Sa100 2019

What is the Sa100

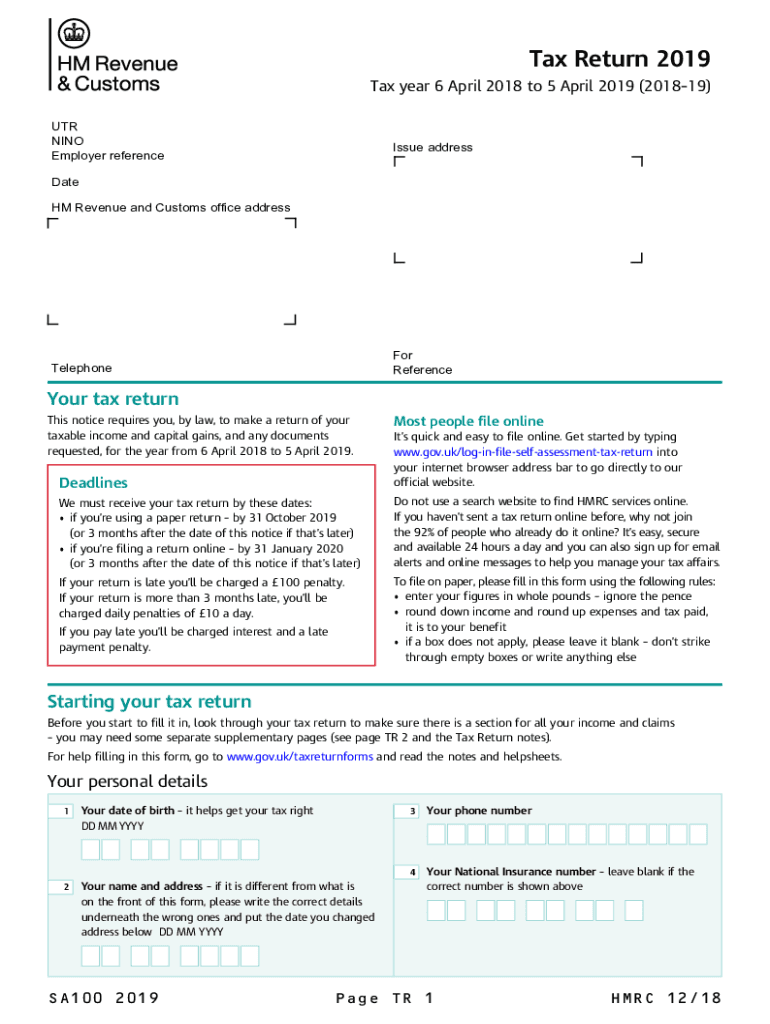

The Sa100 is the official tax return form used by individuals in the UK for reporting their income and capital gains to HM Revenue and Customs (HMRC). This form is primarily utilized by self-employed individuals, partnerships, and those with additional income sources outside of regular employment. The Sa100 is crucial for ensuring compliance with tax obligations and accurately calculating the amount of tax owed or any potential refund due.

How to use the Sa100

Using the Sa100 involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements, bank statements, and records of expenses. Next, fill out the form with personal details, income figures, and allowable deductions. It is essential to review the information for accuracy before submission. Once completed, the Sa100 can be filed online or mailed to HMRC, depending on the preferred method of submission.

Steps to complete the Sa100

Completing the Sa100 requires careful attention to detail. Follow these steps for a successful submission:

- Gather all relevant financial documents, including income and expense records.

- Fill in your personal information, including your name, address, and National Insurance number.

- Report all sources of income, including self-employment earnings, rental income, and dividends.

- Claim any allowable expenses and deductions to reduce your taxable income.

- Double-check all entries for accuracy and completeness.

- Submit the completed form online or send it by mail to HMRC.

Legal use of the Sa100

The Sa100 must be completed and submitted in accordance with UK tax laws. Legal use of the form ensures that taxpayers fulfill their obligations while avoiding penalties. It is important to provide accurate information and to keep records of all submitted documents. Failure to comply with tax regulations can result in fines or other legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the Sa100 are critical to avoid penalties. Typically, the deadline for submitting the form online is January thirty-first following the end of the tax year, while paper submissions are due by October thirty-first. Taxpayers should mark these dates on their calendars to ensure timely filing and compliance with HMRC requirements.

Required Documents

To complete the Sa100 accurately, several documents are required. These include:

- Income statements from all sources, including self-employment and investments.

- Bank statements that detail income and expenses.

- Receipts for allowable expenses, such as business-related costs.

- Any previous tax returns or correspondence from HMRC.

Form Submission Methods (Online / Mail / In-Person)

The Sa100 can be submitted through various methods. Taxpayers can file online using HMRC's digital services, which is the most efficient method. Alternatively, the completed form can be mailed to HMRC. In-person submission is generally not available, but taxpayers may contact HMRC for guidance on specific situations. Each method has its own processing times and requirements, so it is advisable to choose the one that best suits individual needs.

Quick guide on how to complete sa100 2019

Complete Sa100 effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the tools required to create, alter, and electronically sign your documents swiftly without interruptions. Manage Sa100 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Sa100 seamlessly

- Find Sa100 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to apply your changes.

- Select your preferred method to submit your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious document searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Sa100 to guarantee effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sa100 2019

Create this form in 5 minutes!

How to create an eSignature for the sa100 2019

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the HMRC 2019 tax return form?

The HMRC 2019 tax return form is an essential document for taxpayers in the UK to report their income and claim any allowances. It includes sections for income from various sources, deductions, and tax calculations. Completing this form accurately ensures compliance with HMRC regulations.

-

How can airSlate SignNow help with the HMRC 2019 tax return form?

airSlate SignNow provides a user-friendly platform to easily sign and send the HMRC 2019 tax return form electronically. Our solution streamlines the document workflow, ensuring that you can prepare, sign, and submit your tax return efficiently. SignNow keeps your documents secure and organized for quick access.

-

What are the benefits of using airSlate SignNow for my HMRC 2019 tax return form?

Using airSlate SignNow for your HMRC 2019 tax return form offers benefits like increased efficiency, reduced paperwork, and enhanced security. You can track the status of your documents and receive notifications when they are signed. This ensures that you meet deadlines with ease, minimizing stress during tax season.

-

Is airSlate SignNow compatible with other tax software for the HMRC 2019 tax return form?

Yes, airSlate SignNow integrates seamlessly with various tax software solutions, making it easy to manage your HMRC 2019 tax return form. This compatibility allows you to import data effortlessly and ensures you can generate the necessary documents for submission. Streamlining these processes minimizes errors and saves time.

-

What features does airSlate SignNow offer for managing the HMRC 2019 tax return form?

airSlate SignNow offers features such as electronic signatures, customizable templates, and document tracking specifically for the HMRC 2019 tax return form. These tools simplify the signing process, enable you to create reusable templates, and keep you informed about document status. With these features, you can handle your tax return efficiently.

-

Are there any costs associated with using airSlate SignNow for my HMRC 2019 tax return form?

airSlate SignNow offers a range of pricing plans to accommodate various business needs when managing the HMRC 2019 tax return form. Our plans are designed to be cost-effective, ensuring you only pay for the features you need. You can choose from monthly or annual subscriptions to find the best fit for your budget.

-

Can I track the status of my HMRC 2019 tax return form using airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily track the status of your HMRC 2019 tax return form. You'll receive real-time notifications when the document is viewed, signed, or completed, providing peace of mind that your submission process is on track. This feature signNowly enhances your document management experience.

Get more for Sa100

Find out other Sa100

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe