State of Ma Income Tax 1 4 Tax Form 2017

What is the State of MA Income Tax Form 1 4?

The State of Massachusetts Income Tax Form 1 4 is a tax form used by residents to report their income and calculate their state tax liability. This form is essential for individuals who earn income in Massachusetts and need to comply with state tax regulations. It includes sections for reporting various types of income, deductions, and credits applicable to Massachusetts taxpayers. Understanding this form is crucial for ensuring accurate tax filings and avoiding penalties.

Steps to Complete the State of MA Income Tax Form 1 4

Completing the State of MA Income Tax Form 1 4 involves several steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and records of any other income.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Input your total income from all sources in the designated sections.

- Claim deductions: Identify and claim any deductions you qualify for, such as personal exemptions or specific credits.

- Calculate tax liability: Use the provided tax tables to determine your total tax owed based on your income and deductions.

- Review and sign: Carefully review the completed form for accuracy, then sign and date it before submission.

Legal Use of the State of MA Income Tax Form 1 4

The State of MA Income Tax Form 1 4 is legally binding when completed accurately and submitted to the Massachusetts Department of Revenue. It must be filled out in accordance with state tax laws and regulations. Failure to provide accurate information can lead to penalties, including fines and interest on unpaid taxes. It is essential to ensure that all information is truthful and complete to maintain compliance with Massachusetts tax laws.

Form Submission Methods

There are several methods for submitting the State of MA Income Tax Form 1 4:

- Online: Taxpayers can file electronically through the Massachusetts Department of Revenue’s online portal, which is often the fastest method.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Massachusetts Department of Revenue.

- In-Person: Taxpayers may also submit their forms in person at designated state tax offices, although this option may require an appointment.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the State of MA Income Tax Form 1 4. Typically, the deadline for individual income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be mindful of any extensions they may apply for, which can provide additional time to file but not to pay any taxes owed.

Required Documents

To complete the State of MA Income Tax Form 1 4, taxpayers need to gather several key documents:

- W-2 Forms: For reporting wages and salaries from employers.

- 1099 Forms: For reporting other income sources, such as freelance work or interest income.

- Receipts for Deductions: Documentation for any deductions claimed, such as charitable contributions or medical expenses.

Quick guide on how to complete state of ma income tax 1 4 tax form

Complete State Of Ma Income Tax 1 4 Tax Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your papers swiftly without hold-ups. Manage State Of Ma Income Tax 1 4 Tax Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The easiest way to modify and eSign State Of Ma Income Tax 1 4 Tax Form without difficulty

- Locate State Of Ma Income Tax 1 4 Tax Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or conceal sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Verify all the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the stress of missing or lost documents, time-consuming form searches, or errors that necessitate printing new document versions. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and eSign State Of Ma Income Tax 1 4 Tax Form and guarantee excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of ma income tax 1 4 tax form

Create this form in 5 minutes!

How to create an eSignature for the state of ma income tax 1 4 tax form

How to generate an electronic signature for a PDF in the online mode

How to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

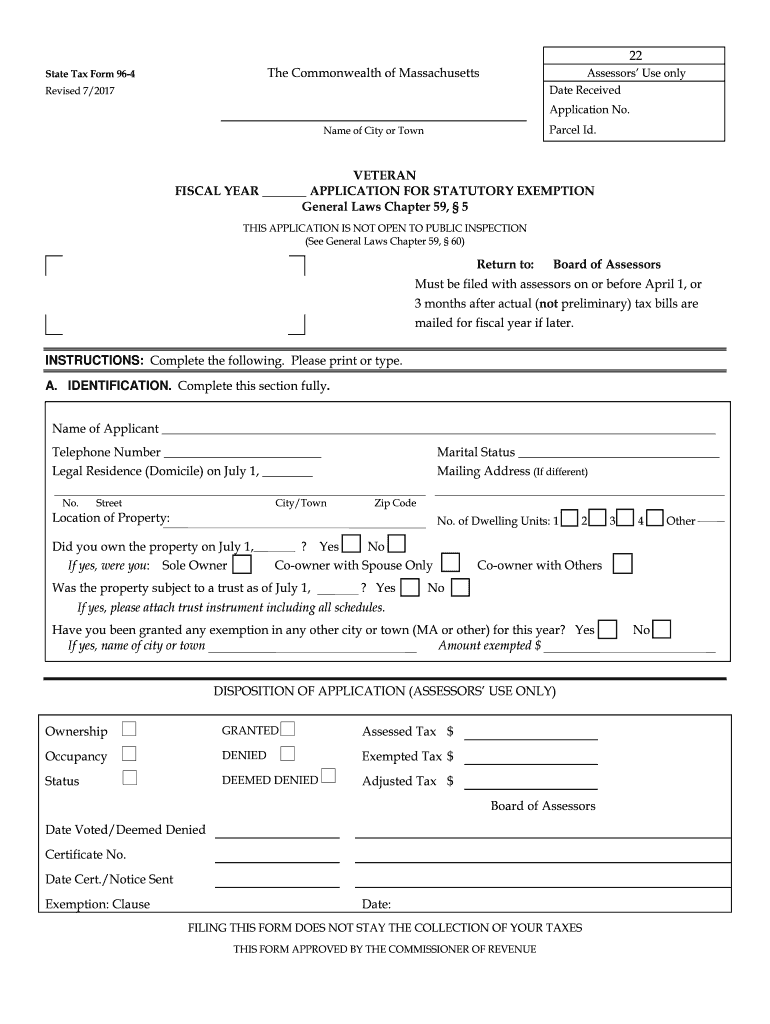

What is the MA tax form 96 4 and why is it important?

The MA tax form 96 4 is a critical document used for business tax reporting in Massachusetts. It serves to report various income and tax liabilities, making compliance much easier for businesses. Understanding how to properly fill out this form is essential to avoid penalties.

-

How can airSlate SignNow help with the MA tax form 96 4?

airSlate SignNow provides a platform for businesses to easily create, send, and eSign the MA tax form 96 4. The user-friendly interface simplifies the process, ensuring that all necessary information is accurately captured and submitted on time. This helps to streamline compliance and save time.

-

Is airSlate SignNow cost-effective for managing the MA tax form 96 4?

Yes, airSlate SignNow offers competitive pricing tailored to meet the needs of businesses managing the MA tax form 96 4. With its affordable plans, companies can efficiently handle electronic signatures and document workflows without breaking the bank, increasing their operational efficiency.

-

What features does airSlate SignNow offer for the MA tax form 96 4?

airSlate SignNow includes features like customizable templates, real-time collaboration, and secure eSigning specifically designed for documents such as the MA tax form 96 4. These features enhance productivity and ensure that all necessary legal requirements are met with minimal hassle.

-

Can airSlate SignNow integrate with other software for filing the MA tax form 96 4?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting and financial software to enhance the workflow for filing the MA tax form 96 4. This integration facilitates easy transfer of data, reducing errors and saving time during the filing process.

-

What benefits do users experience when using airSlate SignNow for the MA tax form 96 4?

Users of airSlate SignNow report increased efficiency and compliance when managing the MA tax form 96 4. The platform's ease of use, combined with features like automation and reminders, signNowly reduces the stress commonly associated with tax filings.

-

Is there a free trial available for airSlate SignNow to manage the MA tax form 96 4?

Yes, airSlate SignNow offers a free trial that allows users to explore its capabilities for managing the MA tax form 96 4. This gives prospective customers the opportunity to test the platform's features and see how it can help streamline their document workflows before committing to a subscription.

Get more for State Of Ma Income Tax 1 4 Tax Form

Find out other State Of Ma Income Tax 1 4 Tax Form

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form