City of Miami BTR Application 2017-2026

What is the City of Miami Business Tax Receipt Application?

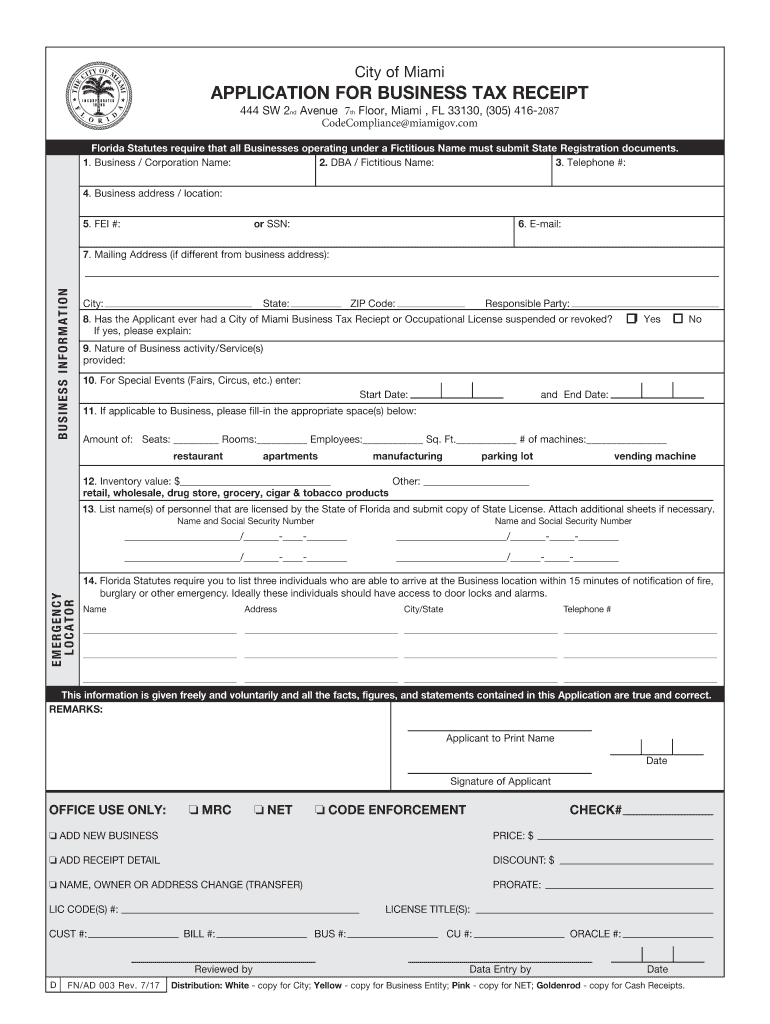

The City of Miami Business Tax Receipt (BTR) Application is a crucial document that businesses must obtain to operate legally within the city. This application serves as a permit that confirms a business is registered and compliant with local regulations. By acquiring a BTR, businesses demonstrate their commitment to following city laws and contributing to the local economy. The application process ensures that all necessary information is collected, including business type, ownership details, and operational scope.

Steps to Complete the City of Miami Business Tax Receipt Application

Completing the City of Miami Business Tax Receipt Application involves several key steps:

- Gather necessary information, including your business name, address, and ownership details.

- Determine the appropriate business classification that aligns with your operations.

- Access the application form, which can be found online or at designated city offices.

- Fill out the application accurately, ensuring all required fields are completed.

- Submit the application along with any required documentation and fees.

Following these steps carefully will help streamline the application process and ensure compliance with local regulations.

Required Documents for the City of Miami Business Tax Receipt Application

When applying for a City of Miami Business Tax Receipt, several documents are typically required to support your application. These may include:

- A valid government-issued identification for the business owner.

- Proof of business registration, such as articles of incorporation or a partnership agreement.

- Any necessary licenses or permits specific to your industry.

- Proof of address for the business location.

- Financial statements, if applicable, to demonstrate the business's viability.

Ensuring that all required documents are submitted with the application can expedite the approval process.

Who Issues the City of Miami Business Tax Receipt?

The City of Miami Business Tax Receipt is issued by the City of Miami's Department of Finance. This department is responsible for reviewing applications, ensuring compliance with local laws, and issuing BTRs to eligible businesses. They also provide guidance on the application process and any specific requirements that may apply to different business types.

Legal Use of the City of Miami Business Tax Receipt Application

The City of Miami Business Tax Receipt Application must be used in accordance with local laws and regulations. It is essential for businesses to understand that operating without a valid BTR can result in penalties and fines. The application serves as a legal acknowledgment that a business is authorized to operate within the city limits, and it must be renewed periodically to maintain compliance.

Application Process & Approval Time

The application process for the City of Miami Business Tax Receipt typically involves submitting the completed application along with all required documents and fees. Once submitted, the review process usually takes a few weeks, but this can vary based on the volume of applications received. Businesses are encouraged to apply well in advance of their intended start date to ensure timely processing and avoid any disruptions in operations.

Quick guide on how to complete city of miami btr application

Complete City Of Miami BTR Application effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage City Of Miami BTR Application on any device using airSlate SignNow Android or iOS applications and enhance any document-based operation today.

How to edit and eSign City Of Miami BTR Application with ease

- Obtain City Of Miami BTR Application and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign City Of Miami BTR Application to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct city of miami btr application

Create this form in 5 minutes!

How to create an eSignature for the city of miami btr application

The way to generate an eSignature for a PDF file online

The way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

How to generate an eSignature for a PDF on Android devices

People also ask

-

What is a city of Miami business tax receipt?

A city of Miami business tax receipt is a license that permits businesses to operate within the city limits of Miami. It is a legal requirement for any commercial entity to obtain this receipt in order to comply with local regulations and ensure that the business operates lawfully. Without this receipt, businesses may face fines or other penalties.

-

How can I apply for a city of Miami business tax receipt?

To apply for a city of Miami business tax receipt, you need to submit an application through the Miami-Dade County Business Tax Office. This can often be done online, where you’ll provide necessary documentation, such as proof of address and business ownership. Once your application is reviewed, you will receive your city of Miami business tax receipt if everything is in order.

-

What documents are needed to obtain a city of Miami business tax receipt?

To obtain a city of Miami business tax receipt, you'll typically need a government-issued ID, proof of business location, and any specific licenses related to your industry. It's important to check with the Miami-Dade County Business Tax Office for a complete list of required documents. Ensuring all paperwork is accurate will expedite the process of acquiring your city of Miami business tax receipt.

-

How much does a city of Miami business tax receipt cost?

The cost of a city of Miami business tax receipt varies based on the type of business you operate and its size. Generally, there are different fee structures for different business categories, and some businesses may be eligible for discounts. It's best to consult the Miami-Dade County Business Tax website for the most current fee schedule.

-

What are the benefits of having a city of Miami business tax receipt?

Holding a city of Miami business tax receipt provides your business with legitimacy and the right to operate within the city. It helps protect your business from legal issues and demonstrates compliance with local laws. Additionally, it may enhance your credibility with customers and clients, showcasing your commitment to operating a lawful business.

-

How often do I need to renew my city of Miami business tax receipt?

A city of Miami business tax receipt typically needs to be renewed annually. It’s crucial to stay on top of renewal dates to avoid any lapses that could impact your business operations. Renewal fees and process information can be found on the Miami-Dade County Business Tax Office website.

-

Can I transfer my city of Miami business tax receipt if I sell my business?

Yes, you can transfer your city of Miami business tax receipt when selling your business, but specific procedures must be followed. It’s essential to inform the Miami-Dade County Business Tax Office about the change of ownership to ensure a smooth transition. Consult with the office for guidance on the necessary steps to complete the transfer.

Get more for City Of Miami BTR Application

Find out other City Of Miami BTR Application

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure