COLORADO DEPARTMENT of REVENUE 100719 Retail Sales Tax 2019-2026

Understanding the Colorado Department of Revenue Retail Sales Tax

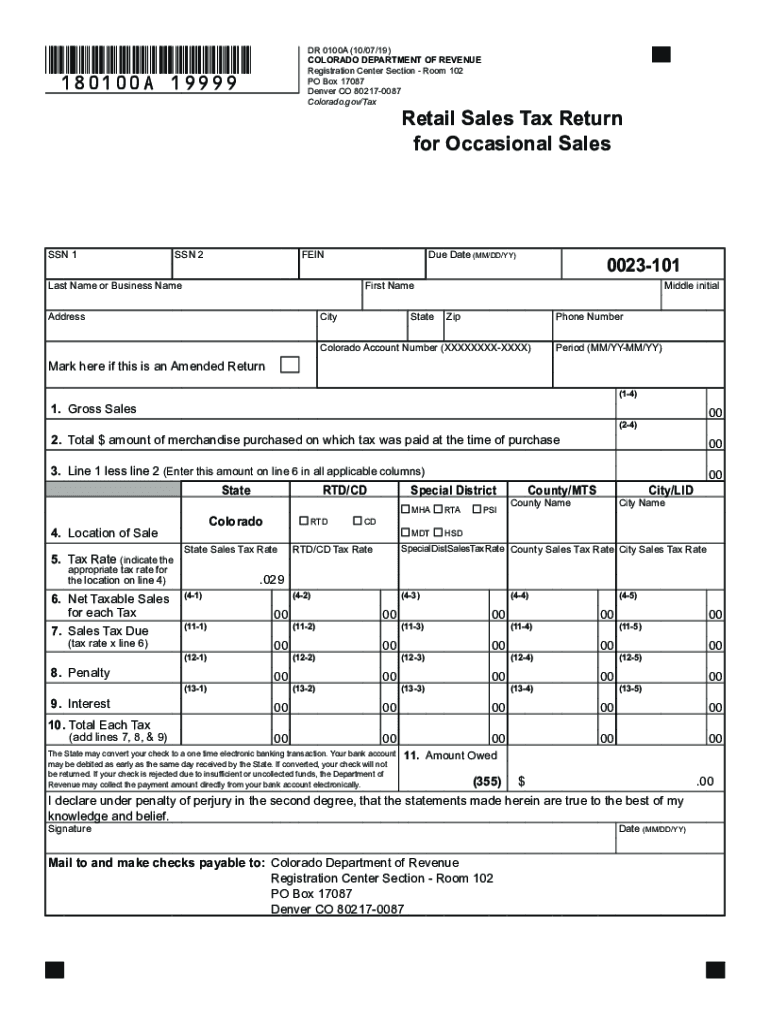

The Colorado Department of Revenue Retail Sales Tax is a tax imposed on the sale of tangible personal property and some services in the state of Colorado. This tax is crucial for businesses operating within the state, as it contributes to state and local revenue. The current state sales tax rate is set at two point nine percent, with additional local taxes varying by jurisdiction. Businesses must ensure they are compliant with both state and local tax regulations to avoid penalties.

Steps to Complete the Colorado Department of Revenue Retail Sales Tax

Completing the Colorado retail sales tax form involves several key steps. First, businesses must gather all relevant sales data, including total sales, taxable sales, and any exempt sales. Next, the appropriate form must be selected based on the business type and the nature of the sales. The most commonly used form is the Retail Sales Tax Return. After filling out the form accurately, businesses should review it for any errors before submission. Finally, the completed form can be submitted online or via mail, depending on the preference of the business.

Filing Deadlines and Important Dates

Filing deadlines for the Colorado retail sales tax vary based on the frequency of filing. Most businesses are required to file monthly, with returns due on the 20th of the month following the reporting period. For businesses that qualify for quarterly or annual filing, deadlines are adjusted accordingly. It is essential for businesses to stay informed about these dates to avoid late fees and penalties.

Required Documents for Filing

When filing the Colorado retail sales tax, businesses must prepare various documents to support their submission. Key documents include sales records, invoices, and any exemption certificates for tax-exempt sales. Maintaining accurate records is vital for compliance and can help in the event of an audit by the Colorado Department of Revenue.

Penalties for Non-Compliance

Failure to comply with Colorado retail sales tax regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. The Colorado Department of Revenue actively enforces compliance, making it essential for businesses to understand their obligations and file accurately and on time.

Digital vs. Paper Version of the Retail Sales Tax Form

Businesses have the option to complete the Colorado retail sales tax form either digitally or on paper. The digital version allows for easier submission and tracking, while the paper form may be preferred by those who are less comfortable with technology. Regardless of the method chosen, it is important to ensure that the form is filled out correctly and submitted by the appropriate deadline.

Eligibility Criteria for Filing

To file the Colorado retail sales tax, businesses must meet certain eligibility criteria. Generally, any business selling tangible personal property or specific services in Colorado is required to register for a sales tax license and file returns. This includes retailers, wholesalers, and service providers. Understanding these criteria helps businesses ensure they are compliant with state tax laws.

Quick guide on how to complete colorado department of revenue 100719 retail sales tax

Complete COLORADO DEPARTMENT OF REVENUE 100719 Retail Sales Tax effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents swiftly without delays. Handle COLORADO DEPARTMENT OF REVENUE 100719 Retail Sales Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign COLORADO DEPARTMENT OF REVENUE 100719 Retail Sales Tax with ease

- Find COLORADO DEPARTMENT OF REVENUE 100719 Retail Sales Tax and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your updates.

- Decide how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries over lost or mislaid documents, tiresome form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Adjust and eSign COLORADO DEPARTMENT OF REVENUE 100719 Retail Sales Tax and ensure exceptional communication throughout any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct colorado department of revenue 100719 retail sales tax

Create this form in 5 minutes!

How to create an eSignature for the colorado department of revenue 100719 retail sales tax

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF on Android OS

People also ask

-

What is the current rate for Colorado income tax?

The current rate for Colorado income tax is a flat rate of 4.55%. This means that all individuals and businesses in Colorado pay the same percentage of their income as tax, making it simpler to calculate your tax obligations. Keeping track of your Colorado income tax can be made easier with electronic signature solutions like airSlate SignNow.

-

How can airSlate SignNow help with filing Colorado income tax?

airSlate SignNow simplifies the process of gathering signatures and approvals required for tax documents. With easy-to-use electronic signature capabilities, you can quickly obtain the necessary consents for Colorado income tax filings, ensuring compliance and efficiency. This can save you time and reduce stress during tax season.

-

Is there a way to manage multiple documents related to Colorado income tax with airSlate SignNow?

Yes, airSlate SignNow allows users to manage multiple documents efficiently. You can organize, send for signatures, and track the status of your Colorado income tax-related documents all in one place. This centralization promotes better workflow and timely submissions, essential for tax compliance.

-

What are the pricing options for airSlate SignNow users concerned about Colorado income tax?

airSlate SignNow offers various pricing options tailored to different business needs. Whether you're a freelancer or a larger business, you can find a plan that fits your budget while enabling you to manage your Colorado income tax documents effectively. The cost-effective solution ensures that you pay only for the features you require.

-

Can I integrate airSlate SignNow with accounting software to manage Colorado income tax?

Absolutely! airSlate SignNow easily integrates with popular accounting software, allowing for seamless data transfer and management of your Colorado income tax documents. This integration helps streamline your tax preparation process, ensuring that all financial information is accurate and readily accessible.

-

What security features does airSlate SignNow provide for my Colorado income tax documents?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and secure cloud storage to protect your Colorado income tax documents, ensuring that your sensitive information remains confidential. You can eSign with peace of mind, knowing that your data is safeguarded against unauthorized access.

-

How does airSlate SignNow ensure compliance with Colorado income tax laws?

airSlate SignNow is designed to help users comply with various legal regulations, including Colorado income tax laws. The platform provides templates and prompts that guide you through the necessary steps, helping to ensure that your documents meet all requirements. This reduces the risk of errors when filing your taxes.

Get more for COLORADO DEPARTMENT OF REVENUE 100719 Retail Sales Tax

- Levey jennings chart maker form

- How to register a lien sale vehicle in california form

- Uwi elpt test sample form

- Nikah certificate template 100373396 form

- Proof of residency texas form

- Child adoption form pdf

- Imm 5604 form 424522795

- Dost philippine science high school system national competitive examination nce application form

Find out other COLORADO DEPARTMENT OF REVENUE 100719 Retail Sales Tax

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word