Applicable for the Tax Period September 1, to November 30, ONLY 2020

What is the Applicable For The Tax Period September 1, To November 30, ONLY

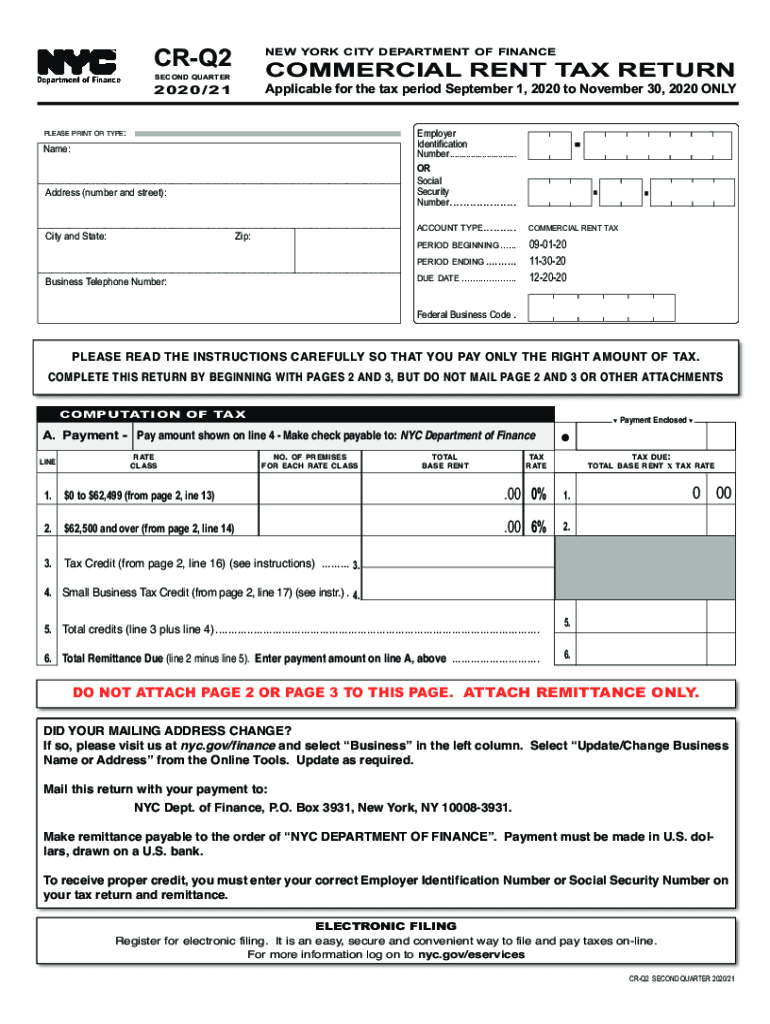

The NYC commercial rent tax applies to businesses that rent commercial space in New York City. For the tax period from September 1 to November 30, the tax is calculated based on the gross rent paid during this timeframe. This period is crucial for landlords and tenants to understand, as it directly impacts their financial obligations and tax filings. The commercial rent tax is applicable to businesses with annual rents exceeding a specific threshold, and it is essential to accurately report these figures to avoid penalties.

Steps to complete the Applicable For The Tax Period September 1, To November 30, ONLY

Completing the NYC commercial rent tax forms for the period from September 1 to November 30 involves several key steps:

- Gather all necessary documentation, including lease agreements and records of rent payments.

- Calculate the total gross rent paid during the specified period.

- Fill out the NYC CR-Q2 form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form either online or via mail, adhering to the established deadlines.

Filing Deadlines / Important Dates

For the NYC commercial rent tax, it is vital to be aware of the filing deadlines. The forms for the tax period from September 1 to November 30 must typically be submitted by December 15 of the same year. Missing this deadline can result in penalties and interest charges, making timely filing essential for compliance.

Required Documents

To successfully complete the NYC CR-Q2 form, certain documents are required. These include:

- Lease agreements that outline the terms of the rental.

- Records of rent payments made during the tax period.

- Any prior tax filings related to commercial rent, if applicable.

Having these documents ready will streamline the process and ensure accurate reporting.

Penalties for Non-Compliance

Failure to comply with the NYC commercial rent tax regulations can lead to significant penalties. These may include:

- Monetary fines for late submissions.

- Interest on unpaid taxes, which can accumulate over time.

- Potential legal action for persistent non-compliance.

Understanding these penalties emphasizes the importance of accurate and timely filing.

Digital vs. Paper Version

When filing the NYC commercial rent tax forms, businesses have the option to submit either a digital or paper version. The digital version allows for quicker processing and can be filled out using e-signature solutions, ensuring compliance with legal requirements. In contrast, paper submissions may take longer to process and could lead to delays in confirmation of filing. Choosing the digital method can enhance efficiency and reduce the risk of errors.

Quick guide on how to complete applicable for the tax period september 1 2020 to november 30 2020 only

Complete Applicable For The Tax Period September 1, To November 30, ONLY effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Applicable For The Tax Period September 1, To November 30, ONLY on any device with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The easiest method to modify and eSign Applicable For The Tax Period September 1, To November 30, ONLY with ease

- Locate Applicable For The Tax Period September 1, To November 30, ONLY and click on Get Form to begin.

- Use the tools available to fill out your form.

- Emphasize signNow parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from a device of your choice. Modify and eSign Applicable For The Tax Period September 1, To November 30, ONLY and ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct applicable for the tax period september 1 2020 to november 30 2020 only

Create this form in 5 minutes!

How to create an eSignature for the applicable for the tax period september 1 2020 to november 30 2020 only

The best way to generate an electronic signature for a PDF file online

The best way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

People also ask

-

What are NYC commercial rent tax forms CR Q2 fillable, and why are they important?

NYC commercial rent tax forms CR Q2 fillable are specific documents required by businesses in New York City to report and pay the commercial rent tax. These forms are critical for compliance, ensuring that your business meets the city’s tax obligations. Using fillable forms streamline the process, making it easier to enter information accurately and submit on time.

-

How can airSlate SignNow help with filling out NYC commercial rent tax forms CR Q2?

airSlate SignNow simplifies the process of filling out NYC commercial rent tax forms CR Q2 by providing an intuitive interface to complete your forms online. With features such as drag-and-drop document editing and real-time collaboration, you can ensure that your forms are filled out correctly. This helps reduce the risk of errors and enhances efficiency.

-

Are there any costs associated with using airSlate SignNow for NYC commercial rent tax forms CR Q2 fillable?

While airSlate SignNow offers a range of pricing plans, the basic features to fill out and eSign NYC commercial rent tax forms CR Q2 fillable are competitively priced. Customers can select a plan that suits their business needs and budget. Additionally, the efficiency gained can offset costs by saving time and minimizing errors.

-

What features does airSlate SignNow offer for NYC commercial rent tax forms CR Q2 fillable?

airSlate SignNow includes features like customizable templates for NYC commercial rent tax forms CR Q2 fillable, automated reminders, and advanced security options. These features ensure that your documents are not only completed accurately but are also securely stored and easily retrievable. This enhances the overall user experience and satisfaction.

-

Is it easy to integrate airSlate SignNow with other software for managing NYC commercial rent tax forms CR Q2?

Yes, airSlate SignNow offers seamless integrations with popular software platforms, making it easy to manage your NYC commercial rent tax forms CR Q2 fillable alongside your other tools. Whether you're using accounting software or ERP systems, you can connect and streamline your workflow. This integration helps ensure your tax forms are consistently updated and accessible.

-

Can I access my completed NYC commercial rent tax forms CR Q2 fillable from any device?

Absolutely! airSlate SignNow is designed to be accessible from any device with an internet connection, allowing you to complete and review your NYC commercial rent tax forms CR Q2 fillable on-the-go. Whether you're on a desktop, laptop, tablet, or smartphone, you can manage your documents conveniently and efficiently.

-

What are the benefits of using airSlate SignNow for NYC commercial rent tax forms CR Q2?

Using airSlate SignNow for your NYC commercial rent tax forms CR Q2 provides several benefits, including time savings, improved accuracy, and ease of use. The fillable forms reduce manual entry errors, while the eSignature feature allows for quick approvals. This results in faster submission processes and better compliance with tax regulations.

Get more for Applicable For The Tax Period September 1, To November 30, ONLY

Find out other Applicable For The Tax Period September 1, To November 30, ONLY

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors