, and store forms efficiently. This ensures that you can handle multiple filings without losing track of important documents.

-

Can airSlate SignNow integrate with my existing accounting software for the 2020 8858?

Yes, airSlate SignNow offers integrations with various accounting and tax preparation software. These integrations help you easily pull the necessary financial data to complete your 2020 8858 forms. This seamless connection between systems reduces data entry errors and improves overall efficiency.

-

What are the benefits of using airSlate SignNow for the 2020 8858 filings?

Using airSlate SignNow for your 2020 8858 filings provides benefits such as enhanced security, compliance assurance, and increased productivity. Our platform is designed to help you manage sensitive documents safely. With easy document tracking and reminders, you can ensure timely filings and avoid penalties.

-

How secure is airSlate SignNow when handling the 2020 8858 form?

AirSlate SignNow prioritizes security with robust encryption and secure servers for document handling, including the 2020 8858 form. We adhere to industry standards to ensure that your sensitive information is kept safe. This commitment to security gives you peace of mind when managing important filings.

Get more for About Form 8858, Information Return Of U S Persons With

- Wyoming forest products timber sale contract wyoming form

- Assumption agreement of mortgage and release of original mortgagors wyoming form

- Wyoming foreign judgment enrollment wyoming form

- Wy estate form

- Wyoming unlawful form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497432528 form

- Wyoming annual file form

- Notices resolutions simple stock ledger and certificate wyoming form

Find out other About Form 8858, Information Return Of U S Persons With

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile