Form 8858 2007

What is the Form 8858

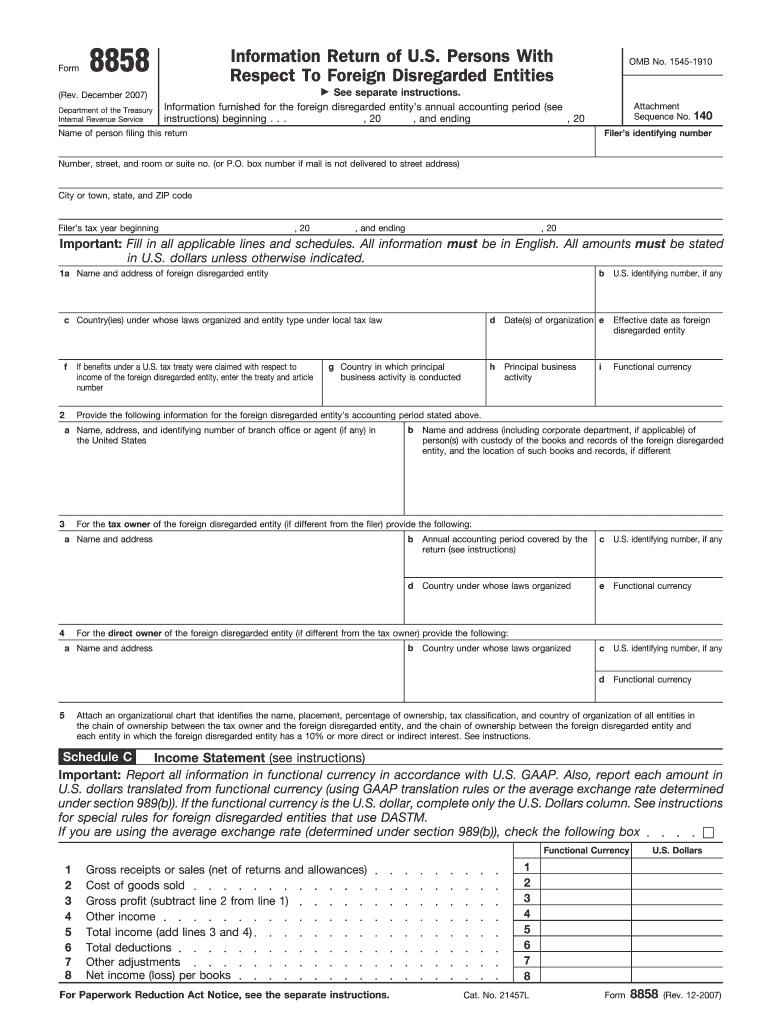

The Form 8858, also known as the Information Return of U.S. Persons With Respect to Foreign Disregarded Entities, is a tax form required by the Internal Revenue Service (IRS) for U.S. persons who own foreign disregarded entities. This form is essential for reporting the financial activities of these entities, ensuring compliance with U.S. tax laws. The primary purpose of Form 8858 is to provide the IRS with information about the foreign entity's income, deductions, and other relevant financial details.

How to use the Form 8858

To effectively use the Form 8858, taxpayers must first determine if they meet the criteria for filing. U.S. persons who own a foreign disregarded entity must complete this form as part of their tax return. The form requires detailed information about the entity, including its name, address, and financial activities. Accurate completion is crucial, as errors may lead to penalties. Once filled out, the form must be submitted alongside the taxpayer's annual income tax return.

Steps to complete the Form 8858

Completing the Form 8858 involves several key steps:

- Gather necessary information about the foreign disregarded entity, including its financial statements and identification details.

- Fill in the entity's name, address, and taxpayer identification number (TIN).

- Report the entity's income, deductions, and other financial data as required by the form.

- Review the completed form for accuracy and ensure all required sections are filled.

- Attach the Form 8858 to your annual tax return and submit it to the IRS by the due date.

Legal use of the Form 8858

The legal use of Form 8858 is governed by IRS regulations, which require U.S. persons to report their ownership of foreign disregarded entities accurately. Failure to file this form or providing incorrect information can result in significant penalties. It is essential to understand the legal implications of the form, as it plays a critical role in maintaining compliance with U.S. tax laws regarding foreign entities.

Filing Deadlines / Important Dates

Filing deadlines for Form 8858 align with the taxpayer's annual income tax return due date. Typically, this means the form must be submitted by April 15 for most individuals. However, taxpayers may qualify for an extension, allowing them to file by October 15. It is crucial to adhere to these deadlines to avoid penalties for late submission.

Penalties for Non-Compliance

Non-compliance with Form 8858 can lead to severe penalties, including fines for failure to file or inaccurate reporting. The IRS may impose a penalty of up to $10,000 for each failure to file the form. Additionally, if the IRS determines that the failure to report was intentional, penalties may increase significantly. Therefore, understanding and adhering to the requirements of Form 8858 is essential for U.S. taxpayers with foreign disregarded entities.

Quick guide on how to complete form 8858 2007

Complete Form 8858 effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Handle Form 8858 on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven processes today.

The simplest method to edit and eSign Form 8858 with ease

- Find Form 8858 and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize key sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Decide how you would like to send your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any preferred device. Modify and eSign Form 8858 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8858 2007

Create this form in 5 minutes!

How to create an eSignature for the form 8858 2007

The best way to generate an electronic signature for your PDF document online

The best way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is Form 8858 and why is it important?

Form 8858 is an IRS form used by certain tax filers to report information related to foreign entities. It's crucial for ensuring compliance with U.S. tax laws, especially for businesses operating internationally. Accurate filing of Form 8858 helps avoid penalties and ensures proper tax reporting.

-

How can airSlate SignNow simplify the process of submitting Form 8858?

airSlate SignNow offers an intuitive platform for easily preparing, signing, and submitting Form 8858. The user-friendly interface allows you to manage documents efficiently, ensuring that all necessary information is included. With airSlate SignNow, you can streamline your workflow and minimize the risk of errors when submitting Form 8858.

-

What features does airSlate SignNow offer for handling Form 8858?

airSlate SignNow provides features such as electronic signatures, document templates, and secure cloud storage to facilitate the management of Form 8858. These tools not only enhance document accuracy but also improve collaboration among teams. You can customize workflows to ensure that Form 8858 is completed and filed promptly.

-

Is airSlate SignNow a cost-effective solution for managing Form 8858?

Yes, airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes. The cost-effectiveness of our solution lies in its comprehensive features, which can save time and reduce the need for additional resources when managing Form 8858. You can choose a plan that best fits your needs and budget.

-

Can I integrate airSlate SignNow with other accounting tools for Form 8858 preparation?

Absolutely! airSlate SignNow supports integration with various accounting and tax preparation software to ensure seamless handling of Form 8858. This integration allows for automatic data transfer, reducing manual input errors and speeding up the document preparation process. It's designed to enhance your existing workflow effortlessly.

-

What security measures does airSlate SignNow implement for Form 8858 submissions?

airSlate SignNow prioritizes the security of your documents, including Form 8858, by utilizing advanced encryption protocols. Our platform ensures that all data is securely stored and only accessible by authorized users. We also comply with industry standards to protect sensitive information throughout the signing process.

-

How can airSlate SignNow help me track the submission status of Form 8858?

With airSlate SignNow, you can monitor the status of your Form 8858 submissions in real time. Our dashboard provides updates on who has signed the document and when it was submitted. This transparency helps you maintain accountability and ensures that nothing slips through the cracks.

Get more for Form 8858

Find out other Form 8858

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien