About Form 2555, Foreign Earned IncomeInternal Revenue

Understanding Form 2555 for Foreign Earned Income

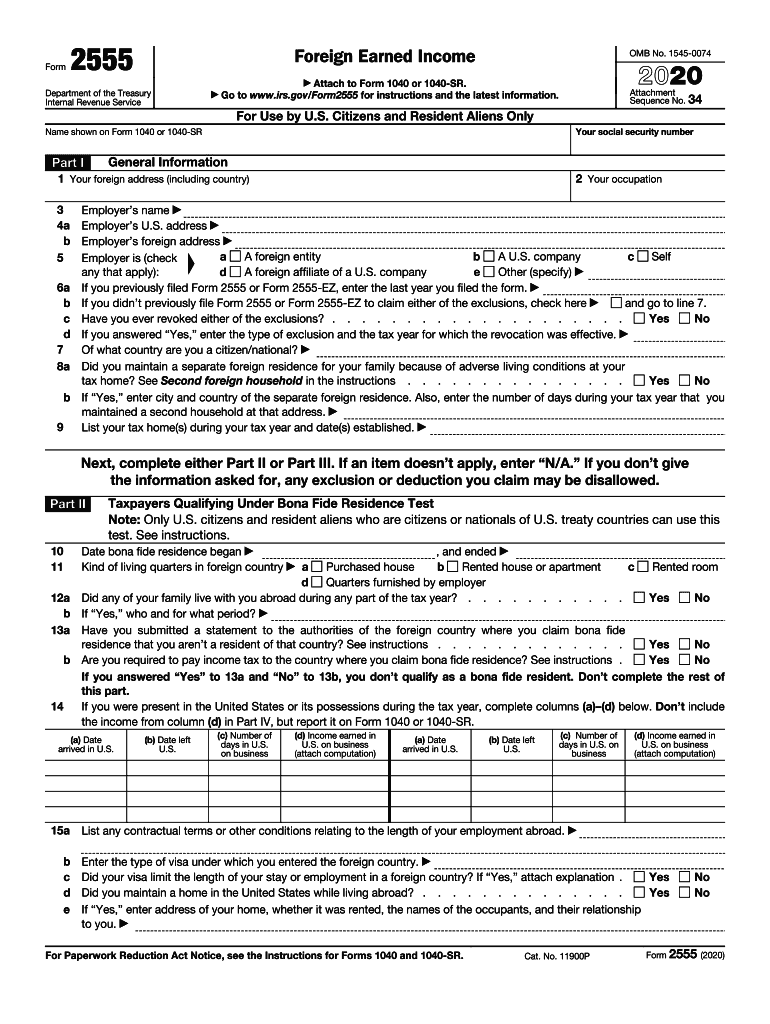

The 2020 Form 2555 is a critical document for U.S. citizens and resident aliens who earn income abroad. This form allows eligible taxpayers to claim the foreign earned income exclusion, which can significantly reduce their taxable income. By completing the 2555 form, individuals can exclude a portion of their foreign earnings from U.S. taxation, provided they meet specific criteria set by the IRS. Understanding this form is essential for anyone working outside the United States, as it can lead to substantial tax savings.

Steps to Complete Form 2555

Completing the 2020 Form 2555 involves several key steps. First, gather necessary documentation, including your foreign income details and residency information. Next, fill out the form accurately, ensuring that you provide all required details about your foreign earned income and the physical presence test or bona fide residence test. After completing the form, review it for accuracy before submitting it with your 1040 tax return. Utilizing a digital platform can streamline this process, making it easier to fill out and sign the form securely.

Eligibility Criteria for Form 2555

To qualify for the foreign earned income exclusion using Form 2555, taxpayers must meet specific eligibility criteria. Primarily, you must have foreign earned income and either be a bona fide resident of a foreign country or meet the physical presence test. The bona fide residence test requires you to reside in a foreign country for an entire tax year, while the physical presence test necessitates being outside the U.S. for at least 330 full days during a 12-month period. Understanding these criteria is crucial for successful completion of the form.

Filing Deadlines for Form 2555

The filing deadline for the 2020 Form 2555 aligns with the standard tax return due date, which is typically April 15 of the following year. However, if you are living abroad, you may qualify for an automatic extension, allowing you to file until June 15 without penalties. It is important to keep track of these deadlines to avoid any late filing penalties. If additional time is needed, you can request an extension, but ensure that you comply with all IRS requirements.

Required Documents for Form 2555

When completing the 2020 Form 2555, certain documents are essential to support your claims. You will need proof of foreign earned income, such as pay stubs or tax documents from your employer. Additionally, documentation establishing your residency status, such as rental agreements or utility bills, may be required. Having these documents readily available will facilitate a smoother filing process and help ensure that your form is accurate and complete.

Digital vs. Paper Version of Form 2555

Choosing between a digital and paper version of the 2020 Form 2555 can impact your filing experience. The digital version offers advantages such as easier edits, secure storage, and the ability to eSign, which can expedite the submission process. In contrast, the paper version requires mailing and may take longer to process. Utilizing a digital platform for completing and submitting the form can enhance efficiency and provide a more streamlined experience.

Quick guide on how to complete about form 2555 foreign earned incomeinternal revenue

Accomplish About Form 2555, Foreign Earned IncomeInternal Revenue seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without delays. Handle About Form 2555, Foreign Earned IncomeInternal Revenue on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related task today.

The simplest way to edit and eSign About Form 2555, Foreign Earned IncomeInternal Revenue effortlessly

- Obtain About Form 2555, Foreign Earned IncomeInternal Revenue and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Select important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign About Form 2555, Foreign Earned IncomeInternal Revenue and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 2555 foreign earned incomeinternal revenue

How to create an eSignature for your PDF file in the online mode

How to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to generate an eSignature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

How to generate an eSignature for a PDF file on Android

People also ask

-

What is the form 2555 2020 used for?

The form 2555 2020 is used by U.S. citizens and resident aliens living abroad to claim the Foreign Earned Income Exclusion. This form allows individuals to exclude a certain amount of their foreign earnings from U.S. taxation, helping them maximize their tax benefits.

-

How can airSlate SignNow assist with the form 2555 2020?

airSlate SignNow simplifies the process of preparing and signing the form 2555 2020. With our easy-to-use platform, users can quickly fill out, eSign, and securely send their tax forms without the hassle of printing or mailing documents.

-

What are the pricing options for airSlate SignNow related to form 2555 2020?

airSlate SignNow offers competitive pricing plans that are designed for individuals and businesses alike. Pricing varies based on the features you need to handle documents like the form 2555 2020, with options for monthly or annual subscriptions that ensure great value.

-

Are there specific features in airSlate SignNow for tax document management, including form 2555 2020?

Yes, airSlate SignNow includes features tailored for managing tax documents such as the form 2555 2020. Users can benefit from document templates, automated workflows, and secure storage functionality that simplifies the tax filing process.

-

Can I integrate airSlate SignNow with other software to manage form 2555 2020?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and tax software. This enables users to streamline the submission of form 2555 2020 and other related financial documents directly from their preferred applications.

-

Is it easy to eSign the form 2555 2020 using airSlate SignNow?

Yes, eSigning the form 2555 2020 using airSlate SignNow is incredibly user-friendly. Our platform allows you to sign documents electronically in just a few clicks, ensuring a quick and efficient process without any need for physical signatures.

-

What benefits does airSlate SignNow provide for users completing form 2555 2020?

Using airSlate SignNow for completing the form 2555 2020 provides numerous benefits, including time savings and reduced paperwork. Our digital solution makes it easier to track document statuses and ensures compliance with tax regulations.

Get more for About Form 2555, Foreign Earned IncomeInternal Revenue

Find out other About Form 2555, Foreign Earned IncomeInternal Revenue

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe