Llc 35 15 2012

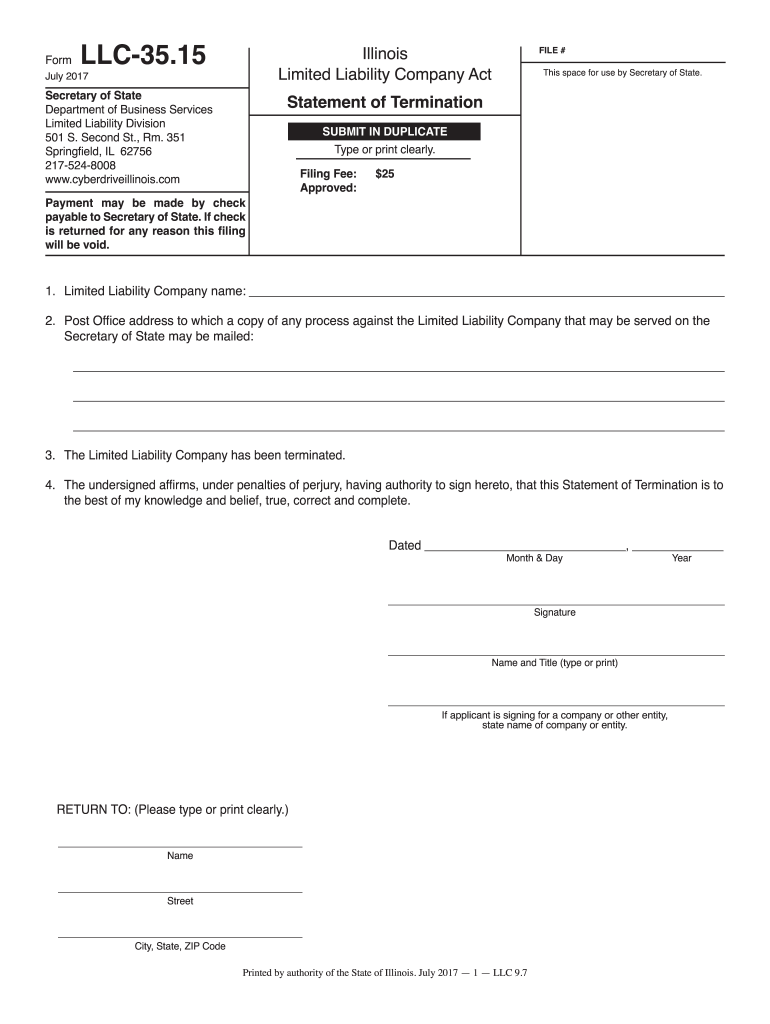

What is the LLC 35 15?

The LLC 35 15, also known as the Illinois Articles of Dissolution, is a legal document required for formally dissolving a limited liability company (LLC) in the state of Illinois. This form notifies the Illinois Secretary of State that the LLC has ceased operations and intends to dissolve. It is essential for ensuring that the dissolution is recognized legally and that the company is no longer liable for taxes or other obligations.

How to Use the LLC 35 15

To use the LLC 35 15, you must complete the form accurately, providing necessary details such as the LLC's name, the date of dissolution, and any other required information. This form can be filed online or submitted via mail. It is crucial to ensure that all information is correct to avoid delays in processing. Once submitted, the Secretary of State will review the application and, if approved, will issue a certificate of dissolution.

Steps to Complete the LLC 35 15

Completing the LLC 35 15 involves several key steps:

- Gather necessary information about your LLC, including its name and registration details.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the form online or mail it to the appropriate office of the Illinois Secretary of State.

- Pay any applicable fees associated with the dissolution process.

Required Documents

When filing the LLC 35 15, you may need to provide additional documentation, such as:

- Proof of any outstanding tax obligations being settled.

- Any previous filings that may be relevant to the dissolution.

- Identification details of the LLC members or managers.

Filing Deadlines / Important Dates

It is important to be aware of any deadlines associated with filing the LLC 35 15. Generally, the form should be submitted as soon as the decision to dissolve the LLC has been made. However, if there are pending obligations or liabilities, it may be wise to resolve those before filing. Keeping track of any specific deadlines related to tax filings or other legal obligations is crucial to ensure compliance.

Penalties for Non-Compliance

Failing to file the LLC 35 15 can result in several penalties, including:

- Continued liability for taxes and fees associated with the LLC.

- Potential legal action from creditors or the state.

- Difficulty in obtaining a certificate of good standing in the future.

Digital vs. Paper Version

Both digital and paper versions of the LLC 35 15 are available for submission. The digital version allows for quicker processing and confirmation of receipt, while the paper version may take longer to process. Choosing the digital option can streamline the dissolution process and provide immediate confirmation that the form has been filed.

Quick guide on how to complete llc 35 15

Complete Llc 35 15 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly solution to traditional printed and signed paperwork, as you can easily find the required form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage Llc 35 15 on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to edit and eSign Llc 35 15 effortlessly

- Find Llc 35 15 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Llc 35 15 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct llc 35 15

Create this form in 5 minutes!

How to create an eSignature for the llc 35 15

The best way to generate an eSignature for your PDF document online

The best way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is a certificate of dissolution in Illinois?

A certificate of dissolution in Illinois is a legal document that officially terminates the existence of a business entity in the state. This document must be filed with the Illinois Secretary of State to ensure that the business is formally dissolved. Without this certificate, the business may continue to incur legal obligations and liabilities.

-

How can airSlate SignNow help me obtain a certificate of dissolution in Illinois?

airSlate SignNow provides a streamlined platform to prepare, sign, and submit the necessary documentation for a certificate of dissolution in Illinois. Our easy-to-use interface simplifies the process, allowing you to complete required forms and securely obtain electronic signatures. This ensures timely submission to the state, reducing potential delays.

-

What are the costs associated with filing a certificate of dissolution in Illinois?

The filing fee for a certificate of dissolution in Illinois typically ranges around $100, but it's important to check with the Illinois Secretary of State for the most accurate fees. Using airSlate SignNow minimizes additional costs related to document preparation and storage, making the process more cost-effective for businesses.

-

How long does it take to process a certificate of dissolution in Illinois?

The processing time for a certificate of dissolution in Illinois can vary but generally takes about 10-15 business days once submitted. Using airSlate SignNow helps expedite this process by ensuring your documents are accurate and complete before filing, reducing the risk of delays.

-

What features does airSlate SignNow offer for managing the certificate of dissolution in Illinois?

airSlate SignNow offers several features to assist with the certificate of dissolution in Illinois, including customizable templates, eSignature capabilities, and comprehensive document tracking. These tools help streamline the process, making it easier to manage all aspects of your dissolution efficiently and effectively.

-

Are there any benefits of using airSlate SignNow over traditional methods for a certificate of dissolution in Illinois?

Using airSlate SignNow to handle your certificate of dissolution in Illinois offers numerous benefits, including increased efficiency, reduced paperwork, and better tracking of your documents. Unlike traditional methods, our digital platform allows for remote access, enabling you to manage documents from anywhere, greatly simplifying the process.

-

Does airSlate SignNow integrate with other business applications for filing a certificate of dissolution in Illinois?

Yes, airSlate SignNow integrates seamlessly with various business applications, allowing for efficient management of your certificate of dissolution in Illinois and other important documents. This integration ensures that your workflow remains smooth and organized, connecting all necessary tools for a hassle-free experience.

Get more for Llc 35 15

Find out other Llc 35 15

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document