Form 5471 Internal Revenue Service 2020-2026

What is the Form 5471?

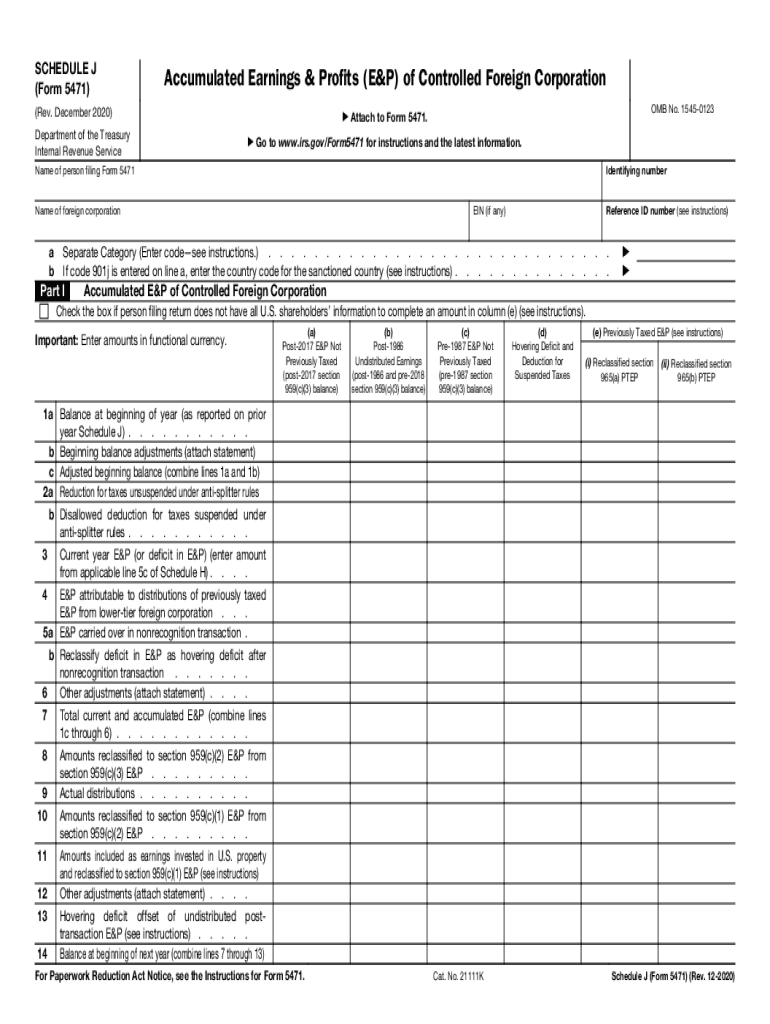

The Form 5471 is an IRS document used by U.S. citizens and residents to report their interests in foreign corporations. This form is essential for tax compliance, as it helps the Internal Revenue Service (IRS) track foreign income and assets. The form requires detailed information about the foreign corporation, including its financial statements, ownership structure, and transactions with U.S. shareholders. Understanding the purpose and requirements of Form 5471 is crucial for individuals and businesses engaged in international operations.

How to Use the Form 5471

Using Form 5471 involves several steps to ensure accurate reporting. Taxpayers must first determine their filing requirements based on their ownership interest in foreign corporations. The form is divided into multiple schedules, each addressing different aspects of the foreign corporation's operations. It is important to complete all relevant sections to provide a comprehensive overview of the foreign entity. Taxpayers may also need to consult IRS guidelines or a tax professional to navigate complex reporting requirements effectively.

Steps to Complete the Form 5471

Completing the Form 5471 requires careful attention to detail. Here are key steps to follow:

- Identify your filing category based on your ownership interest.

- Gather necessary financial information about the foreign corporation, including balance sheets and income statements.

- Fill out the appropriate schedules, such as Schedule A for information about the foreign corporation and Schedule B for U.S. shareholders.

- Review the completed form for accuracy and ensure all required signatures are included.

- Submit the form along with your tax return by the specified deadline.

Key Elements of the Form 5471

Form 5471 consists of several key components that must be accurately reported. These include:

- Identification Information: Basic details about the foreign corporation, such as its name, address, and Employer Identification Number (EIN).

- Ownership Structure: Information on the shareholders, including their ownership percentages and types of shares held.

- Financial Statements: Required financial data, including income statements and balance sheets for the reporting year.

- Transactions: Details of any transactions between the U.S. shareholders and the foreign corporation, including loans and sales.

Filing Deadlines / Important Dates

Filing deadlines for Form 5471 are aligned with your tax return due date. Generally, the form must be filed by the due date of the taxpayer's federal income tax return, including extensions. For most individuals, this is April 15, while businesses may have different deadlines based on their fiscal year. It is essential to stay informed about these dates to avoid penalties for late submission.

Penalties for Non-Compliance

Failure to file Form 5471 or providing inaccurate information can result in significant penalties. The IRS imposes a penalty of $10,000 for each form not filed or filed late, and additional penalties may apply for failure to report foreign income. It is crucial for taxpayers to understand these consequences and ensure compliance to avoid financial repercussions.

Quick guide on how to complete form 5471 internal revenue service

Complete Form 5471 Internal Revenue Service seamlessly on any device

Digital document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Form 5471 Internal Revenue Service on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Form 5471 Internal Revenue Service effortlessly

- Find Form 5471 Internal Revenue Service and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you prefer. Modify and eSign Form 5471 Internal Revenue Service and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5471 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 5471 internal revenue service

The way to make an eSignature for a PDF document in the online mode

The way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is form 5471 and why is it important?

Form 5471 is a U.S. tax form used by certain U.S. citizens and residents to report foreign corporations in which they are involved. It is vital for maintaining compliance with IRS regulations and avoiding signNow fines. Understanding how to correctly fill out form 5471 can help you manage your international business activities effectively.

-

How can airSlate SignNow assist with form 5471?

airSlate SignNow provides a simple and efficient platform for eSigning and managing documents, including form 5471. With our user-friendly interface, you can easily prepare, send, and store your form 5471 securely. This streamlines the process, saving you time and ensuring you meet all necessary deadlines.

-

What pricing plans does airSlate SignNow offer for managing form 5471?

airSlate SignNow offers a variety of pricing plans suitable for businesses of all sizes looking to manage documents like form 5471. Plans start at a low monthly rate, providing affordability for small businesses while scaling up for larger enterprises. Each plan includes essential features to help you effectively handle your documentation needs.

-

Are there any features specific to handling form 5471 with airSlate SignNow?

Yes, airSlate SignNow includes features designed to assist with form 5471, such as templates and reusable fields. These features help you accurately fill out repetitive sections of the form with ease. Additionally, you can track the status of your documents in real-time for maximum efficiency.

-

Can I integrate airSlate SignNow with other tools to manage form 5471?

Absolutely! airSlate SignNow supports integrations with a wide range of business applications, allowing you to connect with tools you already use to manage form 5471 smoothly. This ensures all your documents and data are in sync, boosting productivity and reducing errors.

-

Is it secure to use airSlate SignNow for sensitive documents like form 5471?

Yes, security is a top priority at airSlate SignNow. We implement advanced encryption technologies to safeguard your documents, including form 5471. You can confidently send and store your sensitive data knowing that it is protected against unauthorized access.

-

What benefits does airSlate SignNow provide for businesses submitting form 5471?

Using airSlate SignNow for submitting form 5471 streamlines your documentation process, reducing the time spent on paperwork. Our platform enhances collaboration by allowing multiple stakeholders to eSign and review documents effortlessly. This makes it easier to meet important tax deadlines without stress.

Get more for Form 5471 Internal Revenue Service

- Wwwhangnhatbaigiarecomzoy0ckj9tennessee departmenttennessee department of revenue vehicle services division form

- Official weight slip x form

- Dmv junk slip form

- Dtop 770 form

- Sample motion for appointment of counsel form

- Change of venue cause form

- Deferral program form

- Order form for warehouse receipts

Find out other Form 5471 Internal Revenue Service

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself