Revised Form 5471 for 2018

What is the Revised Form 5471 For

The Revised Form 5471 is primarily used by U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations. This form is essential for reporting information about foreign entities and their financial activities to the Internal Revenue Service (IRS). It aims to ensure compliance with U.S. tax regulations, particularly for those who have significant control or ownership in these foreign corporations. The revised version includes updates to enhance clarity and address regulatory changes, making it crucial for accurate reporting.

How to Use the Revised Form 5471

Using the Revised Form 5471 involves several steps. First, determine your filing requirement based on your ownership interest in a foreign corporation. Next, gather necessary financial information regarding the foreign corporation, including balance sheets, income statements, and details about shareholders. Complete each section of the form accurately, ensuring that all required information is provided. It is important to review the IRS guidelines for any specific instructions related to your situation. Finally, submit the form by the due date to avoid penalties.

Steps to Complete the Revised Form 5471

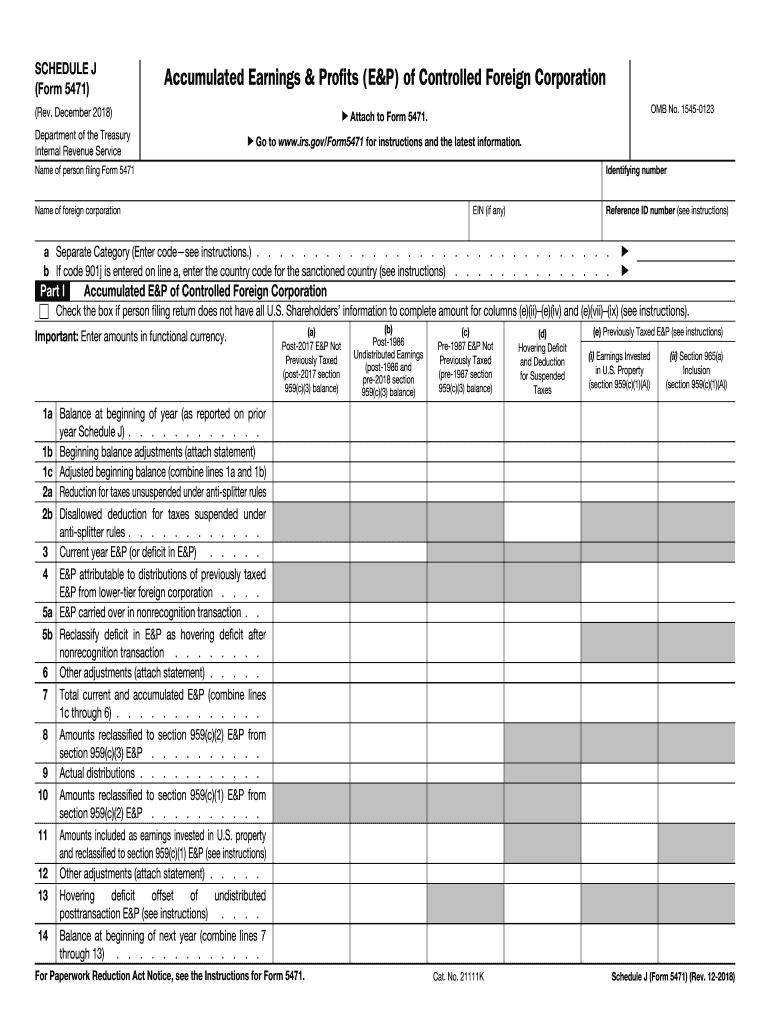

Completing the Revised Form 5471 requires careful attention to detail. Start by filling out the basic identification information, including your name, address, and taxpayer identification number. Next, provide details about the foreign corporation, such as its name, address, and country of incorporation. Complete the financial sections, which may require information from the corporation’s financial statements. Ensure that all schedules related to the form are filled out, including Schedule J, which reports the corporation's earnings and profits. Double-check all entries for accuracy before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Revised Form 5471 are typically aligned with the due date of your income tax return. For most taxpayers, this means the form is due on April fifteenth, following the end of the tax year. If you file for an extension, the deadline for submitting the form may also be extended. It is crucial to stay informed about any changes to these deadlines, as late submissions can result in significant penalties.

Penalties for Non-Compliance

Failing to file the Revised Form 5471 or submitting it inaccurately can lead to severe penalties. The IRS imposes a penalty of $10,000 for each form not filed on time. Additionally, if the failure to file continues for more than 90 days after receiving a notice from the IRS, an additional penalty of $10,000 per month may apply. It is essential to understand these penalties and ensure timely and accurate filing to avoid financial repercussions.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Revised Form 5471. These guidelines detail the information required for each section of the form, including definitions of terms and instructions on how to report foreign income and expenses. Familiarizing yourself with these guidelines is vital for ensuring compliance and avoiding mistakes that could lead to penalties. Refer to the IRS website or official publications for the most current information and updates related to the form.

Quick guide on how to complete 5471 sch j 2018 2019 form

Uncover the most efficient approach to complete and endorse your Revised Form 5471 For

Are you still spending time preparing your official documents on paper instead of doing it online? airSlate SignNow offers a superior method to finalize and endorse your Revised Form 5471 For and similar forms for public services. Our advanced electronic signature solution equips you with all necessary tools to handle documents swiftly and in compliance with official standards - comprehensive PDF editing, managing, securing, signing, and sharing functionalities all available within an easy-to-use interface.

Only a few actions are required to complete and endorse your Revised Form 5471 For:

- Upload the editable template to the editor using the Get Form button.

- Review the information you need to input in your Revised Form 5471 For.

- Move between fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your details.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is truly important or Blackout sections that are no longer relevant.

- Click on Sign to generate a legally valid electronic signature using any method of your choice.

- Add the Date next to your signature and wrap up your task with the Done button.

Store your completed Revised Form 5471 For in the Documents folder within your account, download it, or transfer it to your preferred cloud storage. Our solution also provides versatile form sharing options. There's no need to print your forms when you can submit them to the relevant public office - do it via email, fax, or by requesting a USPS "snail mail" delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct 5471 sch j 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do I fill out the Rai Publication Scholarship Form 2019?

Rai Publication Scholarship Exam 2019- Rai Publication Scholarship Form 5th, 8th, 10th & 12th.Rai Publication Scholarship Examination 2019 is going to held in 2019 for various standards 5th, 8th, 10th & 12th in which interested candidates can apply for the following scholarship examination going to held in 2019. This scholarship exam is organized by the Rai Publication which will held only in Rajasthan in the year 2019. Students can apply for the following scholarship examination 2019 before the last date of application that is 15 January 2019. The exam will be conducted district wise in Rajasthan State by the Rai Publication before June 2019.Students of class 5th, 8th, 10th and 12th can fill online registration for Rai Publication scholarship exam 2019. Exam is held in February in all districts of Rajasthan. Open registration form using link given below.In the scholarship examination, the scholarship will be given to the 20 topper students from each standard of 5th, 8th, 10th & 12th on the basis of lottery which will be equally distributed among all 20 students. The declaration of the prize will be announced by July 2019.राय पब्लिकेशन छात्रव्रत्ति परीक्षा का आयोजन सत्र 2019 में किया जाएगा कक्षा 5वी , 8वी , 10वी एवं 12वी के लिए, इच्छुक अभ्यार्थी आवेदन कर सकते है इस छात्रव्रत्ति परीक्षा 2019 के लिए | यह छात्रव्रत्ति परीक्षा राजस्थान में राइ पब्लिकेशन के दवारा की जयगी सत्र 2019 में | इच्छुक अभ्यार्थी एक परीक्षा कर सकते है आखरी तारीख 15 जनवरी 2019 से पहले | यह परिखा राजस्थान छेत्र में जिला स्तर पर कराई जाएगी राइ पब्लिकेशन के दवारा जून 2019 से पहले |इस छात्रव्रत्ति परीक्षा में, छात्रव्रत्ति 20 विजेता छात्र छात्राओं दो दी जयेगी जिसमे हर कक्षा के 20 छात्र होंगे जिन्हे बराबरी में बाटा जयेगा। पुरस्कार की घोसणा जुलाई 2019 में की जयेगी |Rai Publication Scholarship Exam 2019 information :This scholarship examination is conducted for 5th, 8th, 10th & 12th standard for which interested candidates can apply which a great opportunity for the students. The exam syllabus will be based according to the standards of their exam which might help them in scoring in the Rai Publication Scholarship Examination 2019. The question in the exam will be multiple choice questions (MCQ’s) and there will be 100 multiple choice questions. To apply for the above scholarship students must have to fill the application form but the 15 January 2019.यह छात्रव्रत्ति परीक्षा कक्षा कक्षा 5वी , 8वी , 10वी एवं 12वी के लिए आयोजित है जिसमे इच्छुक अभ्यार्थी पंजीकरण करा सकते है जोकि छात्र छात्राओं के लिए एक बड़ा अवसर होगा | राय पब्लिकेशन छात्रव्रत्ति परीक्षा 2019 परीक्षा का पाठ्यक्रम कक्षा अनुसार ही होगा जोकि उन्हें प्राथम आने में सहयोग प्रदान करेगा | परीक्षा के प्रश्न-पत्र में सारे प्रश्न बहुविकल्पीय प्रश्न होंगे एवं प्रश्न-पत्र में कुल 100 प्रश्न दिए जायेंगे | इस छात्रव्रत्ति परीक्षा को देने क लिए अभयार्थियो को पहले पंजीकरण करना अनिवार्य होगा जोकि ऑनलाइन होगा जिसकी आखरी तारीख 15 जनवरी 2019 है |Distribution of Rai Publication Deskwork Scholarship Exam 2019:5th Class Topper Prize Money:- 4 Lakh Rupees8th Class Topper Prize Money:- 11 Lakh Rupees10th Class Topper Prize Money:- 51 Lakh Rupees12thClass Topper Prize Money:- 39 Lakh RupeesHow to fill Rai Publication Scholarship Form 2019 :Follow the above steps to register for the for Rai Publication Scholarship Examination 2019:Candidates can follow these below given instructions to apply for the scholarship exam of Rai Publication.The Rai Publication Scholarship application form is available in the news paper (Rajasthan Patrika.) You can also download it from this page. It also can be downloaded from the last page of your desk work.Application form is also given on the official website of Rai Publication: Rai Publication - Online Book Store for REET RPSC RAS SSC Constable Patwar 1st 2nd Grade TeacherNow fill the details correctly in the application form.Now send the application form to the head office of Rai Publication.Rai Publication Website Link Click HereHead Office Address of Rai PublicationShop No: -24 & 25, Bhagwan Das Market, Chaura Rasta, Jaipur, RajasthanPIN Code:- 302003Contact No.- 0141 232 1136Source : Rai Publication Scholarship Exam 2019

-

While filling out the JEE main application form 2018, I filled out the wrong school name, can it be changed? How?

HiYou can edit your JEE Main 2018 application form only if you haven’t paid registration fee. You have to login to your account and enter details-Then click on view application form on the left side.Now click on Edit Application formNow after signNowing to this page you can edit your application form.Hope this will help you.Thanks !!

-

How can I fill out the application form for the JMI (Jamia Millia Islamia) 2019?

Form for jamia school have been releaseYou can fill it from jamia siteJamia Millia Islamia And for collegeMost probably the form will out end of this month or next monthBut visit the jamia site regularly.Jamia Millia Islamiacheck whether the form is out or not for the course you want to apply.when notification is out then you have to create the account for entrance and for 2 entrance same account will be used you have to check in the account that the course you want to apply is there in listed or not ….if not then you have to create the different account for that course .If you have any doubts you can freely ask me .

Create this form in 5 minutes!

How to create an eSignature for the 5471 sch j 2018 2019 form

How to make an electronic signature for your 5471 Sch J 2018 2019 Form in the online mode

How to make an eSignature for your 5471 Sch J 2018 2019 Form in Google Chrome

How to make an eSignature for signing the 5471 Sch J 2018 2019 Form in Gmail

How to create an electronic signature for the 5471 Sch J 2018 2019 Form right from your mobile device

How to create an electronic signature for the 5471 Sch J 2018 2019 Form on iOS

How to generate an electronic signature for the 5471 Sch J 2018 2019 Form on Android

People also ask

-

What is the form 5471 schedule j and why is it important?

The form 5471 schedule j is a key component of IRS reporting for U.S. shareholders of foreign corporations. It provides detailed information about the foreign corporation's income, deductions, and distributions. Understanding this form is crucial for compliance and avoiding potential penalties.

-

How can airSlate SignNow help with filing form 5471 schedule j?

airSlate SignNow offers an easy-to-use platform that streamlines the eSigning and document management process for form 5471 schedule j. Our solution allows users to efficiently fill, sign, and send important tax documents securely. This can signNowly reduce the time and complexity associated with filing.

-

Is airSlate SignNow cost-effective for preparing form 5471 schedule j?

Yes, airSlate SignNow provides a cost-effective solution for businesses looking to handle form 5471 schedule j. Our pricing plans are designed to fit a variety of budgets, making it accessible for both small and large firms. With airSlate SignNow, you can save on both time and money when managing your tax documents.

-

Can I integrate airSlate SignNow with my existing accounting software for form 5471 schedule j?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software applications. This feature allows you to easily manage your form 5471 schedule j alongside other financial tasks, enhancing workflow efficiency and ensuring compliance.

-

What features does airSlate SignNow provide for form 5471 schedule j management?

airSlate SignNow includes features like customizable templates, secure eSigning, document tracking, and collaboration tools, all tailored to simplify the management of form 5471 schedule j. These features empower users to create and manage tax documents easily and securely.

-

How does airSlate SignNow ensure the security of form 5471 schedule j documents?

Security is a top priority for airSlate SignNow. We utilize advanced encryption protocols and secure cloud storage to protect your form 5471 schedule j documents. Additionally, our platform complies with industry standards, ensuring that your sensitive information remains confidential.

-

Can airSlate SignNow assist with revisions of form 5471 schedule j?

Yes, airSlate SignNow allows for easy revisions and updates to form 5471 schedule j documents. With our platform, you can collaborate with team members in real-time, making it simple to edit and finalize documents before submission. This feature helps minimize errors and enhances accuracy.

Get more for Revised Form 5471 For

- Icu score sheet form

- Confidential private placement memorandum regulation d rule 506 pcc capital investments llc form

- Tcu drug screen v ibr tcu form

- 6c in production in pdf form

- Diocese of st augustine our lady star of the sea catholic church form

- Notice of limited appearance family law cases 22nd judicial form

- Wopr eugene record of decision wopr eugene record of decision blm form

- Pte 247080200 new mexico pass through entit form

Find out other Revised Form 5471 For

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA