MA State Tax Form 96 4 2022-2026

What is the Massachusetts State Tax Form 96 4

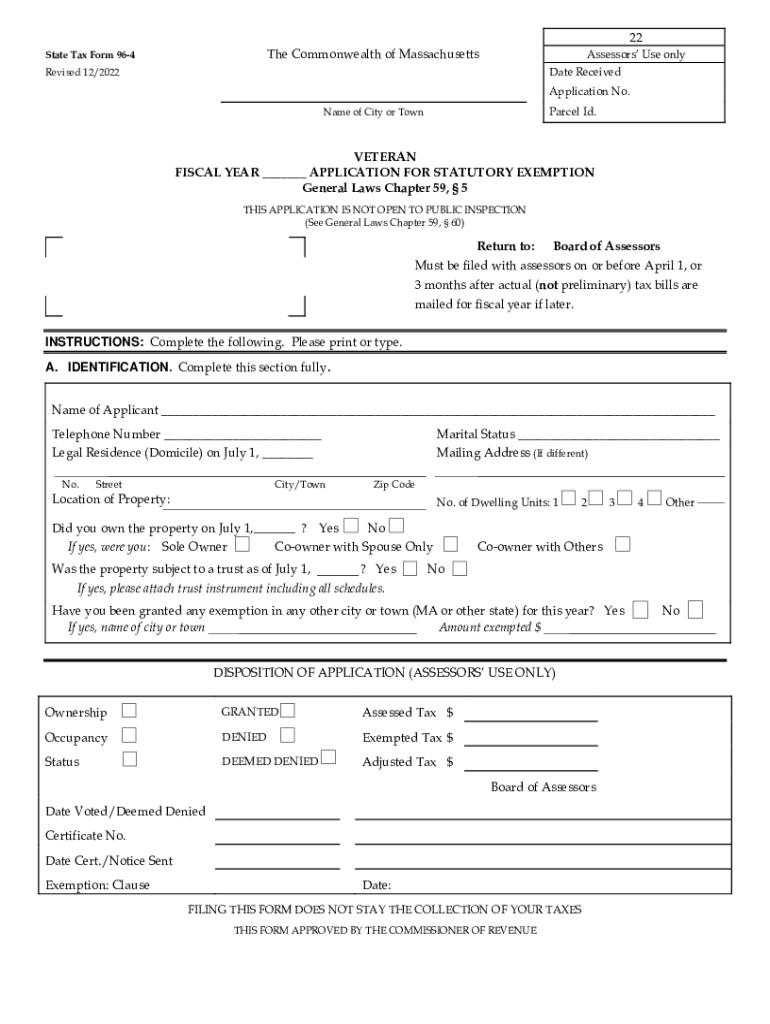

The Massachusetts State Tax Form 96 4 is a specific document used to apply for the veteran statutory exemption. This form is essential for qualifying veterans seeking tax relief on their property taxes. The exemption aims to provide financial support to those who have served in the military, acknowledging their service and sacrifices. Understanding the purpose and function of this form is crucial for eligible veterans to benefit from the available tax reductions.

How to use the Massachusetts State Tax Form 96 4

Using the Massachusetts State Tax Form 96 4 involves a few straightforward steps. First, ensure that you meet the eligibility criteria for the veteran statutory exemption. Once confirmed, obtain the form from the appropriate state tax authority or download it from a reliable source. Fill out the form accurately, providing all required personal information and documentation to support your claim. After completing the form, submit it to your local tax assessor's office for review and processing.

Steps to complete the Massachusetts State Tax Form 96 4

Completing the Massachusetts State Tax Form 96 4 requires careful attention to detail. Follow these steps:

- Gather necessary documents, including proof of military service and identification.

- Download the form or obtain a physical copy from your local tax office.

- Fill out the form, ensuring that all sections are completed accurately.

- Review the form for any errors or missing information.

- Submit the completed form to your local tax assessor's office by the designated deadline.

Eligibility Criteria

To qualify for the veteran statutory exemption using the Massachusetts State Tax Form 96 4, applicants must meet specific eligibility criteria. Generally, the applicant must be a veteran who has served in active duty and received an honorable discharge. Additional requirements may include residency in Massachusetts and ownership of the property for which the exemption is sought. It is important to check with local tax authorities for any additional stipulations that may apply.

Form Submission Methods

The Massachusetts State Tax Form 96 4 can be submitted through various methods, ensuring convenience for applicants. Options include:

- Online submission via the state tax authority's website, if available.

- Mailing the completed form to the local tax assessor's office.

- In-person submission at the local tax office during business hours.

Choosing the most suitable method depends on personal preference and the urgency of the application.

Key elements of the Massachusetts State Tax Form 96 4

The Massachusetts State Tax Form 96 4 includes several key elements that applicants must complete. These elements typically encompass:

- Personal information, including name, address, and contact details.

- Details regarding military service, such as dates of service and discharge status.

- Property information, including the address and type of property owned.

- Signature of the applicant, affirming the accuracy of the information provided.

Ensuring that all key elements are accurately filled out is essential for a successful application.

Quick guide on how to complete ma state tax form 96 4

Finish MA State Tax Form 96 4 easily on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed papers, as you can find the correct form and securely keep it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly without delays. Handle MA State Tax Form 96 4 on any device with airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

Steps to modify and electronically sign MA State Tax Form 96 4 effortlessly

- Find MA State Tax Form 96 4 and click Get Form to begin.

- Utilize the features we offer to finish your document.

- Emphasize pertinent sections of the documents or obscure confidential details with tools that airSlate SignNow provides specifically for this task.

- Create your electronic signature using the Sign tool, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of distributing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow takes care of all your document management requirements in just a few clicks from your device of choice. Modify and electronically sign MA State Tax Form 96 4 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ma state tax form 96 4

Create this form in 5 minutes!

How to create an eSignature for the ma state tax form 96 4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Massachusetts State Tax Form 96 4?

The Massachusetts State Tax Form 96 4 is a document used for corporations and partnerships to report income and expenses. This form helps businesses comply with state tax regulations and ensure accurate reporting. By utilizing airSlate SignNow, you can easily eSign and submit your Massachusetts State Tax Form 96 4.

-

How does airSlate SignNow simplify the process of filing the Massachusetts State Tax Form 96 4?

AirSlate SignNow streamlines the filing process by providing a user-friendly platform for eSigning and sending your Massachusetts State Tax Form 96 4. Users can complete their forms electronically, saving time and reducing paperwork. Moreover, the integrated features ensure that your documents are secure and compliant with state regulations.

-

Are there any costs associated with using airSlate SignNow for the Massachusetts State Tax Form 96 4?

AirSlate SignNow offers cost-effective pricing plans that cater to various business needs. The investment includes access to features that facilitate eSigning and document management, making it easy to handle the Massachusetts State Tax Form 96 4. Explore our pricing page to find a suitable plan for your organization.

-

What features does airSlate SignNow offer for managing the Massachusetts State Tax Form 96 4?

AirSlate SignNow provides a variety of features including eSignature, document templates, and real-time collaboration tools. These features signNowly enhance your ability to prepare and submit the Massachusetts State Tax Form 96 4 efficiently. Additionally, users benefit from audit trails and compliance checks to ensure accuracy.

-

Is it possible to integrate airSlate SignNow with other software for filing the Massachusetts State Tax Form 96 4?

Yes, airSlate SignNow supports integration with various software applications to streamline the filing process for the Massachusetts State Tax Form 96 4. You can easily connect with popular accounting software, CRMs, and other tools. This helps businesses maintain a seamless workflow while ensuring compliance with state tax requirements.

-

How secure is airSlate SignNow when handling the Massachusetts State Tax Form 96 4?

AirSlate SignNow prioritizes security, using industry-standard encryption and authentication protocols. Your data and documents, including the Massachusetts State Tax Form 96 4, are protected against unauthorized access. Our platform also provides an audit trail, ensuring that every action taken on your documents is tracked and recorded.

-

Can I access airSlate SignNow from any device for the Massachusetts State Tax Form 96 4?

Absolutely! AirSlate SignNow is designed to be accessible from any device, including smartphones, tablets, and desktops. This allows you to work on your Massachusetts State Tax Form 96 4 anytime and from anywhere, ensuring maximum convenience for busy professionals.

Get more for MA State Tax Form 96 4

- Sc1040tc sc department of revenue form

- Individual income sc department of revenue form

- Early retirement distributions social security benefits and form

- State tax form 2 form of list

- Ca last form fill out ampamp sign online dochub

- State rundown 15 state taxes coming in hot in new year form

- Sc issues tax relief due to hurricane ian encourages filing by form

- Motor vehicle and vessel gift declaration fill online form

Find out other MA State Tax Form 96 4

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer