Schedule of Florida Sales or Use Tax Credits Claimed on Form

What is the Schedule of Florida Sales or Use Tax Credits Claimed On

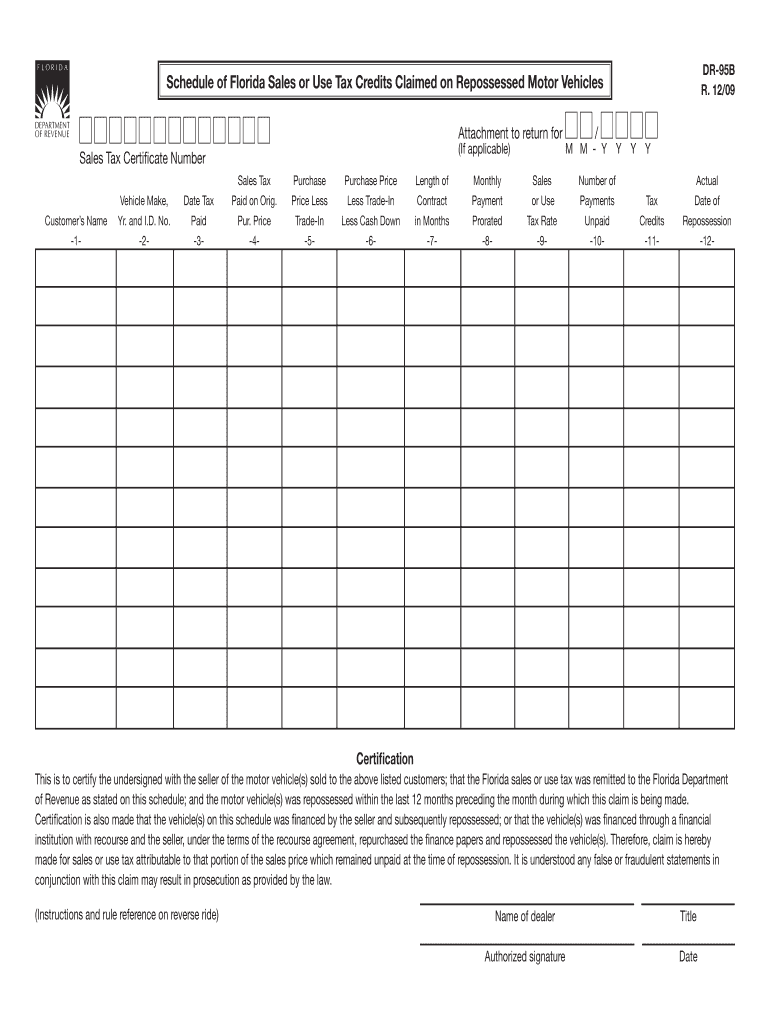

The Schedule of Florida Sales or Use Tax Credits Claimed On is a crucial document for businesses operating within Florida. It serves to report and claim credits against the sales and use tax that a business has paid. This form is essential for ensuring that businesses can recover taxes that were overpaid or that qualify for specific exemptions. Understanding this schedule is vital for compliance and effective tax management.

Steps to Complete the Schedule of Florida Sales or Use Tax Credits Claimed On

Completing the Schedule of Florida Sales or Use Tax Credits Claimed On involves several key steps:

- Gather all relevant documentation, including receipts and invoices that detail the sales and use tax paid.

- Fill in the required fields accurately, ensuring that all amounts are correct and supported by documentation.

- Review the form for any errors or omissions before submission.

- Submit the completed schedule electronically or via mail, depending on your preference and the requirements set by the Florida Department of Revenue.

Legal Use of the Schedule of Florida Sales or Use Tax Credits Claimed On

The legal use of the Schedule of Florida Sales or Use Tax Credits Claimed On is governed by state tax laws. It is essential to ensure that the information provided is accurate and truthful, as any discrepancies can lead to penalties or audits. This form must be completed in accordance with the guidelines established by the Florida Department of Revenue to ensure its validity and acceptance.

Required Documents for the Schedule of Florida Sales or Use Tax Credits Claimed On

To successfully complete the Schedule of Florida Sales or Use Tax Credits Claimed On, certain documents are required:

- Receipts for purchases that incurred sales tax.

- Invoices that detail the sales tax paid on goods and services.

- Previous tax returns that may support claims for credits.

- Any correspondence from the Florida Department of Revenue regarding tax credits.

Eligibility Criteria for the Schedule of Florida Sales or Use Tax Credits Claimed On

Eligibility for claiming credits on the Schedule of Florida Sales or Use Tax Credits Claimed On typically includes:

- Businesses registered in Florida that have incurred sales and use tax.

- Entities that can provide documentation supporting their claims for credits.

- Compliance with all relevant tax laws and regulations.

Filing Deadlines for the Schedule of Florida Sales or Use Tax Credits Claimed On

Filing deadlines for the Schedule of Florida Sales or Use Tax Credits Claimed On are critical for compliance. Generally, businesses must submit this schedule along with their sales tax return. It is advisable to check the Florida Department of Revenue’s official calendar for specific deadlines, as they may vary based on the filing frequency of the business.

Quick guide on how to complete schedule of florida sales or use tax credits claimed on

Effortlessly Prepare Schedule Of Florida Sales Or Use Tax Credits Claimed On on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Schedule Of Florida Sales Or Use Tax Credits Claimed On on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign Schedule Of Florida Sales Or Use Tax Credits Claimed On with Ease

- Locate Schedule Of Florida Sales Or Use Tax Credits Claimed On and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes just seconds and has the same legal validity as a traditional ink signature.

- Review the information and then click the Done button to save your modifications.

- Select your preferred method to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, and errors that require reprinting new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Schedule Of Florida Sales Or Use Tax Credits Claimed On to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

I can't figure out if I should claim 1 dependent or 2 dependents on my W-4 tax form. When and how do you make changes to your W-4 tax form after having children?

OK, first off I’m going to say *IGNORE* the instructions on the updated W-4 form. It’s not worth anything. And yes, I’ve seen and followed the directions, which are wildly inaccurate and misleading.Here’s how exemptions and the W-4 work.As of last year, per the Tax Cuts and Job Act, you can NO LONGER, claim yourself as a dependent/exemption. You can, if you are married, no longer claim your spouse as a dependent/exemption.IF you have minor children (Age 19 and under) you *MAY* claim one exemption per child. IF you have a child, enrolled ‘full time in school’ who is age 24 or under, and that schooling is College, Trade School, Vo-Tech, etc and NOT primary education (IE High School education, GED classes, etc) you may claim an exemption for them.So simple example. Jack and Jane Darling are married. They have one child born June 1st.From January to June, Jack and Jane can *ONLY* claim ZERO EXEMPTIONS on their W-4. From June 1st, when the child is born, on wards, they can each claim ONE Exemption on their W-4.Hopefully that helps and simplifies it down. And yes, I’m a tax preparer as well. I spent all of last year warning various clients and I’m doing the same this year, along with explaining how many you can *legally* claim on your W-4.

-

How many Child Tax Credits of up to $6,269 are used on casinos and out-of-town trips, as there was $96 million in CA welfare?

Who cares?The entire point of cash assistance and child tax credits and other unrestricted subsidies is to increase aggregate demand. I don’t care where it’s spent, so long as it is spent, because that is it’s purpose.To illustrate this point, in your linked article there is a tattoo artist who is upset that someone used public funds to purchase a tattoo because “taxes keep going up”. However, since this artist pays taxes based on income, is he better off or worse off after someone bought the tattoo with public funds? Surely the taxes weren’t 100% or more, and surely he turned a profit from it. It’s almost certain that he’d be worse off if no one ever bought a tattoo with public funds.We see this type of argument with means tested welfare all the time. Even with something as tightly controlled as food stamps, you get states that want to restrict people from buying things like pre-made spaghetti sauce or potato chips, which are staple foods in most American households. Companies like Kraft and Frito-Lay understand the concept I outlined above, and know that public dollars are an increase to their bottom line and fight any and all legislation that tries to restrict food stamp use. I’ll guarantee they pay more in taxes than you ever will, and yet they fight in favor of these programs because it’s financially prudent.THOSE PUBLIC DOLLARS BEING SPENT ON TATTOOS, GAMBLING, VACATIONS, SPAGHETTI SAUCE, ETC., ARE LITERALLY PROFITS THAT CREATE JOBS. Stop caring about what they are spent on, and be happy that they are spent. They don’t create a paycheck when they are sitting in a bank account.Getting back to the “taxes keep going up” line… Los Angeles had a tax reduction over the last 6 years at some point. California State sales tax dropped -.25%, and at some point LA dropped another -.75%, because in 2011 it was 9.75% and today it stands at 8.75%. Various other taxes rise and fall depending on the economic situation as well, demonstrably throughout history. It’s disingenuous to claim otherwise while making a point.

-

Using current 2019 US Tax brackets, how much income tax would you pay on an annual income of exactly $10,000,000? (assuming no credits/deductions/ tax breaks or any form of tax reduction mechanisms are allowed)

Source: 2019 Federal Income Tax Brackets | 2019 Tax Brackets & RatesAssuming nothing more than this list applies (and using Head of Household rates):$1,385 +$4,680 +$6,897 +$18,360 +$13,888 +$107,170 +$3,511,189or $3,663,569

-

How do you think Mexico can stop the US from charging Mexico for the wall using tariffs on goods manufactured in Mexico for sale in the US, and/or for taxing money sent out of the US to Mexico?

Mexico can't stop America from doing that. They also can't stop America from charging tariffs and taxing Americans to pay for Trump's hair treatments. Mexico has no control over America's tariff and taxation policy, that's run by the US government, and is ultimately only accountable to the American people.What Mexico can, and absolutely will do, is retaliate by imposing tariffs on American goods, effectively kicking off a trade war which will hurt both countries. American farmers, ranchers, manufacturers, etc., who sell things to Mexico will lose business, and some will go out of business. American consumers will pay more for everything from gas to grapes, and American manufacturers who buy materials and components from Mexico (and there are many), will find their expenses going up. Some will have lay offs or go out of business.As for the taxation, if Trump can convince a Republican congress to raise taxes, Mexico has no say in it. I mean, to 100% certainty it will increase the market for illegal smuggling of money and other financial interests across international borders. Some of the more tech-savvy organizations might use BitCoin, or some other digital currency. America will likely try to crack down on this, occasionally confiscate an envelope of money to wave around on the news as a sign they're doing their job, but the additional federal money gained from this program will probably be less than the additional money we have to spend on border enforcement just chasing the dark money. But that's ultimately a US thing. Sure, it would be hypocritical of a Republican congress to raise federal taxes, but hypocrisy has never stopped them before. And it would have massive political backlash from every American with friends or relatives in Mexico who wants to send them money for any reason. But this administration has basically written of the support of everyone with Mexican ties in the entire US, so that's probably not such a big thing.So, if destruction of trade and onerous taxes on the poorest of our workers is what Trump wants to build his wall on, all Pena can do is try to tie his country closer with other, more reasonable global powers.

Create this form in 5 minutes!

How to create an eSignature for the schedule of florida sales or use tax credits claimed on

How to create an eSignature for your Schedule Of Florida Sales Or Use Tax Credits Claimed On online

How to create an electronic signature for the Schedule Of Florida Sales Or Use Tax Credits Claimed On in Google Chrome

How to make an eSignature for putting it on the Schedule Of Florida Sales Or Use Tax Credits Claimed On in Gmail

How to create an electronic signature for the Schedule Of Florida Sales Or Use Tax Credits Claimed On from your smartphone

How to create an eSignature for the Schedule Of Florida Sales Or Use Tax Credits Claimed On on iOS devices

How to make an electronic signature for the Schedule Of Florida Sales Or Use Tax Credits Claimed On on Android devices

People also ask

-

What is the Schedule Of Florida Sales Or Use Tax Credits Claimed On?

The Schedule Of Florida Sales Or Use Tax Credits Claimed On is a crucial tax form that businesses must complete to claim sales or use tax credits in Florida. This form helps ensure compliance with state tax regulations and allows businesses to recover eligible taxes paid. Understanding how to properly fill out this schedule can maximize your tax savings.

-

How can airSlate SignNow assist with the Schedule Of Florida Sales Or Use Tax Credits Claimed On?

airSlate SignNow streamlines the process of preparing and signing documents related to the Schedule Of Florida Sales Or Use Tax Credits Claimed On. With our easy-to-use platform, you can quickly create, send, and eSign the necessary forms, ensuring you meet submission deadlines efficiently. Our solution simplifies document management, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for my Schedule Of Florida Sales Or Use Tax Credits Claimed On?

Yes, while airSlate SignNow offers a cost-effective solution for document management, pricing may vary based on the features you choose. We provide flexible pricing plans that cater to different business needs, ensuring you get the best value when preparing your Schedule Of Florida Sales Or Use Tax Credits Claimed On. You can review our pricing page for more details.

-

What features does airSlate SignNow offer for eSigning tax documents like the Schedule Of Florida Sales Or Use Tax Credits Claimed On?

airSlate SignNow offers a variety of features designed specifically for eSigning tax documents, including customizable templates, secure storage, and real-time tracking of document status. These features ensure that your Schedule Of Florida Sales Or Use Tax Credits Claimed On is handled efficiently and securely, allowing for easy collaboration among team members.

-

Can I integrate airSlate SignNow with my existing accounting software for tax credits?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, enhancing your workflow when managing the Schedule Of Florida Sales Or Use Tax Credits Claimed On. This integration allows for automatic data transfer and reduces the risk of errors, ensuring your tax credits are claimed accurately and on time.

-

What benefits do I gain from using airSlate SignNow for tax-related documents?

By using airSlate SignNow for your tax-related documents, such as the Schedule Of Florida Sales Or Use Tax Credits Claimed On, you benefit from increased efficiency and reduced processing time. The platform also enhances security and compliance, ensuring that all your documents are signed and stored safely. This means you can focus more on your business rather than paperwork.

-

Is it easy to get started with airSlate SignNow for my tax document needs?

Yes, getting started with airSlate SignNow is incredibly straightforward. You can sign up for an account, explore our features, and begin creating and managing documents like the Schedule Of Florida Sales Or Use Tax Credits Claimed On in just a few minutes. Our user-friendly interface makes it easy for anyone to navigate the system.

Get more for Schedule Of Florida Sales Or Use Tax Credits Claimed On

- Edited from httpmichigan michbar form

- Standard inventory inspection form templatenet

- Remainder of the form is to be completed by the qualified professional who is

- Minnesota delegation of power by parent form flanders law firm

- Remainder of the form is to be completed by each educational institution or testing

- Notice to applicant this section of this form is to be completed by you

- State of montana board of bar examiners ampamp commission form

- Montana application cover page form

Find out other Schedule Of Florida Sales Or Use Tax Credits Claimed On

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast