IHT402 Claim to Transfer Unused Nil Band Rate Form to Capture Client Information Relating to Unused Nil Rate Band 2015-2026

What is the IHT402 form?

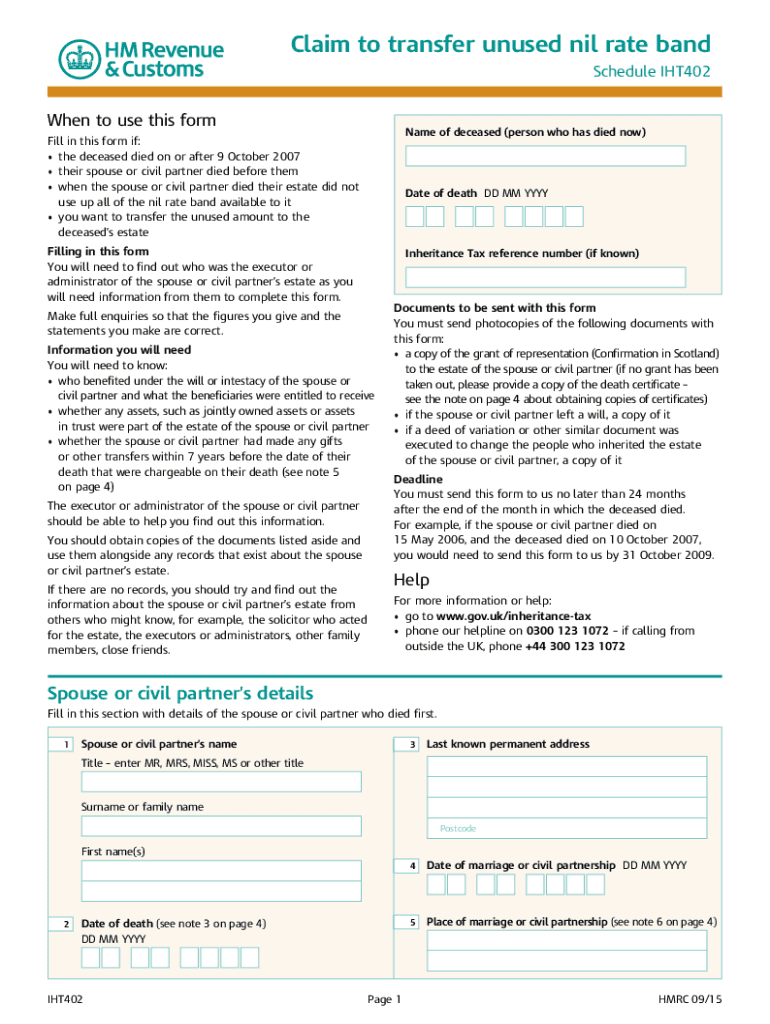

The IHT402 form is a document used in the United Kingdom for claiming the transfer of unused nil rate band allowances. This form is essential for individuals who have inherited assets from a deceased person and wish to utilize any unused portion of their inheritance tax (IHT) threshold. The nil rate band is the amount up to which an estate has no inheritance tax to pay, and this form helps capture client information related to the unused nil rate band. Understanding the purpose and function of the IHT402 form is crucial for effective tax planning and compliance.

Steps to complete the IHT402 form

Completing the IHT402 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the deceased's estate and any previous claims made on the nil rate band. Next, accurately fill out the form, providing details such as the deceased's name, date of death, and any relevant financial information. It is important to double-check all entries for correctness. Once completed, the form should be submitted to the appropriate tax authority along with any required supporting documentation. Following these steps carefully will help facilitate a smooth claim process.

How to obtain the IHT402 form

The IHT402 form can be obtained through official government resources. Individuals can visit the HM Revenue and Customs (HMRC) website to download the form directly. It is available in a printable format, allowing users to fill it out by hand if preferred. Additionally, some tax professionals may provide access to the form as part of their services. Ensuring that you have the most current version of the form is important, as tax regulations may change over time.

Legal use of the IHT402 form

The IHT402 form holds legal significance in the context of inheritance tax claims. When properly completed and submitted, it serves as an official request to the tax authority for the transfer of any unused nil rate band. This legal framework ensures that beneficiaries can maximize their tax allowances and minimize potential liabilities. Compliance with the relevant tax laws and regulations is essential when using this form, as any inaccuracies or omissions could lead to delays or penalties.

Key elements of the IHT402 form

Several key elements must be included in the IHT402 form to ensure its validity. These elements include the deceased's details, such as name and date of death, as well as the claimant's information. The form also requires specific financial details regarding the estate and any previous nil rate band claims. Additionally, it is crucial to provide accurate calculations of the unused nil rate band being claimed. Ensuring that all required information is complete and accurate will help facilitate a successful claim process.

Form submission methods

The IHT402 form can be submitted through various methods, depending on the preferences of the claimant. Individuals may choose to submit the form online through the HMRC portal, which offers a streamlined process for electronic submissions. Alternatively, the completed form can be mailed to the appropriate tax office. In some cases, individuals may also deliver the form in person. Understanding the available submission methods can help claimants choose the most convenient option for their needs.

Quick guide on how to complete iht402 claim to transfer unused nil band rate form to capture client information relating to unused nil rate band

Complete IHT402 Claim To Transfer Unused Nil Band Rate Form To Capture Client Information Relating To Unused Nil Rate Band effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without interruptions. Handle IHT402 Claim To Transfer Unused Nil Band Rate Form To Capture Client Information Relating To Unused Nil Rate Band on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign IHT402 Claim To Transfer Unused Nil Band Rate Form To Capture Client Information Relating To Unused Nil Rate Band with ease

- Find IHT402 Claim To Transfer Unused Nil Band Rate Form To Capture Client Information Relating To Unused Nil Rate Band and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign IHT402 Claim To Transfer Unused Nil Band Rate Form To Capture Client Information Relating To Unused Nil Rate Band and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iht402 claim to transfer unused nil band rate form to capture client information relating to unused nil rate band

Create this form in 5 minutes!

How to create an eSignature for the iht402 claim to transfer unused nil band rate form to capture client information relating to unused nil rate band

The best way to generate an electronic signature for a PDF file online

The best way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the iht402 form and why is it important?

The iht402 form is a document used to report and claim relief from inheritance tax in the UK. It is essential for individuals dealing with estates to ensure compliance with tax regulations. Understanding how to accurately complete the iht402 form can save time and money, making it a crucial part of estate management.

-

How does airSlate SignNow simplify the completion of the iht402 form?

airSlate SignNow streamlines the process of completing the iht402 form by offering easy-to-use templates and eSignature capabilities. Users can fill out the form electronically and ensure all required fields are completed without hassle. This automation minimizes errors and speeds up the submission process.

-

Is there a cost associated with using airSlate SignNow for the iht402 form?

Yes, there is a pricing structure in place for using airSlate SignNow, which varies based on the chosen subscription plan. Each plan provides different features that may be beneficial for handling documents like the iht402 form. Investing in a plan can enhance overall efficiency and security in managing important documents.

-

What features does airSlate SignNow offer to support the iht402 form?

airSlate SignNow offers a variety of features tailored for the iht402 form, including customizable templates, secure eSignatures, and document tracking. These features ensure that users can maintain organization while handling sensitive estate documents. Additionally, users receive notifications to keep track of their form’s status.

-

Can I integrate airSlate SignNow with other software to enhance the iht402 form process?

Absolutely! airSlate SignNow allows seamless integrations with various software applications to enhance the process of managing the iht402 form. Whether it's connecting with CRM systems or cloud storage solutions, integrations enable efficient data flow, further simplifying estate management tasks.

-

What benefits can I expect from using airSlate SignNow for the iht402 form?

Using airSlate SignNow for the iht402 form offers several benefits, including increased efficiency, less paperwork, and improved accuracy in document submission. Users also gain from the enhanced security features that protect sensitive data throughout the process. Overall, it modernizes how individuals manage estate documentation.

-

How can I get started with airSlate SignNow for the iht402 form?

Getting started with airSlate SignNow for the iht402 form is easy. Simply visit the website, sign up for an account, and choose a pricing plan that fits your needs. Once registered, you can access templates and begin crafting your iht402 form quickly and efficiently.

Get more for IHT402 Claim To Transfer Unused Nil Band Rate Form To Capture Client Information Relating To Unused Nil Rate Band

Find out other IHT402 Claim To Transfer Unused Nil Band Rate Form To Capture Client Information Relating To Unused Nil Rate Band

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now