LC GENERAL FILING INSTRUCTIONS 2020

What are the Kansas annual report instructions?

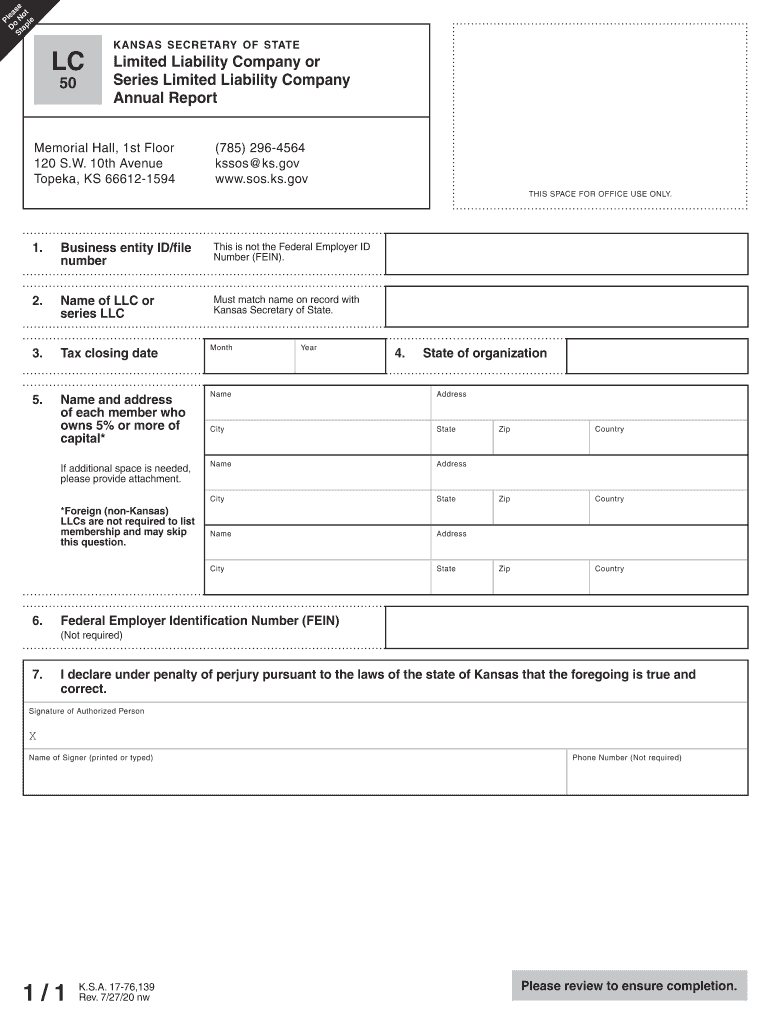

The Kansas annual report instructions outline the requirements for businesses to file their annual reports with the state. This document is essential for maintaining good standing and ensuring compliance with state regulations. The instructions typically include information on required fields, deadlines, and submission methods. For example, businesses must provide details such as the entity's name, address, and the names of its officers or directors. Understanding these instructions helps ensure that businesses correctly complete their Kansas annual report, avoiding potential penalties.

Steps to complete the Kansas annual report

Completing the Kansas annual report involves several key steps. First, gather necessary information about your business, including its legal name, address, and the names of its owners or officers. Next, access the appropriate form, which can usually be found on the Kansas Secretary of State's website. Fill out the form accurately, ensuring all required fields are completed. After reviewing the information for accuracy, submit the report either online or by mail, depending on your preference. Finally, keep a copy of the submitted report for your records.

Required documents for the Kansas annual report

When filing the Kansas annual report, specific documents may be required to support the information provided. Typically, businesses must include their current business registration number and any amendments made since the last filing. If applicable, additional documents such as proof of address or identification of officers may also be necessary. Ensuring that all required documents are included helps facilitate a smooth filing process and reduces the likelihood of delays or rejections.

Filing deadlines for the Kansas annual report

Filing deadlines for the Kansas annual report are crucial for maintaining compliance. Generally, businesses must submit their annual reports by the end of the month in which their anniversary date falls. For example, if a business was registered on March 15, the report would be due by March 31 each year. Late filings may incur penalties, so it is important to mark these dates on your calendar and prepare your report in advance to avoid any last-minute issues.

Penalties for non-compliance with the Kansas annual report

Failure to file the Kansas annual report on time can result in various penalties. Businesses may face late fees, which can accumulate over time. Additionally, prolonged non-compliance can lead to the suspension of the business's good standing status, impacting its ability to conduct business legally in the state. In severe cases, the state may initiate administrative dissolution of the business entity. Therefore, timely filing is essential to avoid these consequences and ensure continued operation.

Form submission methods for the Kansas annual report

Businesses have several options for submitting the Kansas annual report. The most common method is online submission through the Kansas Secretary of State's website, which offers a convenient and efficient way to file. Alternatively, businesses can choose to mail their completed reports to the appropriate office. In-person submissions are also possible, though less common. Each method has its own advantages, such as immediate confirmation of receipt for online filings, making it important to choose the one that best suits your needs.

Quick guide on how to complete lc general filing instructions

Accomplish LC GENERAL FILING INSTRUCTIONS effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal green alternative to conventional printed and signed forms, allowing you to locate the necessary document and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents promptly without delays. Manage LC GENERAL FILING INSTRUCTIONS on any device using airSlate SignNow Android or iOS applications and streamline any document-related workflow today.

How to modify and eSign LC GENERAL FILING INSTRUCTIONS without any hassle

- Find LC GENERAL FILING INSTRUCTIONS and click Get Form to begin.

- Make use of the tools available to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Design your eSignature using the Sign tool, which takes only a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to secure your modifications.

- Select your preferred method of sending your document, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Alter and eSign LC GENERAL FILING INSTRUCTIONS and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct lc general filing instructions

Create this form in 5 minutes!

How to create an eSignature for the lc general filing instructions

The way to create an electronic signature for your PDF online

The way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The way to make an eSignature for a PDF document on Android

People also ask

-

What is a Kansas annual report?

A Kansas annual report is a document that businesses must file annually to update the Secretary of State with information about their company, such as address, officers, and business activities. It is essential for maintaining good standing and compliance within the state of Kansas.

-

How can airSlate SignNow help with filing a Kansas annual report?

airSlate SignNow offers a streamlined solution for businesses to digitally complete and eSign their Kansas annual report documents. With its user-friendly interface, signing and submitting these reports is quick and efficient, helping you save time and reduce paperwork.

-

Is there a cost associated with using airSlate SignNow to file a Kansas annual report?

Yes, there is a subscription fee for using airSlate SignNow, which varies based on the plan you choose. However, considering the time and resources saved by electronically managing your Kansas annual report, many users find it to be a cost-effective solution.

-

What features does airSlate SignNow offer for Kansas annual report filings?

airSlate SignNow provides various features designed for seamless document management, including eSignature capabilities, document templates, and secure cloud storage. These features ensure that your Kansas annual report filings are both easy to complete and securely stored.

-

Are there integrations available with airSlate SignNow for Kansas annual report management?

Yes, airSlate SignNow integrates with several popular business applications, allowing you to manage your Kansas annual report filings alongside other business processes. This integration can enhance efficiency and reduce the chances of errors during filing.

-

What are the benefits of using airSlate SignNow for my Kansas annual report?

Using airSlate SignNow for your Kansas annual report provides multiple benefits, including increased accuracy, faster processing times, and reduced administrative burdens. Additionally, the ability to eSign documents from anywhere simplifies compliance and keeps your business operations running smoothly.

-

Can I track the status of my Kansas annual report filing with airSlate SignNow?

Absolutely! airSlate SignNow offers tracking functionalities that allow you to monitor the status of your Kansas annual report filing in real time. This transparency ensures that you can confirm the submission and completion of your filing efficiently.

Get more for LC GENERAL FILING INSTRUCTIONS

- Earn rs 10 000 per day without investment form

- Nspo form 1 download

- Sample of courtesy visit letter to the governor form

- Angus council housing application form

- State farm property certification test answers form

- Provisional ltopf 2021 form

- Texas license plate template form

- Phi beta sigma application form

Find out other LC GENERAL FILING INSTRUCTIONS

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast