Retail Sales Tax Return for Occasional Sales Colorado Gov 2018

What is the Retail Sales Tax Return For Occasional Sales Colorado gov

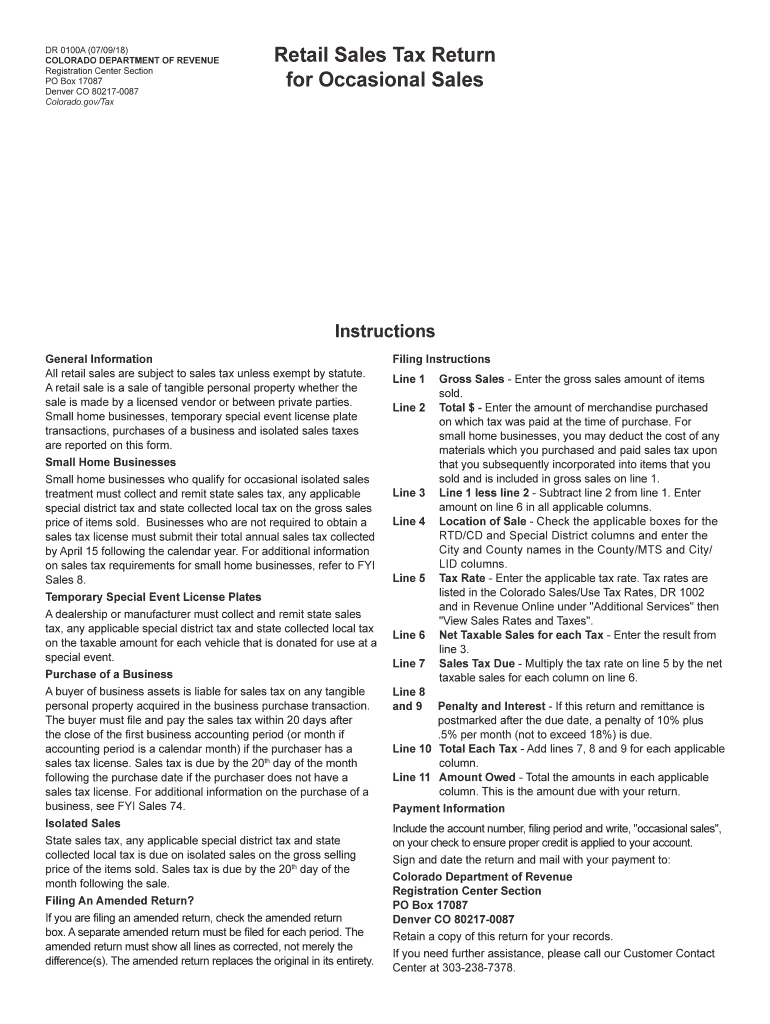

The Retail Sales Tax Return for Occasional Sales in Colorado is a specific tax form designed for individuals or businesses that engage in occasional sales of tangible personal property. This form allows sellers to report and remit sales tax collected from these transactions to the state. Occasional sales typically refer to infrequent sales that do not constitute regular business operations, such as garage sales or one-time events. Understanding this form is crucial for compliance with state tax regulations.

Steps to complete the Retail Sales Tax Return For Occasional Sales Colorado gov

Completing the Retail Sales Tax Return for Occasional Sales involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant sales information, including the total sales amount and the sales tax collected. Next, accurately fill out the form, providing your name, address, and the details of the sales. It is important to double-check all entries for errors. Once completed, submit the form by the designated deadline to avoid penalties.

Key elements of the Retail Sales Tax Return For Occasional Sales Colorado gov

Key elements of the Retail Sales Tax Return for Occasional Sales include the seller's information, the total amount of sales, the total sales tax collected, and any deductions applicable to the sales. Additionally, the form may require details about the nature of the sales and the dates on which they occurred. Accurate reporting of these elements is essential for proper tax compliance and to avoid potential issues with state tax authorities.

Legal use of the Retail Sales Tax Return For Occasional Sales Colorado gov

The legal use of the Retail Sales Tax Return for Occasional Sales is governed by Colorado state tax laws. This form is legally binding when completed accurately and submitted on time. It is essential for sellers to maintain records of their sales and the tax collected, as these may be requested by tax authorities for verification. Failure to use the form correctly can result in penalties or legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the Retail Sales Tax Return for Occasional Sales vary depending on the specific circumstances of the sale. Generally, the form should be submitted by the end of the month following the sale. It is important for sellers to be aware of these deadlines to ensure timely compliance and avoid late fees. Keeping a calendar of important dates related to tax submissions can help in managing these responsibilities effectively.

Form Submission Methods (Online / Mail / In-Person)

The Retail Sales Tax Return for Occasional Sales can be submitted through various methods. Sellers may choose to file the form online through the Colorado Department of Revenue's website, which provides a convenient and efficient way to submit tax returns. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own processing times, so sellers should consider their preferred submission method based on their needs.

Quick guide on how to complete retail sales tax return for occasional sales coloradogov

Complete Retail Sales Tax Return For Occasional Sales Colorado gov effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily locate the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without holdups. Manage Retail Sales Tax Return For Occasional Sales Colorado gov on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and electronically sign Retail Sales Tax Return For Occasional Sales Colorado gov without exertion

- Locate Retail Sales Tax Return For Occasional Sales Colorado gov and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that by airSlate SignNow.

- Generate your signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Retail Sales Tax Return For Occasional Sales Colorado gov and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct retail sales tax return for occasional sales coloradogov

Create this form in 5 minutes!

How to create an eSignature for the retail sales tax return for occasional sales coloradogov

How to generate an eSignature for your Retail Sales Tax Return For Occasional Sales Coloradogov online

How to generate an electronic signature for the Retail Sales Tax Return For Occasional Sales Coloradogov in Chrome

How to generate an eSignature for signing the Retail Sales Tax Return For Occasional Sales Coloradogov in Gmail

How to generate an electronic signature for the Retail Sales Tax Return For Occasional Sales Coloradogov straight from your smart phone

How to generate an eSignature for the Retail Sales Tax Return For Occasional Sales Coloradogov on iOS

How to create an eSignature for the Retail Sales Tax Return For Occasional Sales Coloradogov on Android OS

People also ask

-

What is a Retail Sales Tax Return For Occasional Sales in Colorado?

A Retail Sales Tax Return For Occasional Sales in Colorado is a specific tax return that businesses need to file when they make sales on an infrequent basis. This return helps ensure that the state collects the appropriate sales tax from these occasional sales. Understanding this process is essential for compliance with Colorado state tax regulations.

-

How do I file a Retail Sales Tax Return For Occasional Sales in Colorado?

To file a Retail Sales Tax Return For Occasional Sales in Colorado, you can use the online services provided by the Colorado Department of Revenue. Alternatively, you can utilize platforms like airSlate SignNow to easily complete and eSign your tax return. This simplifies the submission process and ensures you meet the state's deadlines.

-

What information do I need to provide for the Retail Sales Tax Return For Occasional Sales?

When completing a Retail Sales Tax Return For Occasional Sales in Colorado, you'll need to provide details such as your business information, the amount of sales you made, and the corresponding sales tax collected. Utilizing airSlate SignNow makes it easy to gather this information and finalize your return efficiently.

-

Are there any late fees for filing the Retail Sales Tax Return For Occasional Sales in Colorado?

Yes, if you miss the deadline to file your Retail Sales Tax Return For Occasional Sales in Colorado, you may incur late fees. It's crucial to submit your return on time to avoid additional costs. Using airSlate SignNow ensures timely filing by streamlining the document preparation process.

-

What features does airSlate SignNow offer for filing tax forms?

airSlate SignNow provides various features for filing tax forms, such as easy document editing, templates for tax returns, and electronic signature capabilities. These tools make the process of filing your Retail Sales Tax Return For Occasional Sales in Colorado straightforward and efficient, even for those new to eSigning documents.

-

How much does it cost to use airSlate SignNow for filing tax returns?

The pricing for using airSlate SignNow varies based on the plan you choose, but it generally offers affordable options for businesses of all sizes. This cost-effective solution ensures that you can manage your Retail Sales Tax Return For Occasional Sales in Colorado without breaking the bank while accessing premium features.

-

Can airSlate SignNow integrate with my accounting software?

Yes, airSlate SignNow can seamlessly integrate with various accounting software systems, making it easier to manage your Retail Sales Tax Return For Occasional Sales in Colorado. This integration allows for automatic data syncing, reducing the chances of errors and streamlining your overall tax management process.

Get more for Retail Sales Tax Return For Occasional Sales Colorado gov

Find out other Retail Sales Tax Return For Occasional Sales Colorado gov

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament