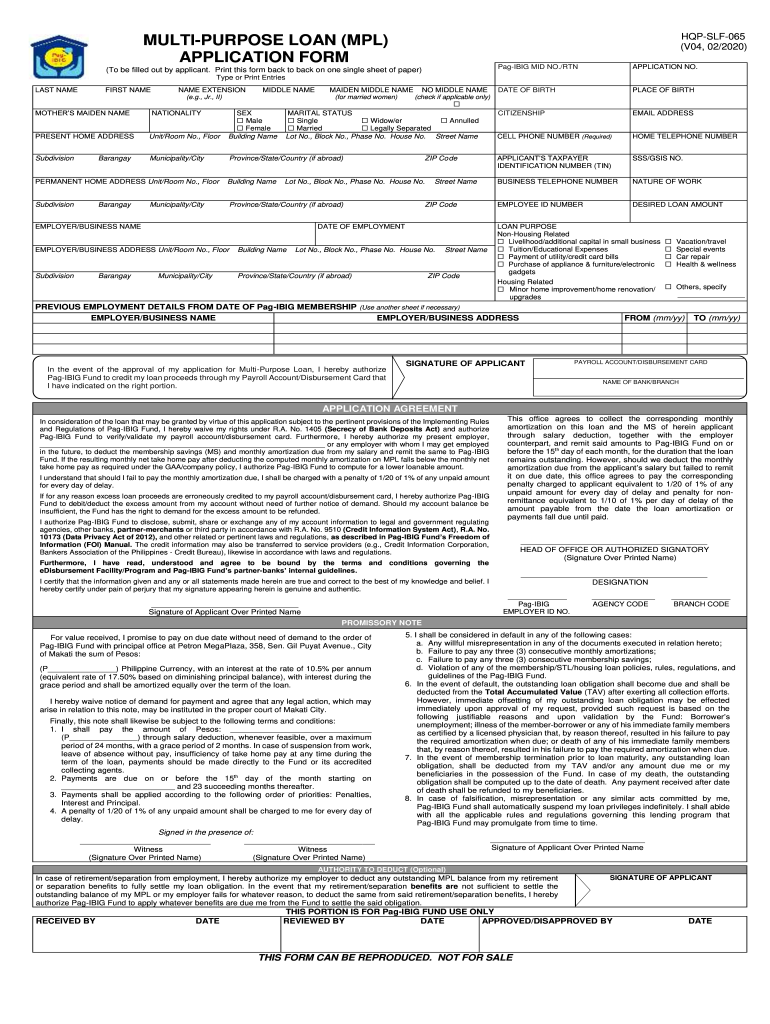

Pag Ibig Fund Multi Purpose Loan Application Form 2020

What is the Pag Ibig Fund Multi Purpose Loan Application Form

The Pag Ibig Fund Multi Purpose Loan Application Form is a crucial document for individuals seeking financial assistance through the Pag Ibig Fund in the Philippines. This form is designed to facilitate various types of loans, including those for home improvement, education, and medical expenses. It serves as an official request for funding and outlines the borrower's intent, personal information, and loan specifics. Understanding this form is essential for ensuring a smooth application process and compliance with the requirements set by the Pag Ibig Fund.

Steps to complete the Pag Ibig Fund Multi Purpose Loan Application Form

Completing the Pag Ibig Fund Multi Purpose Loan Application Form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary personal documents, such as identification and proof of income. Next, fill out the form with precise information, including your full name, address, and details regarding the loan purpose. It is important to review the form for any errors before submission. Finally, submit the completed form through the designated method, whether online or in person, and retain a copy for your records.

Required Documents

To successfully submit the Pag Ibig Fund Multi Purpose Loan Application Form, several documents are required. These typically include:

- Valid government-issued identification

- Proof of income, such as payslips or tax returns

- Any supporting documents relevant to the loan purpose, such as medical bills or educational invoices

- Pag Ibig membership details to verify eligibility

Ensuring that all required documents are included with your application can expedite the approval process.

Eligibility Criteria

Eligibility for the Pag Ibig Fund Multi Purpose Loan is determined by several factors. Applicants must be active members of the Pag Ibig Fund with a minimum contribution period. Additionally, the loan amount is often based on the member's total contributions and capacity to repay. It is also important to have a good credit standing and meet any specific requirements related to the intended loan purpose. Understanding these criteria can help potential borrowers assess their eligibility before applying.

How to obtain the Pag Ibig Fund Multi Purpose Loan Application Form

The Pag Ibig Fund Multi Purpose Loan Application Form can be obtained through various channels. It is available online on the official Pag Ibig Fund website, where users can download the form in PDF format. Alternatively, physical copies can be requested at any Pag Ibig Fund branch. It is advisable to ensure that you are using the most current version of the form to avoid any issues during the application process.

Legal use of the Pag Ibig Fund Multi Purpose Loan Application Form

The legal use of the Pag Ibig Fund Multi Purpose Loan Application Form is governed by the regulations set forth by the Pag Ibig Fund. The form must be filled out accurately and honestly, as any discrepancies may lead to legal consequences or denial of the loan. Additionally, submitting the form electronically requires compliance with eSignature laws, ensuring that all digital signatures are legally binding and secure. Understanding these legal aspects is vital for applicants to protect their interests.

Quick guide on how to complete pag ibig fund multi purpose loan application form

Effortlessly Prepare Pag Ibig Fund Multi Purpose Loan Application Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Pag Ibig Fund Multi Purpose Loan Application Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Modify and Electronically Sign Pag Ibig Fund Multi Purpose Loan Application Form

- Locate Pag Ibig Fund Multi Purpose Loan Application Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with the specialized tools available in airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Pag Ibig Fund Multi Purpose Loan Application Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pag ibig fund multi purpose loan application form

Create this form in 5 minutes!

How to create an eSignature for the pag ibig fund multi purpose loan application form

The best way to create an eSignature for a PDF in the online mode

The best way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the pag ibig loan form new and how does it work?

The pag ibig loan form new is a specific document required to apply for a housing loan from the Pag-IBIG Fund. It streamlines the application process, ensuring that all necessary information is provided for loan approval. By using the airSlate SignNow platform, you can easily complete, sign, and send this form online, making the entire process efficient and user-friendly.

-

How can I fill out the pag ibig loan form new using airSlate SignNow?

Filling out the pag ibig loan form new with airSlate SignNow is straightforward. Simply upload the document to the platform, use the editing tools to input your information, and add your electronic signature. This eliminates the need for printing, scanning, and mailing, saving you time and effort in your loan application process.

-

Are there any fees associated with using the airSlate SignNow for the pag ibig loan form new?

airSlate SignNow offers a cost-effective solution for managing documents like the pag ibig loan form new. While there may be subscription fees depending on the plan you choose, the value of streamlined document management can outweigh these costs. It's best to check the pricing page for the most up-to-date information and options.

-

What features does airSlate SignNow provide for the pag ibig loan form new?

AirSlate SignNow provides numerous features to enhance the management of your pag ibig loan form new, including document templates, cloud storage, and real-time tracking of document status. These features ensure that you can complete your loan application quickly and effectively, maintaining a clear overview of your progress.

-

Can I save my pag ibig loan form new for future use?

Yes, with airSlate SignNow you can easily save your completed pag ibig loan form new for future reference. The platform allows you to store documents securely in the cloud, enabling you to access and edit them whenever necessary. This is particularly beneficial if you plan to apply for multiple loans over time.

-

How does airSlate SignNow ensure the security of my pag ibig loan form new?

AirSlate SignNow prioritizes the security of your documents, including the pag ibig loan form new, by employing advanced encryption technologies and secure data storage. Your information is protected throughout the signing process, ensuring that your sensitive data remains confidential and secure from unauthorized access.

-

What are the benefits of using airSlate SignNow for my pag ibig loan form new?

Using airSlate SignNow for your pag ibig loan form new offers a range of benefits, including faster processing times and reduced paperwork. The platform's user-friendly interface allows you to complete your application seamlessly, helping you to avoid delays in securing your loan. Additionally, the ease of electronic signing can lead to quicker approvals.

Get more for Pag Ibig Fund Multi Purpose Loan Application Form

- Louisiana odometer disclosure statement 11042552 form

- Public defender request form

- Printable temporary license plate colorado form

- Ross correctional institution visitation form

- Texas liability insurance form

- Transformer preventive maintenance checklist excel

- Tdcj inmate search release date form

- Rasch built overall disability scale pdf form

Find out other Pag Ibig Fund Multi Purpose Loan Application Form

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later