F1040sf PDF SCHEDULE FForm 1040 Department of the Treasury

What is the 2020 Schedule F Tax Form?

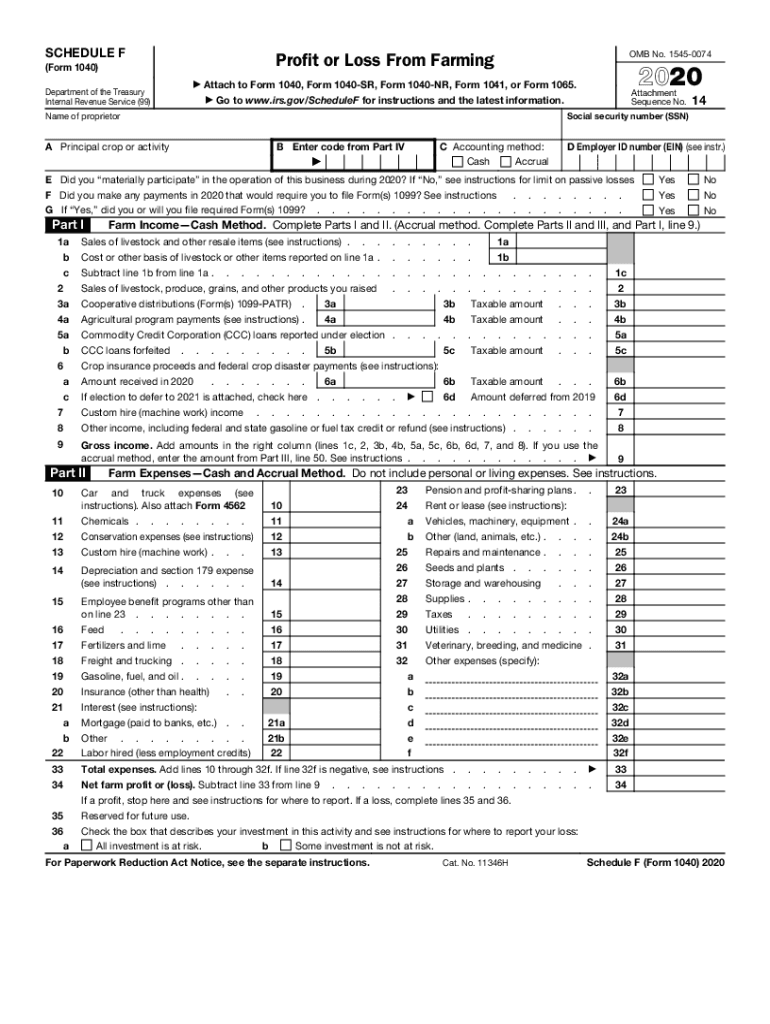

The 2020 Schedule F tax form is a crucial document used by farmers to report their income and expenses to the Internal Revenue Service (IRS). This form allows individuals engaged in farming activities to calculate their profit or loss from farming operations. It is an attachment to Form 1040, which is the standard individual income tax return form in the United States. The Schedule F form includes sections for reporting various types of income, such as sales of livestock, produce, and other farm products, as well as deductions for expenses like feed, fertilizer, and equipment costs.

Steps to Complete the 2020 Schedule F Tax Form

Completing the 2020 Schedule F tax form involves several steps to ensure accurate reporting of your farming income and expenses. Begin by gathering all necessary financial records, including receipts and invoices related to your farming activities. Follow these steps:

- Enter your total income from farming on the appropriate line.

- List all deductible expenses, categorized by type, such as operating expenses, depreciation, and other costs.

- Calculate your total expenses and subtract them from your total income to determine your net profit or loss.

- Transfer the net profit or loss to your Form 1040.

Legal Use of the 2020 Schedule F Tax Form

The 2020 Schedule F tax form is legally recognized as a valid document for reporting farming income and expenses. To ensure compliance with IRS regulations, it is essential to provide accurate and truthful information. Any discrepancies or false reporting can lead to penalties or audits. Utilizing digital tools for completing and signing the form can enhance security and compliance, ensuring that all necessary signatures and certifications are properly executed.

IRS Guidelines for the 2020 Schedule F Tax Form

The IRS provides specific guidelines for completing the 2020 Schedule F tax form. These guidelines outline the types of income that must be reported, allowable deductions, and record-keeping requirements. It is important to review these guidelines thoroughly to ensure that you are following the latest tax laws and regulations. The IRS also offers resources and publications that can help clarify any questions regarding the form.

Filing Deadlines for the 2020 Schedule F Tax Form

The filing deadline for the 2020 Schedule F tax form coincides with the due date for Form 1040, which is typically April 15 of the following year. However, if you file for an extension, you may have additional time to submit your forms. It is essential to be aware of any changes in deadlines due to specific circumstances, such as natural disasters or other events that may affect filing schedules.

Required Documents for the 2020 Schedule F Tax Form

To complete the 2020 Schedule F tax form accurately, you will need several documents, including:

- Records of all income received from farming activities.

- Receipts for farming-related expenses.

- Bank statements showing transactions related to your farming business.

- Previous tax returns for reference.

Having these documents organized will facilitate the completion of the form and help ensure compliance with IRS requirements.

Quick guide on how to complete f1040sfpdf schedule fform 1040 department of the treasury

Prepare F1040sf pdf SCHEDULE FForm 1040 Department Of The Treasury effortlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal environmentally-friendly substitute to conventional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage F1040sf pdf SCHEDULE FForm 1040 Department Of The Treasury across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign F1040sf pdf SCHEDULE FForm 1040 Department Of The Treasury with ease

- Find F1040sf pdf SCHEDULE FForm 1040 Department Of The Treasury and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact confidential information with features that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal standing as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign F1040sf pdf SCHEDULE FForm 1040 Department Of The Treasury and ensure effective communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f1040sfpdf schedule fform 1040 department of the treasury

How to generate an eSignature for your PDF file in the online mode

How to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What is the 2020 Schedule F tax form and who should use it?

The 2020 Schedule F tax form is specifically designed for farmers and ranchers to report their income and expenses from farming operations. If you are a business owner in agriculture, this form allows you to calculate the profit or loss from your farming activities, simplifying your tax filing process.

-

How can airSlate SignNow assist with the 2020 Schedule F tax form?

airSlate SignNow provides businesses with an efficient way to eSign and send documents, including the 2020 Schedule F tax form. Our platform ensures that you can easily manage, sign, and store your tax documents securely, enhancing your overall productivity.

-

Are there any features in airSlate SignNow specifically for tax documents like the 2020 Schedule F tax form?

Yes, airSlate SignNow offers features such as document templates, customizable signature workflows, and comprehensive audit trails, making it easier to prepare and manage the 2020 Schedule F tax form. These features help you save time and ensure compliance with tax regulations.

-

Is airSlate SignNow a cost-effective solution for managing the 2020 Schedule F tax form?

Absolutely! airSlate SignNow provides a cost-effective solution designed to help businesses save on printing and mailing costs associated with the 2020 Schedule F tax form. Our pricing plans are flexible and cater to businesses of all sizes, ensuring accessibility for everyone.

-

Can airSlate SignNow integrate with other accounting software for tax filings like the 2020 Schedule F tax form?

Yes, airSlate SignNow seamlessly integrates with various accounting software, allowing you to easily import and manage your financial data for the 2020 Schedule F tax form. This integration streamlines your tax preparation process and minimizes errors.

-

How secure is airSlate SignNow for sending sensitive documents like the 2020 Schedule F tax form?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption methods to ensure that your documents, including the 2020 Schedule F tax form, are kept safe and secure during transmission and storage.

-

What customer support options are available when using airSlate SignNow for the 2020 Schedule F tax form?

airSlate SignNow offers robust customer support options, including live chat, email, and an extensive knowledge base. If you have questions regarding the 2020 Schedule F tax form or need assistance with our platform, our support team is ready to help.

Get more for F1040sf pdf SCHEDULE FForm 1040 Department Of The Treasury

- Ao 441 summons in a civil action united states district court form

- Ampquotalaska marriage certificate request formampquot alaska

- Ar1000rc5 arkansas individual income tax 2006 certificate form

- Pdf document checklist application for a permanent resident card or form

- Imm 5476 e form

- Imm 5546 e form

- Get fillable online pptc 042 e child abroad general passport form

- Wwwcourseherocomfile65662251pptc482pdf save reset form protected when completed b

Find out other F1040sf pdf SCHEDULE FForm 1040 Department Of The Treasury

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form