Form 4684 Casualties and Thefts

What is the Form 4684 Casualties And Thefts

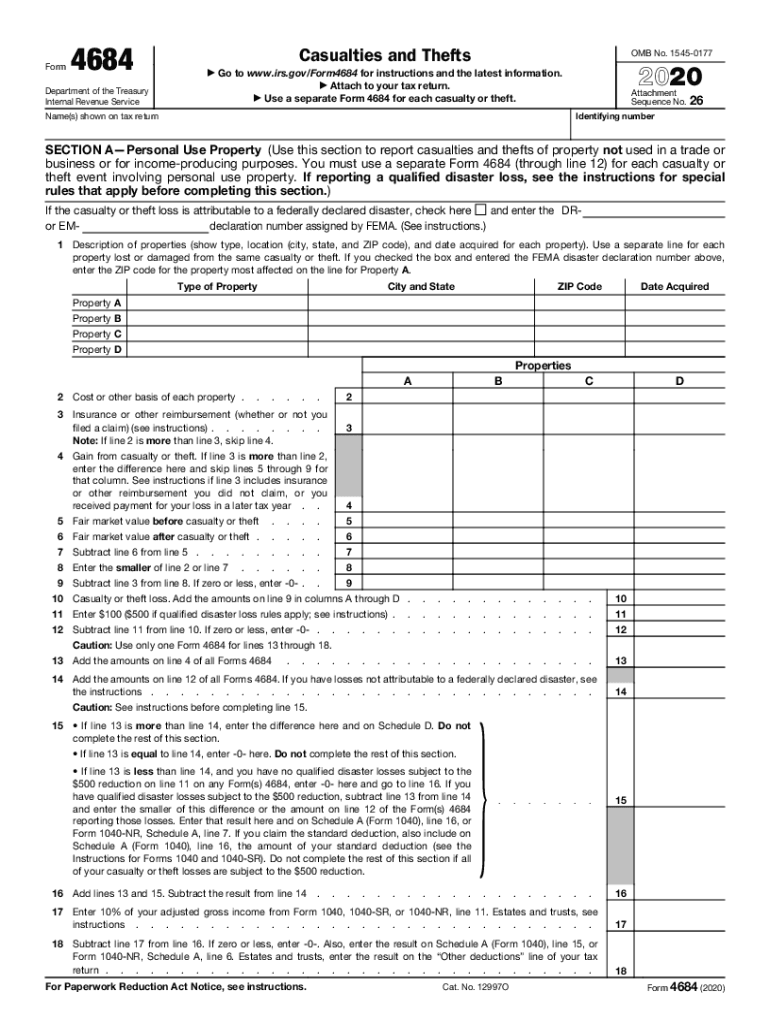

The 2020 IRS Form 4684 is used to report casualties and thefts for tax purposes. This form allows taxpayers to claim a deduction for losses incurred due to unexpected events such as natural disasters or theft of property. The form is essential for accurately calculating the amount of loss that can be deducted from taxable income, helping to alleviate some financial burden resulting from such incidents.

How to use the Form 4684 Casualties And Thefts

To effectively use the 2020 IRS Form 4684, individuals must first gather necessary documentation related to their losses. This includes receipts, photographs, and police reports, if applicable. The form requires detailed information about the type of loss, the date it occurred, and the fair market value of the property before and after the incident. Properly filling out this form ensures that taxpayers can substantiate their claims when filing their tax returns.

Steps to complete the Form 4684 Casualties And Thefts

Completing the 2020 IRS Form 4684 involves several key steps:

- Begin by entering your personal information at the top of the form.

- Detail the type of casualty or theft in Part I, specifying the event and the date it occurred.

- In Part II, list each item lost, including its description, fair market value before the loss, and the amount of loss after the event.

- Calculate the total loss and any insurance reimbursements received, as these will affect your deductible amount.

- Sign and date the form before submitting it with your tax return.

IRS Guidelines

The IRS provides specific guidelines for completing Form 4684, which include instructions on what qualifies as a casualty or theft loss. Taxpayers must adhere to these guidelines to ensure compliance and avoid potential audits. It is important to refer to the IRS instructions for Form 4684 to understand eligibility criteria and necessary documentation, as well as any changes from previous years.

Filing Deadlines / Important Dates

Filing deadlines for the 2020 IRS Form 4684 align with the general tax return deadlines. Typically, individuals must file their federal tax returns by April 15 of the following year. If additional time is needed, taxpayers can request an extension, but it is crucial to ensure that Form 4684 is submitted within the allowed timeframe to avoid penalties.

Required Documents

When completing the 2020 IRS Form 4684, certain documents are required to substantiate claims. These may include:

- Proof of ownership, such as receipts or titles.

- Evidence of the loss, like photographs or police reports.

- Insurance statements detailing any reimbursements received.

- Appraisals or other documentation supporting the fair market value of lost property.

Quick guide on how to complete 2020 form 4684 casualties and thefts

Easily Prepare Form 4684 Casualties And Thefts on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, since you can find the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, alter, and electronically sign your documents swiftly without complications. Manage Form 4684 Casualties And Thefts on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Form 4684 Casualties And Thefts Effortlessly

- Find Form 4684 Casualties And Thefts and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 4684 Casualties And Thefts and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 4684 casualties and thefts

How to create an electronic signature for your PDF document online

How to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is the 2020 IRS 4684 form and how does it relate to airSlate SignNow?

The 2020 IRS 4684 form is used to report the loss of property for tax purposes. With airSlate SignNow, you can easily eSign and send documents related to this form, ensuring a streamlined process for your tax filings. Simplifying this process helps ensure compliance while saving you valuable time.

-

How can airSlate SignNow assist in completing the 2020 IRS 4684?

AirSlate SignNow provides a user-friendly interface that allows you to fill out and eSign the 2020 IRS 4684 form online. Our platform ensures that you can collect signatures seamlessly and keep all records organized in one place. This efficiency reduces the hassle of traditional paperwork.

-

What are the pricing plans for using airSlate SignNow for the 2020 IRS 4684?

AirSlate SignNow offers various pricing plans that cater to different business needs, starting with a free trial. Our competitive pricing allows you to manage forms like the 2020 IRS 4684 without breaking the bank. Explore our plans to find the best fit for your organization's needs.

-

Is airSlate SignNow compliant with IRS regulations for submitting the 2020 IRS 4684?

Yes, airSlate SignNow complies with all necessary regulations for IRS documentation, including the 2020 IRS 4684. Our platform uses advanced security measures to ensure that your signed documents meet IRS standards. Trust us to handle your sensitive documents with care.

-

Can I integrate airSlate SignNow with other software for handling the 2020 IRS 4684?

Absolutely! AirSlate SignNow offers integrations with various software systems such as CRM and accounting tools. This allows you to manage your 2020 IRS 4684 alongside your other business processes efficiently, streamlining your workflow even further.

-

What features does airSlate SignNow offer specifically for the 2020 IRS 4684?

AirSlate SignNow includes several features that enhance your experience with the 2020 IRS 4684, such as template creation, custom workflows, and real-time tracking of document statuses. These features are designed to make signing and sending forms easier for businesses of all sizes.

-

How secure is airSlate SignNow when handling sensitive forms like the 2020 IRS 4684?

We prioritize security at airSlate SignNow, employing encryption and secure access protocols. Your documents, including the 2020 IRS 4684, are protected from unauthorized access, ensuring peace of mind while you manage your tax-related files.

Get more for Form 4684 Casualties And Thefts

- Bostoncambridgecollegeedusitesdefaultstudent id cambridge college 500 rutherford avenue change of form

- Bank statement for university form

- Wwwasuramsedustudent affairshealth servicesstudent health forms albany state university

- Bostoncambridgecollegeedurequest informationrequest informationcambridge college boston

- Mla cheat sheet form

- Permanent notary application for wisconsin law marquette form

- Educational planning guide igetc dvc form

- Vis east international commercial arbitration moot hong kong march 2016 memorandum for respondent claimant kaihari waina ltd form

Find out other Form 4684 Casualties And Thefts

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT