Resideence, Remittance Basis Etc Use the SA109 Supplementary Pages to Declare Your Residence and Domicile Status and Claim Perso 2020-2026

Understanding the p53 Tax Form Template

The p53 tax form template is essential for individuals who need to report their income and claim tax allowances. This form is specifically designed for non-residents in the United States, allowing them to declare their residence and domicile status. It plays a crucial role in ensuring compliance with tax regulations while maximizing potential allowances. Understanding its purpose and structure can help streamline the filing process.

Steps to Complete the p53 Tax Form Template

Filling out the p53 tax form template involves several key steps:

- Gather necessary personal information, including your full name, address, and Social Security number.

- Determine your residency status and the applicable allowances based on your situation.

- Carefully fill in each section of the form, ensuring all information is accurate and complete.

- Review the completed form for any errors or omissions before submission.

- Submit the form according to the guidelines provided, either electronically or by mail.

Required Documents for the p53 Tax Form Template

When preparing to complete the p53 tax form template, ensure you have the following documents ready:

- Proof of residency status, such as a visa or residency card.

- Income statements, including W-2s or 1099 forms.

- Any relevant tax documents that support your claims for allowances.

Legal Use of the p53 Tax Form Template

The p53 tax form template is legally binding when filled out correctly and submitted in accordance with IRS guidelines. It is crucial to ensure that all information provided is truthful and accurate, as discrepancies can lead to penalties or audits. Compliance with tax laws protects both the taxpayer and the integrity of the tax system.

Filing Deadlines for the p53 Tax Form Template

Staying aware of filing deadlines is essential for avoiding penalties. The p53 tax form template typically has specific submission dates that align with the overall tax filing season in the United States. It is advisable to check the IRS website or consult a tax professional for the most current deadlines to ensure timely submission.

Form Submission Methods for the p53 Tax Form Template

The p53 tax form template can be submitted through various methods:

- Online submission through the IRS e-file system.

- Mailing a physical copy to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Examples of Scenarios for Using the p53 Tax Form Template

Different taxpayer scenarios may require the use of the p53 tax form template, including:

- Non-residents earning income in the U.S. who need to report their earnings.

- Individuals applying for tax allowances based on their residency status.

- Taxpayers who have complex income sources that require detailed reporting.

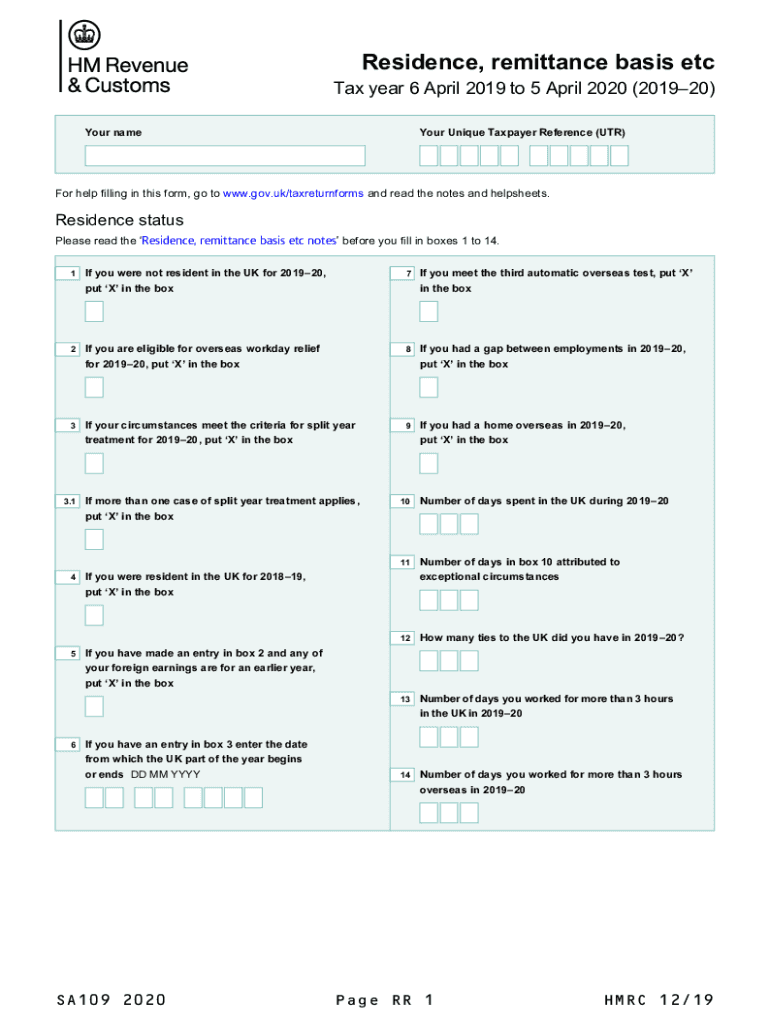

Quick guide on how to complete resideence remittance basis etc 2020 use the sa109 2020 supplementary pages to declare your residence and domicile status and

Easily Prepare Resideence, Remittance Basis Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Perso on Any Device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to find the right template and securely keep it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents promptly and without hold-ups. Manage Resideence, Remittance Basis Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Perso on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to Modify and Electronically Sign Resideence, Remittance Basis Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Perso Effortlessly

- Find Resideence, Remittance Basis Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Perso and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Resideence, Remittance Basis Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Perso while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct resideence remittance basis etc 2020 use the sa109 2020 supplementary pages to declare your residence and domicile status and

Create this form in 5 minutes!

How to create an eSignature for the resideence remittance basis etc 2020 use the sa109 2020 supplementary pages to declare your residence and domicile status and

The way to make an eSignature for a PDF online

The way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

The way to make an eSignature for a PDF document on Android

People also ask

-

What is the SA109 form 2024 and why is it important?

The SA109 form 2024 is a supplementary tax form used to report income and claimed losses by individuals in the UK. This document is essential for ensuring accurate tax reporting and compliance with HMRC regulations. Completing the SA109 form 2024 helps taxpayers understand their tax responsibilities and can potentially reduce their tax liabilities.

-

How can airSlate SignNow help in managing the SA109 form 2024?

airSlate SignNow provides an easy-to-use platform for eSigning and managing documents such as the SA109 form 2024. Our solution streamlines the document-signing process, allowing users to quickly generate, sign, and send necessary forms without delays. This enhances efficiency and ensures that your tax filings are submitted on time.

-

What features does airSlate SignNow offer for businesses dealing with the SA109 form 2024?

With airSlate SignNow, businesses can enjoy features like customizable templates, secure eSigning, and automated reminders for the SA109 form 2024. Our platform supports collaboration by allowing multiple parties to sign and access the document simultaneously. Furthermore, users can track their document's status, ensuring a smooth workflow.

-

Is there a cost associated with using airSlate SignNow for the SA109 form 2024?

Yes, airSlate SignNow offers various pricing plans designed to cater to both individuals and businesses for managing the SA109 form 2024. Our pricing is competitive and transparent, ensuring there are no hidden fees. You can choose a plan that best suits your needs and enjoy features that elevate your document management experience.

-

Are there integrations available with airSlate SignNow for the SA109 form 2024?

airSlate SignNow integrates seamlessly with popular business tools to enhance your experience with the SA109 form 2024. Whether you use CRM systems, cloud storage, or project management apps, our platform allows smooth data transfer and document management. This integration helps maintain consistency across your business operations.

-

Can I access my signed SA109 form 2024 from anywhere?

Absolutely! With airSlate SignNow, your signed SA109 form 2024 is accessible from any device with an internet connection. Our cloud-based platform allows you to retrieve, manage, and store your signed documents securely, ensuring you always have access when you need it. This flexibility is ideal for busy professionals on the go.

-

What security measures does airSlate SignNow implement for the SA109 form 2024?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the SA109 form 2024. We utilize bank-level encryption and comply with industry standards to safeguard your data. Our platform also offers authentication options to ensure that only authorized individuals can access and sign your documents.

Get more for Resideence, Remittance Basis Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Perso

- Heirship affidavit texas form

- Texas engineering professional conduct and ethics examination form

- Mentored youth hunter program registration form

- Ohio veterans hall of fame nomination form

- Supplier information form update existing supplier

- Oepa sso reporting form fill and sign printable template onlineus

- Pet food processor licenseregistration application cdph 8676 form

- Westby syttende mai car ampamp bike show registration form

Find out other Resideence, Remittance Basis Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Perso

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter