Form 10i

What is the Form 10i

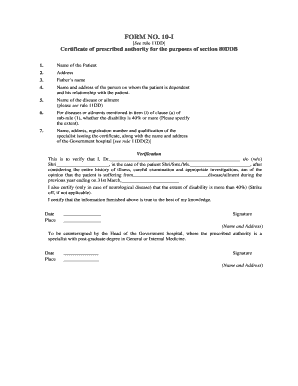

The Form 10i is a tax document utilized in the United States, primarily for claiming deductions related to specified medical expenses under Section 80DD of the Internal Revenue Code. This form is essential for individuals seeking to benefit from tax relief for expenses incurred in the treatment of dependents with disabilities. Understanding the purpose and requirements of the Form 10i is crucial for accurate tax filing and compliance.

How to use the Form 10i

Using the Form 10i involves several straightforward steps. First, gather all necessary documentation related to medical expenses that qualify for deductions. This includes receipts, bills, and any relevant medical certificates. Next, fill out the form accurately, ensuring all required fields are completed. After completing the form, review it for any errors before submission. The completed Form 10i can then be submitted along with your tax return to claim your deductions.

Steps to complete the Form 10i

Completing the Form 10i requires careful attention to detail. Follow these steps:

- Collect all relevant medical expense documentation.

- Download the Form 10i from a reliable source.

- Fill in your personal information, including your name, address, and Social Security number.

- Detail the medical expenses incurred, ensuring to include the nature of the expenses and the amounts.

- Attach any necessary supporting documents, such as medical certificates or receipts.

- Review the form for accuracy and completeness.

- Submit the Form 10i with your tax return.

Legal use of the Form 10i

The legal use of the Form 10i is governed by the IRS guidelines regarding medical expense deductions. To ensure compliance, it is important to understand the eligibility criteria for expenses that can be claimed. The form must be filled out accurately and submitted within the designated filing period to avoid penalties. Utilizing the form correctly not only helps in claiming legitimate deductions but also ensures adherence to tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 10i align with the standard tax return deadlines set by the IRS. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is essential to keep track of these dates to ensure timely submission of the Form 10i to avoid penalties and interest on unpaid taxes.

Required Documents

To complete the Form 10i, certain documents are required to substantiate your claims. These include:

- Receipts for medical expenses incurred.

- Medical certificates verifying the disability of the dependent.

- Any additional documentation that supports the claims made on the form.

Having these documents ready will facilitate a smoother filing process and enhance the credibility of your claims.

Quick guide on how to complete form 10i

Complete Form 10i effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Manage Form 10i on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

The simplest method to alter and electronically sign Form 10i without stress

- Find Form 10i and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your alterations.

- Choose your preferred method of submitting your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Form 10i and ensure excellent communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 10i

The best way to create an eSignature for your PDF document in the online mode

The best way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is a form 10ia filled sample?

A form 10ia filled sample is a completed version of the form, showcasing how to accurately fill out each section. Using a sample can help users understand the required information and format, ensuring successful submission. This guide is vital for those unfamiliar with form requirements.

-

How can I create a form 10ia filled sample using airSlate SignNow?

To create a form 10ia filled sample with airSlate SignNow, simply upload the blank form to our platform, fill in the necessary fields, and save it as a template. This process ensures that you always have a properly completed sample available for future use or sharing. Our user-friendly interface makes it easy for anyone to get started.

-

What are the benefits of using airSlate SignNow for form 10ia filled samples?

Using airSlate SignNow for form 10ia filled samples offers numerous benefits including a streamlined workflow, secure eSignature capabilities, and easy document sharing. This simplifies the process of creating, signing, and managing forms, which ultimately saves time and improves efficiency for businesses. You can also access forms from anywhere, making it a flexible solution.

-

Are there any costs associated with using airSlate SignNow for form 10ia filled samples?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features that can help with managing documents, including creating form 10ia filled samples. You can choose a plan that suits your budget and business requirements while still enjoying great value.

-

Can I integrate airSlate SignNow with other software for managing form 10ia filled samples?

Absolutely! airSlate SignNow provides integrations with popular software such as Google Drive, Dropbox, and Microsoft Office. This means you can easily import and export your form 10ia filled samples and manage them in your preferred applications, enhancing your overall workflow.

-

How secure is airSlate SignNow when handling my form 10ia filled samples?

airSlate SignNow prioritizes security, utilizing advanced encryption and secure cloud storage for all documents, including form 10ia filled samples. This ensures that your data remains confidential and protected from unauthorized access. You can have peace of mind knowing that your sensitive information is safe.

-

Can I edit my form 10ia filled samples once they are created?

Yes, airSlate SignNow allows you to easily edit your form 10ia filled samples at any stage. This provides flexibility to update information as needed, ensuring that your documents remain accurate and relevant. Editing is straightforward, allowing you to make changes quickly.

Get more for Form 10i

- Vulnerable child declaration form

- Crack adobe acrobat 7 0 professional form

- Kssl ztbl form

- Pdf to fillable form pdf to fillable form

- Piktochart create infographics presentations amp reports form

- Directed study registration formhawaii pacific un

- Submit this form to kent state university health services

- Immunization form valdosta state university valdosta

Find out other Form 10i

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors