As a Retailer, You Knew the Importance of Obtaining All Required Accounts When You Started a Business Form

Understanding the 65 form no download needed

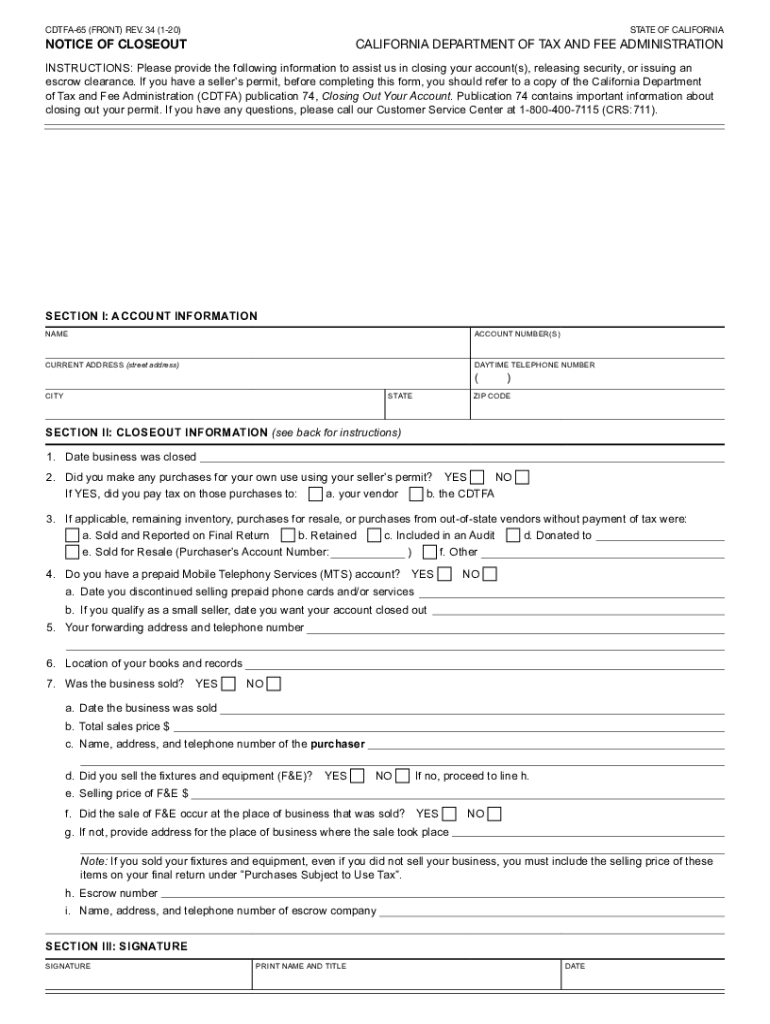

The 65 form, often referred to as the California BOE 65, is essential for retailers and businesses operating within California. This form is primarily used for reporting sales and use tax information. Understanding its purpose is crucial for compliance with state regulations. The 65 form no download needed allows users to complete and submit the form electronically, simplifying the process and ensuring timely filing.

Steps to complete the 65 form no download needed

Completing the 65 form electronically is straightforward. Follow these steps to ensure accurate submission:

- Access the form: Navigate to the appropriate online platform where the 65 form is hosted.

- Fill in your information: Enter your business details, including name, address, and account number.

- Report sales data: Input the required sales and use tax information accurately.

- Review your entries: Double-check all information for accuracy to avoid penalties.

- Submit the form: Follow the prompts to submit your completed form electronically.

Legal use of the 65 form

The 65 form is legally binding when completed correctly and submitted in compliance with California tax laws. Electronic signatures are recognized as valid under the ESIGN and UETA acts, ensuring that your submission holds legal weight. It is important to maintain records of your submissions for future reference and compliance audits.

Required documents for the 65 form

When preparing to fill out the 65 form, ensure you have the following documents at hand:

- Sales records: Detailed records of all sales transactions during the reporting period.

- Purchase invoices: Invoices for any taxable purchases made by your business.

- Previous tax returns: Copies of past returns may be helpful for reference and consistency.

Form submission methods

The 65 form can be submitted electronically, which is the most efficient method. Users can also opt to submit via mail or in-person at designated locations. However, electronic submission is recommended for its speed and ease of tracking. Ensure that you follow all guidelines for whichever method you choose to avoid delays or penalties.

Penalties for non-compliance

Failure to file the 65 form on time or inaccuracies in reporting can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action from the state. It is crucial to adhere to all filing deadlines and ensure the accuracy of your submissions to maintain compliance and avoid these consequences.

Quick guide on how to complete as a retailer you knew the importance of obtaining all required accounts when you started a business

Prepare As A Retailer, You Knew The Importance Of Obtaining All Required Accounts When You Started A Business effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without interruptions. Manage As A Retailer, You Knew The Importance Of Obtaining All Required Accounts When You Started A Business on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign As A Retailer, You Knew The Importance Of Obtaining All Required Accounts When You Started A Business with ease

- Locate As A Retailer, You Knew The Importance Of Obtaining All Required Accounts When You Started A Business and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that require new document copies to be printed. airSlate SignNow takes care of all your document management needs in just a few clicks from any device. Modify and eSign As A Retailer, You Knew The Importance Of Obtaining All Required Accounts When You Started A Business and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the as a retailer you knew the importance of obtaining all required accounts when you started a business

The way to create an electronic signature for a PDF file in the online mode

The way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The way to make an eSignature for a PDF file on Android

People also ask

-

What is the 65 form no download needed?

The 65 form no download needed is an essential document used for various business processes which can be completed online without requiring any software installations. This feature of airSlate SignNow enables users to fill out, sign, and send documents effortlessly while saving time and resources.

-

How does airSlate SignNow support the 65 form no download needed?

airSlate SignNow facilitates the 65 form no download needed by providing an online platform where users can access, fill out, and eSign their documents securely. This feature ensures that the entire process is streamlined and efficient, eliminating the need for physical paperwork.

-

Is there a cost associated with using the 65 form no download needed service?

Yes, airSlate SignNow offers various pricing plans that include features for the 65 form no download needed. These plans are designed to fit different business sizes and needs, ensuring that all customers find a cost-effective solution.

-

What are the main features of the 65 form no download needed?

The features of the 65 form no download needed include customizable templates, electronic signatures, and real-time collaboration options. These functionalities enhance user experience, making it easier to manage and sign documents efficiently.

-

Can I integrate the 65 form no download needed with other applications?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to utilize the 65 form no download needed seamlessly within your existing workflows. This ensures that you can manage all your documents in one cohesive environment.

-

What benefits does using the 65 form no download needed provide?

Using the 65 form no download needed with airSlate SignNow provides benefits such as saving time, reducing errors, and improving overall workflow efficiency. It allows users to handle documentation from anywhere, driving productivity and convenience.

-

How secure is the 65 form no download needed process?

The 65 form no download needed process in airSlate SignNow is highly secure, employing industry-standard encryption and compliance measures to protect your documents. This means you can confidently send and receive important information without compromising on security.

Get more for As A Retailer, You Knew The Importance Of Obtaining All Required Accounts When You Started A Business

Find out other As A Retailer, You Knew The Importance Of Obtaining All Required Accounts When You Started A Business

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast