103 Gd Form

What is the 103 GD Form

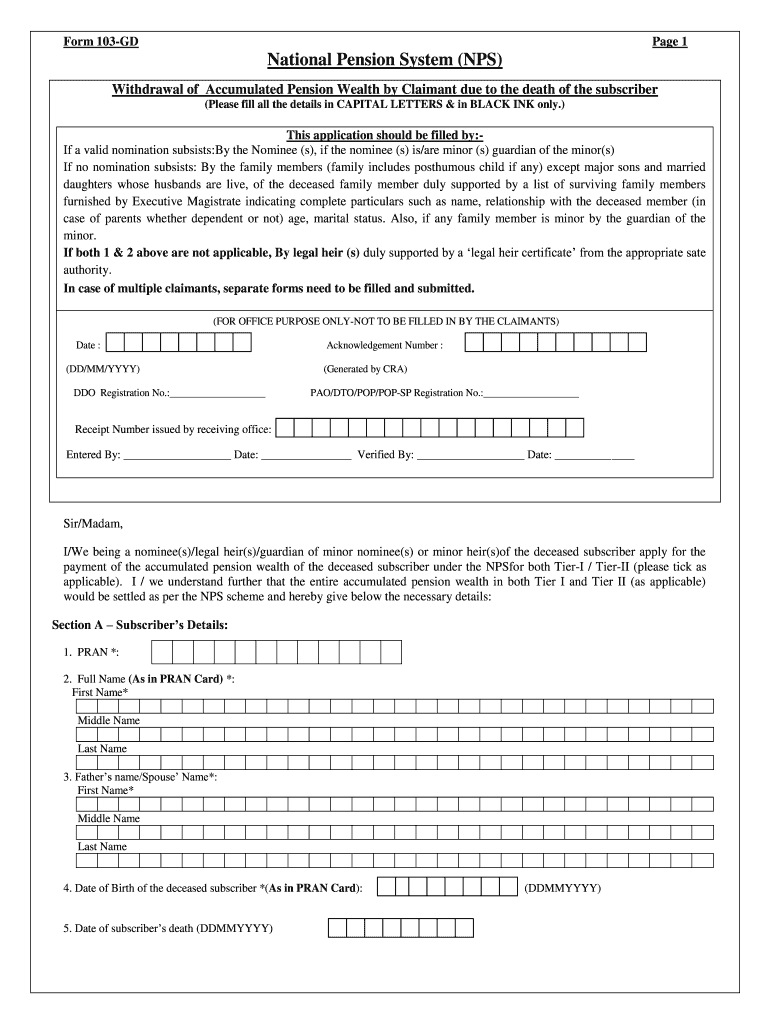

The 103 GD form, commonly referred to as the 103 nps withdrawal form, is a critical document used by individuals seeking to withdraw funds from the National Pension System (NPS) in the United States. This form serves as an official request for the withdrawal of accumulated pension funds, whether due to retirement, death of the subscriber, or other qualifying circumstances. Understanding the purpose and function of this form is essential for any nps withdrawal claimant to navigate the withdrawal process effectively.

Steps to Complete the 103 GD Form

Completing the 103 GD form involves several key steps. First, ensure that you have all necessary personal information readily available, including your NPS account details and identification. Next, accurately fill out all required sections of the form, which typically include personal identification, the reason for withdrawal, and the amount requested. After completing the form, review it for accuracy and completeness. Finally, submit the form through the appropriate channels, which may include online submission or mailing it to the designated authority.

Legal Use of the 103 GD Form

The legal use of the 103 GD form is governed by specific regulations that ensure its validity. To be considered legally binding, the form must be filled out correctly and submitted according to the guidelines set forth by the NPS. Additionally, compliance with eSignature laws, such as the ESIGN and UETA Acts, is crucial when submitting the form electronically. This ensures that the withdrawal request is recognized by financial institutions and legal entities.

Required Documents

When submitting the 103 GD form, certain documents are typically required to support the withdrawal request. These may include:

- A copy of your identification, such as a driver's license or passport.

- Proof of NPS account ownership, such as account statements.

- Documentation supporting the reason for withdrawal, such as a death certificate in cases of a nps withdrawal death.

Gathering these documents in advance can streamline the process and reduce potential delays.

Form Submission Methods

The 103 GD form can be submitted through various methods, depending on the requirements of the NPS. Common submission methods include:

- Online submission via the official NPS portal, which allows for quicker processing.

- Mailing the completed form and supporting documents to the designated NPS office.

- In-person submission at local NPS offices, if available.

Choosing the appropriate submission method can help ensure that your request is processed efficiently.

Eligibility Criteria

To qualify for a withdrawal using the 103 GD form, certain eligibility criteria must be met. Generally, these criteria include:

- Being a registered subscriber of the NPS.

- Meeting the age or service requirements for withdrawal, which may vary based on the reason for withdrawal.

- Providing valid documentation to support the withdrawal request.

Understanding these criteria is essential for any nps withdrawal claimant to ensure a successful application.

Quick guide on how to complete 103 gd form

Effortlessly Complete 103 Gd Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely store it in the cloud. airSlate SignNow equips you with all the essential tools to create, edit, and eSign your documents promptly without any delays. Handle 103 Gd Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign 103 Gd Form with Ease

- Obtain 103 Gd Form and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign 103 Gd Form to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 103 gd form

How to generate an eSignature for your PDF document in the online mode

How to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is an NPS withdrawal claimant?

An NPS withdrawal claimant refers to an individual who seeks to withdraw funds from the National Pension System. Understanding your rights and the withdrawal process as an NPS withdrawal claimant is crucial to accessing your funds efficiently.

-

How can airSlate SignNow help NPS withdrawal claimants?

airSlate SignNow offers a streamlined eSigning process that simplifies document preparation and submission. As an NPS withdrawal claimant, you can quickly sign the necessary documents electronically, saving time and reducing hassles.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow includes features like document templates, secure storage, and tracking capabilities. For NPS withdrawal claimants, these features facilitate better organization and accessibility of the documents needed for the withdrawal process.

-

Is there a pricing plan for NPS withdrawal claimants?

Yes, airSlate SignNow provides various pricing plans designed to accommodate different needs, including those for NPS withdrawal claimants. You can choose a plan that fits your document management requirements and budget.

-

Can I integrate airSlate SignNow with other applications for my NPS withdrawal claim?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your workflow as an NPS withdrawal claimant. You can connect it with tools like CRMs and cloud storage services to streamline your document management process.

-

What are the benefits of using airSlate SignNow for NPS withdrawal claimants?

The primary benefits for NPS withdrawal claimants include faster document processing, enhanced security, and reduced paper usage. By using airSlate SignNow, you ensure a more efficient withdrawal process.

-

How secure is airSlate SignNow for NPS withdrawal claimants?

airSlate SignNow prioritizes security by offering bank-level encryption and ensuring data privacy. As an NPS withdrawal claimant, you can trust that your sensitive documents are handled with the utmost care.

Get more for 103 Gd Form

Find out other 103 Gd Form

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe