REPUBLIC of the PHILIPPINES DEPARTMENT of FINANCE BUREAU 2018-2026

What is the Republic of the Philippines Department of Finance Bureau?

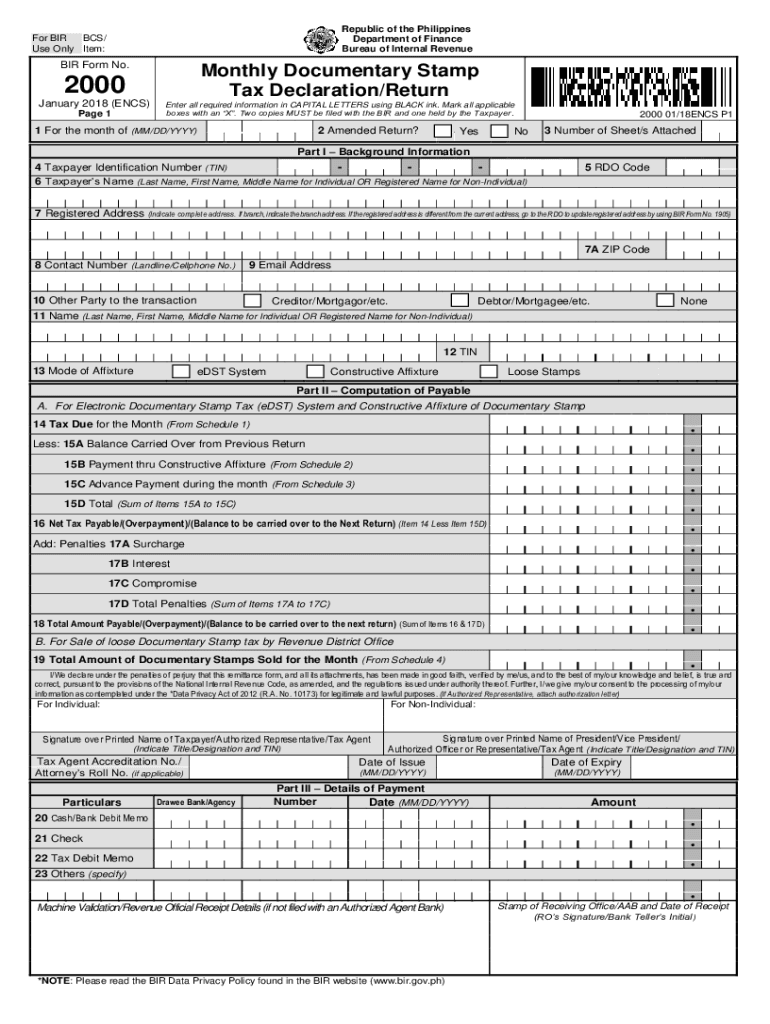

The Republic of the Philippines Department of Finance Bureau is a government agency responsible for managing the financial affairs of the country. This bureau oversees the collection of taxes, including documentary stamp tax, and ensures compliance with tax regulations. It plays a crucial role in the formulation and implementation of fiscal policies, aiming to enhance revenue generation and promote economic stability. Understanding the functions of this bureau is essential for individuals and businesses that need to navigate tax obligations, including the completion of forms like the 1999 bir form 2000.

Steps to Complete the 1999 Bir Form 2000

Completing the 1999 bir form 2000 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal details, income sources, and any applicable deductions. Next, accurately fill out the form, ensuring that all fields are completed as required. Pay special attention to the sections related to documentary stamp tax, as this is a critical component of the form. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form through the appropriate channels, whether online or via mail, depending on the guidelines provided by the Bureau.

Legal Use of the 1999 Bir Return Form

The 1999 bir return form is legally recognized when completed and submitted in accordance with the regulations set forth by the Bureau. To ensure the form's legality, it is important to use a reliable platform for electronic signatures, which provides a certificate of completion. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws is crucial. This legal framework ensures that electronically signed documents, including the 1999 bir form return, hold the same validity as traditional paper documents.

Required Documents for the 1999 Bir Form 2000

When preparing to fill out the 1999 bir form 2000, several documents are typically required. These may include proof of income, such as pay stubs or tax returns, identification documents, and any relevant financial statements. It is also beneficial to have previous tax returns on hand for reference. Ensuring that all necessary documents are gathered beforehand can streamline the completion process and reduce the likelihood of errors.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the 1999 bir form 2000 can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is important for individuals and businesses to understand the consequences of non-compliance to avoid these penalties. Regularly reviewing tax obligations and ensuring timely submission of forms can help mitigate risks associated with non-compliance.

Form Submission Methods

The 1999 bir form 2000 can be submitted through various methods, including online submission, mail, or in-person delivery to designated offices. Online submission is often the most efficient option, allowing for quicker processing and confirmation. For those opting to submit by mail, it is advisable to use a reliable mailing service and keep a record of the submission date. In-person submissions may be necessary for certain situations, providing an opportunity to clarify any questions directly with Bureau representatives.

Quick guide on how to complete republic of the philippines department of finance bureau

Effortlessly create REPUBLIC OF THE PHILIPPINES DEPARTMENT OF FINANCE BUREAU on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, as you can easily retrieve the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and eSign your documents quickly and without complications. Manage REPUBLIC OF THE PHILIPPINES DEPARTMENT OF FINANCE BUREAU on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric task today.

The easiest way to alter and eSign REPUBLIC OF THE PHILIPPINES DEPARTMENT OF FINANCE BUREAU with minimal effort

- Find REPUBLIC OF THE PHILIPPINES DEPARTMENT OF FINANCE BUREAU and select Get Form to begin.

- Use the features we provide to fill out your form.

- Mark important sections of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign function, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all provided information and click on the Done button to confirm your changes.

- Select your preferred method of sharing your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors needing new printouts. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign REPUBLIC OF THE PHILIPPINES DEPARTMENT OF FINANCE BUREAU and guarantee seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct republic of the philippines department of finance bureau

Create this form in 5 minutes!

How to create an eSignature for the republic of the philippines department of finance bureau

The way to generate an electronic signature for a PDF file in the online mode

The way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

The best way to make an eSignature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

What is a 1999 bir form return?

The 1999 bir form return is a specific tax document required by the IRS for reporting income. It allows you to accurately file your taxes and avoid potential penalties. Understanding its components can optimize your tax preparation process.

-

How can airSlate SignNow help with my 1999 bir form return?

airSlate SignNow simplifies the process of signing and sending your 1999 bir form return. Its user-friendly interface allows for easy document management, ensuring you can submit your tax returns efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for my 1999 bir form return?

Yes, airSlate SignNow offers a range of pricing plans suitable for different needs, ensuring a cost-effective solution for managing your 1999 bir form return. You can choose from monthly or annual subscriptions based on your usage requirements.

-

What features does airSlate SignNow provide for completing a 1999 bir form return?

AirSlate SignNow offers features like eSigning, document templates, and cloud storage to help with your 1999 bir form return. These tools streamline the workflow, making it easy to customize and finalizing your tax documents.

-

Can I integrate airSlate SignNow with other accounting software for my 1999 bir form return?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to manage your 1999 bir form return alongside other financial documents. This integration enhances productivity and reduces the likelihood of errors.

-

What are the benefits of using airSlate SignNow for my 1999 bir form return?

Using airSlate SignNow for your 1999 bir form return offers numerous benefits, including increased efficiency, reduced paperwork, and improved security. These features ensure that your tax filing process is not only faster but also more reliable.

-

Is airSlate SignNow easy to use for someone unfamiliar with the 1999 bir form return?

Yes, airSlate SignNow is designed to be user-friendly, making it accessible even if you're unfamiliar with the 1999 bir form return. The intuitive interface and helpful tutorials guide you through each step of the document signing process.

Get more for REPUBLIC OF THE PHILIPPINES DEPARTMENT OF FINANCE BUREAU

- Benton franklin health district waquot keyword found websites form

- Dear parent guardian or cacfp participant form

- Is applicant living in a nursing facility form

- Fa 001 application for benefits application for benefits form

- It is this agencys desire to act in the best interest of you and your children at all times form

- Protestappeal of a redetermination assessment form

- Idaho id birth certificatesbirth records vitalchek form

- Child care services assistance application form

Find out other REPUBLIC OF THE PHILIPPINES DEPARTMENT OF FINANCE BUREAU

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now