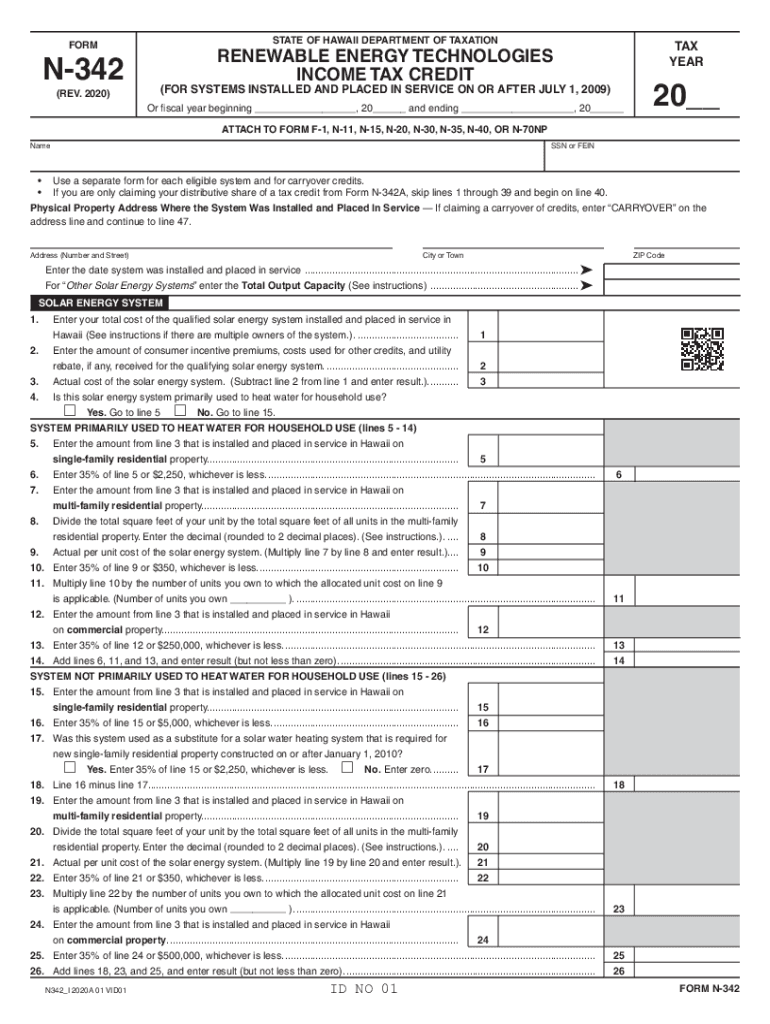

Form N 342, , Renewable Energy Technologies Income Tax Credit for Systems Installed and Placed in Service on or After July 1, 2020-2026

What is the Form N 342?

The Form N 342 is a tax form used in Hawaii to claim the Renewable Energy Technologies Income Tax Credit. This credit is available for systems that are installed and placed in service on or after July 1. It aims to incentivize the adoption of renewable energy technologies, helping residents and businesses reduce their tax liabilities while promoting sustainable energy practices. The form requires detailed information about the installed systems, including their specifications and costs, to ensure compliance with state tax regulations.

How to use the Form N 342

Using the Form N 342 involves several key steps. First, gather all necessary documentation related to the renewable energy system, such as purchase receipts and installation contracts. Next, complete the form by providing accurate information, including the type of technology used and the total costs incurred. It is essential to ensure that all entries are correct to avoid delays in processing. Once completed, the form can be submitted to the appropriate state tax authority for review and approval.

Steps to complete the Form N 342

Completing the Form N 342 requires careful attention to detail. Follow these steps:

- Collect all relevant documentation regarding your renewable energy system.

- Fill out personal information, including your name, address, and Social Security number.

- Provide details about the renewable energy system, including installation date and type.

- Calculate the total cost of the system and the amount of credit you are claiming.

- Review the form for accuracy before submission.

Eligibility Criteria

To qualify for the Renewable Energy Technologies Income Tax Credit using Form N 342, certain eligibility criteria must be met. The system must be installed in Hawaii and placed in service after July 1. Additionally, the technology must be recognized under state guidelines, and the taxpayer must be liable for Hawaii state income tax. It is important to ensure that all conditions are satisfied to successfully claim the credit.

Required Documents

When submitting the Form N 342, specific documents are required to support your claim. These documents typically include:

- Proof of purchase for the renewable energy system.

- Installation contracts or agreements.

- Any additional documentation that verifies the system's specifications and costs.

Having these documents ready will facilitate a smoother review process by the tax authorities.

Form Submission Methods

The Form N 342 can be submitted through various methods to accommodate different preferences. Taxpayers can choose to file the form online through the state's tax portal, or they can opt for traditional methods such as mailing the completed form to the appropriate tax office. In-person submissions may also be available, depending on local regulations and office hours.

Quick guide on how to complete form n 342 2020 renewable energy technologies income tax credit for systems installed and placed in service on or after july 1

Complete Form N 342, , Renewable Energy Technologies Income Tax Credit For Systems Installed And Placed In Service On Or After July 1, effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal sustainable alternative to conventional printed and signed documents, enabling you to find the right form and securely store it online. airSlate SignNow equips you with all the essentials to create, modify, and eSign your documents quickly without any holdups. Manage Form N 342, , Renewable Energy Technologies Income Tax Credit For Systems Installed And Placed In Service On Or After July 1, across all platforms with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The simplest way to modify and eSign Form N 342, , Renewable Energy Technologies Income Tax Credit For Systems Installed And Placed In Service On Or After July 1, without hassle

- Find Form N 342, , Renewable Energy Technologies Income Tax Credit For Systems Installed And Placed In Service On Or After July 1, and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with specialized tools that airSlate SignNow offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Alter and eSign Form N 342, , Renewable Energy Technologies Income Tax Credit For Systems Installed And Placed In Service On Or After July 1, and ensure effective communication at every stage of the form development process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 342 2020 renewable energy technologies income tax credit for systems installed and placed in service on or after july 1

Create this form in 5 minutes!

How to create an eSignature for the form n 342 2020 renewable energy technologies income tax credit for systems installed and placed in service on or after july 1

The way to create an eSignature for a PDF file online

The way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to n 342 hawaii?

AirSlate SignNow is a powerful eSignature solution that simplifies the process of signing and sending documents. In the context of n 342 hawaii, it provides businesses operating in this area with an easy-to-use and cost-effective way to manage their document workflows, ensuring compliance and efficiency.

-

What pricing plans are available for airSlate SignNow in n 342 hawaii?

AirSlate SignNow offers various pricing plans tailored to suit businesses in n 342 hawaii, starting from a basic plan to advanced features for larger teams. Each plan is designed to cater to different user needs, ensuring that you only pay for what you require to effectively manage your document signing.

-

What key features does airSlate SignNow offer for users in n 342 hawaii?

AirSlate SignNow includes a range of features such as customizable templates, secure cloud storage, and real-time tracking for document signing. For users in n 342 hawaii, these features enhance productivity and ensure that important documents are managed efficiently and securely.

-

How does airSlate SignNow improve business efficiency in n 342 hawaii?

By using airSlate SignNow, businesses in n 342 hawaii can signNowly reduce the time spent on document signing and processing. The platform allows for fast electronic signatures and streamlined workflows, which ultimately leads to improved operational efficiency and faster transaction times.

-

Can airSlate SignNow integrate with other software commonly used in n 342 hawaii?

Yes, airSlate SignNow seamlessly integrates with various popular software applications that businesses in n 342 hawaii may already be using. This includes CRMs, project management tools, and cloud storage services, making it easy to incorporate eSigning into your existing workflows.

-

Is airSlate SignNow secure for businesses in n 342 hawaii?

Absolutely, airSlate SignNow is designed with security in mind, ensuring that documents signed in n 342 hawaii are protected. It complies with major security standards, and provides features like encryption and secure access to safeguard sensitive information.

-

What benefits can businesses in n 342 hawaii expect from using airSlate SignNow?

Businesses in n 342 hawaii can expect numerous benefits from using airSlate SignNow, such as enhanced workflow efficiency, reduced operational costs, and improved customer satisfaction through faster document processing. These advantages lead to better overall business performance.

Get more for Form N 342, , Renewable Energy Technologies Income Tax Credit For Systems Installed And Placed In Service On Or After July 1,

Find out other Form N 342, , Renewable Energy Technologies Income Tax Credit For Systems Installed And Placed In Service On Or After July 1,

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple