Iht403 2020-2026

What is the IHT403?

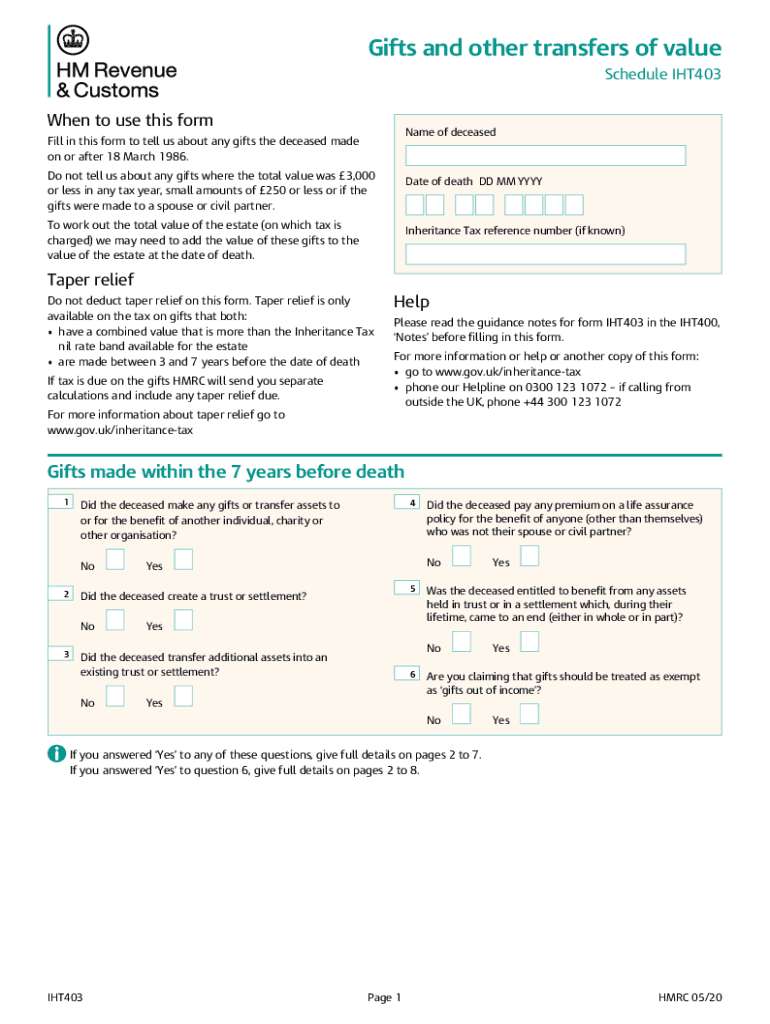

The IHT403 form, also known as the "2010 UK IHT403," is a document used in the context of inheritance tax in the United Kingdom. This form is specifically designed for individuals who are reporting gifts made during their lifetime that may affect their inheritance tax liability. It serves to provide detailed information about the gifts, including their value and the date they were given. Understanding the purpose of this form is crucial for ensuring compliance with tax regulations and accurately reporting financial information.

How to Use the IHT403

Using the IHT403 form involves several key steps to ensure that all relevant information is accurately captured. First, gather all necessary documentation related to the gifts you have made, including their values and the dates they were given. Next, complete the form by entering the required details in the appropriate sections. It is important to be thorough and precise, as any inaccuracies could lead to complications with tax authorities. Once completed, the form must be submitted according to the guidelines set forth by the HM Revenue and Customs (HMRC).

Steps to Complete the IHT403

Completing the IHT403 form involves a systematic approach:

- Collect all relevant information about the gifts, including their monetary value and the recipients.

- Fill out the form accurately, ensuring that all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the form to HMRC, either electronically or by mail, following the specified guidelines.

Legal Use of the IHT403

The legal use of the IHT403 form is governed by inheritance tax laws in the UK. It is essential for individuals to understand that submitting this form is a legal requirement if they have made gifts that fall within the scope of inheritance tax. Failure to accurately report these gifts can result in penalties or additional tax liabilities. Therefore, ensuring compliance with legal standards when using the IHT403 is vital for maintaining good standing with tax authorities.

Required Documents

To complete the IHT403 form, several documents may be required to substantiate the information provided. These may include:

- Records of the gifts made, including their values and dates.

- Any relevant correspondence with HMRC regarding previous tax matters.

- Bank statements or financial documents that reflect the transactions.

Having these documents on hand will facilitate a smoother completion process and help ensure accuracy.

Form Submission Methods

The IHT403 form can be submitted through various methods, depending on individual preferences and requirements. Options include:

- Online submission via the HMRC website, which is often the quickest method.

- Mailing a physical copy of the completed form to the relevant HMRC address.

- In-person submission at designated HMRC offices, if necessary.

Choosing the appropriate submission method can help streamline the process and ensure timely handling of the form.

Quick guide on how to complete iht403

Complete Iht403 effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow provides all the tools you require to create, alter, and electronically sign your documents swiftly with no holdups. Handle Iht403 on any system using the airSlate SignNow Android or iOS applications and streamline any document-centric process today.

The simplest way to alter and electronically sign Iht403 with ease

- Find Iht403 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal value as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Iht403 and ensure excellent communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iht403

Create this form in 5 minutes!

How to create an eSignature for the iht403

The best way to make an eSignature for your PDF file in the online mode

The best way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the iht403 form and why is it important?

The iht403 form is a crucial document used in the context of inheritance tax in the UK. It serves to report historical details about the estate of a deceased person and ensures that the correct inheritance tax is paid. Completing the iht403 form accurately is essential for compliance and avoidance of potential penalties.

-

How does airSlate SignNow assist with the iht403 form?

airSlate SignNow streamlines the process of preparing and eSigning the iht403 form. With its user-friendly interface, businesses can easily create, customize, and send the iht403 form for electronic signatures, which enhances efficiency and reduces paperwork. Our platform is designed to simplify document management for busy professionals.

-

What are the pricing options for using airSlate SignNow for iht403 form management?

airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes, ensuring affordable solutions for managing the iht403 form. Our subscription options can accommodate varying needs, allowing you to choose a plan that fits your organization's document workflow. Explore our pricing page for detailed information and special offers.

-

Does airSlate SignNow provide templates for the iht403 form?

Yes, airSlate SignNow provides customizable templates for the iht403 form, making it easier for users to create compliant documents quickly. These templates can be modified to fit your specific needs and ensure that all necessary information is included, reducing the risk of errors. Our preservation of industry standards helps maintain legal integrity.

-

Can I track the status of my iht403 form with airSlate SignNow?

Absolutely! airSlate SignNow includes robust tracking features that allow you to monitor the status of your iht403 form in real-time. You will receive notifications when the document is viewed, signed, or completed, giving you complete visibility over the process. This transparency helps manage deadlines effectively.

-

Is airSlate SignNow compliant with legal regulations for the iht403 form?

Yes, airSlate SignNow is designed to be compliant with all relevant legal regulations regarding electronic signatures and document management, including the iht403 form. Our platform ensures that all documents are securely signed and stored, meeting legal standards to protect your data. Trust in our compliance to keep your transactions secure.

-

What integrations does airSlate SignNow offer for the iht403 form?

airSlate SignNow seamlessly integrates with various popular applications, enhancing the workflow for managing the iht403 form. Integrations with tools like Google Drive, Dropbox, and popular CRM systems ensure that your document processes remain connected and efficient. This flexibility enables better organization and accessibility of your important files.

Get more for Iht403

- Trooper cadet and cveo personal history and background questionnaire onlineword wsp wa form

- Assignment of ownwership and attestation of identity for the transfer form

- Form 737 affidavit of repossession of a vehicle boat or outboard motor

- Sp 4 164 06 05pennsylvania state police fill and sign form

- Tattoo facility form

- Department of homeland security omb approval no 1651 department of homeland security us customs and borderdepartment of form

- Dorscgovforms siteformsstate of south carolina sc8857 department of revenue request

- Application for vehicle dealer registration plates for dealers licensed form

Find out other Iht403

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online