Truck Driver Tax Deductions Worksheet Form

What is the Truck Driver Tax Deductions Worksheet

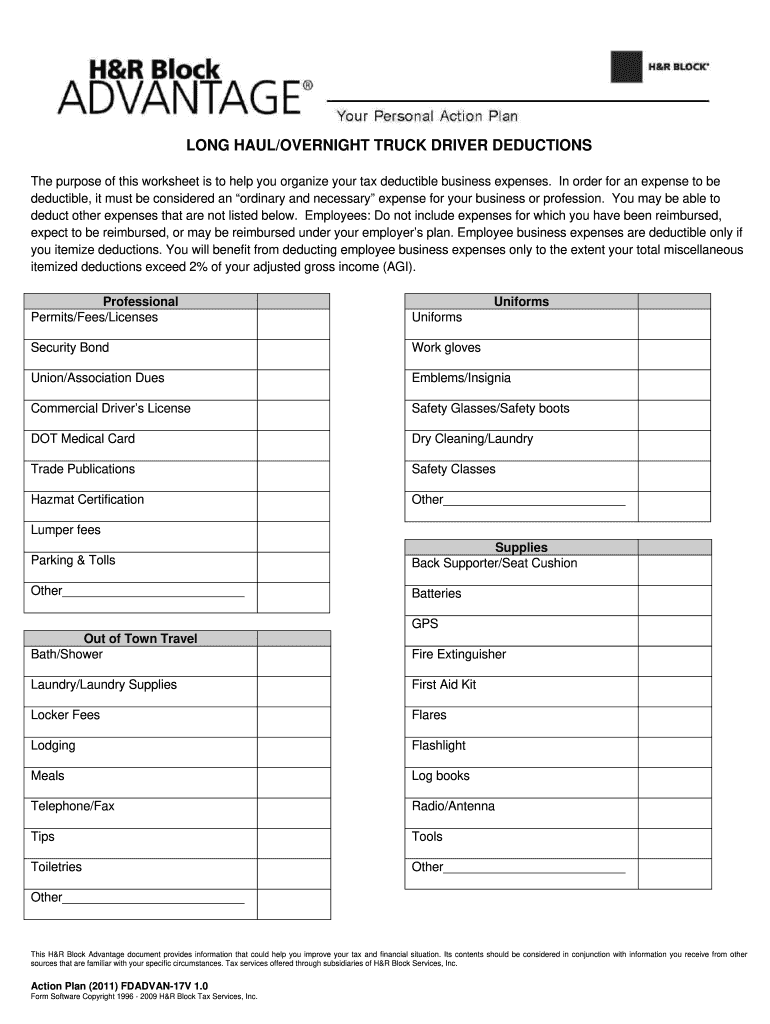

The Truck Driver Tax Deductions Worksheet is a specialized form designed for truck drivers, particularly owner-operators, to help them track and calculate their eligible tax deductions. This worksheet assists in organizing various expenses related to trucking operations, ensuring that drivers can maximize their deductions when filing taxes. It typically includes categories for fuel costs, maintenance and repairs, insurance, and other operational expenses that are deductible under IRS regulations.

How to use the Truck Driver Tax Deductions Worksheet

Using the Truck Driver Tax Deductions Worksheet involves several straightforward steps. First, gather all relevant financial documents, including receipts and invoices related to your trucking expenses. Next, categorize these expenses according to the sections provided in the worksheet. As you fill out the form, ensure that you accurately record each expense, noting the amount and purpose. This organized approach not only simplifies the tax filing process but also helps in identifying all potential deductions.

Steps to complete the Truck Driver Tax Deductions Worksheet

Completing the Truck Driver Tax Deductions Worksheet requires careful attention to detail. Follow these steps for effective completion:

- Gather all necessary documentation, including receipts for fuel, repairs, and other expenses.

- Review the categories outlined in the worksheet to understand where to allocate each expense.

- Enter the total amounts for each category, ensuring accuracy to avoid issues during tax filing.

- Double-check your entries for completeness and correctness before finalizing the worksheet.

- Keep a copy of the completed worksheet for your records and future reference.

Legal use of the Truck Driver Tax Deductions Worksheet

The legal use of the Truck Driver Tax Deductions Worksheet is crucial for ensuring compliance with IRS regulations. This worksheet serves as a record of your expenses and can be used to substantiate your claims during an audit. It is important to maintain accurate and honest records, as any discrepancies could lead to penalties or denial of deductions. Using the worksheet in conjunction with proper documentation strengthens your position should the IRS require verification of your expenses.

IRS Guidelines

The IRS provides specific guidelines regarding the types of expenses that truck drivers can deduct. These guidelines outline what qualifies as a business expense, including costs for fuel, maintenance, lodging, and meals while on the road. Familiarizing yourself with these guidelines is essential for effectively using the Truck Driver Tax Deductions Worksheet. By adhering to IRS rules, you can ensure that you are maximizing your deductions while remaining compliant with tax laws.

Required Documents

To accurately complete the Truck Driver Tax Deductions Worksheet, certain documents are necessary. These include:

- Receipts for fuel purchases.

- Invoices for maintenance and repairs.

- Insurance statements.

- Records of tolls and parking fees.

- Documentation for any other business-related expenses incurred during trucking operations.

Examples of using the Truck Driver Tax Deductions Worksheet

Practical examples can illustrate how to effectively use the Truck Driver Tax Deductions Worksheet. For instance, if a driver spends two hundred dollars on fuel for a trip, this amount should be recorded in the fuel expenses section. Similarly, if repairs cost five hundred dollars, this should be documented under maintenance. By consistently applying these examples to real expenses, drivers can ensure they are capturing all eligible deductions accurately.

Quick guide on how to complete truck driver tax deductions worksheet

Complete Truck Driver Tax Deductions Worksheet seamlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any delays. Manage Truck Driver Tax Deductions Worksheet from any device using the airSlate SignNow Android or iOS applications and simplify your document-based tasks today.

The easiest way to edit and electronically sign Truck Driver Tax Deductions Worksheet effortlessly

- Locate Truck Driver Tax Deductions Worksheet and click Get Form to initiate.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Edit and electronically sign Truck Driver Tax Deductions Worksheet to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the truck driver tax deductions worksheet

The best way to create an eSignature for a PDF file online

The best way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is a truck driver tax deductions worksheet?

A truck driver tax deductions worksheet is a tool designed to help truck drivers accurately track and calculate their eligible tax deductions. This worksheet simplifies the process of noting expenses related to the trucking business, ensuring that drivers maximize their deductions while complying with tax regulations.

-

How can airSlate SignNow assist with a truck driver tax deductions worksheet?

airSlate SignNow offers a user-friendly platform that allows truck drivers to create, edit, and eSign their tax deductions worksheets seamlessly. By integrating smart document features, the solution ensures that all crucial expense data for the truck driver tax deductions worksheet is recorded accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for tax deduction worksheets?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for individual truck drivers. The cost is competitive and provides value by enabling users to manage their truck driver tax deductions worksheet and other document-related tasks easily.

-

What are the key features of airSlate SignNow for creating a truck driver tax deductions worksheet?

Key features of airSlate SignNow include customizable templates for the truck driver tax deductions worksheet, secure eSigning capabilities, and cloud storage for easy access. These features streamline the documentation process, making it easier for truck drivers to manage their tax-related documents.

-

Can I integrate airSlate SignNow with other accounting tools for my tax deductions?

Absolutely! airSlate SignNow can be integrated with various accounting tools and software that help manage finances, including additional features for tracking your truck driver tax deductions worksheet. This integration ensures a smooth workflow for documenting expenses and preparing for tax filing.

-

What benefits do I gain by using a truck driver tax deductions worksheet with airSlate SignNow?

Using a truck driver tax deductions worksheet with airSlate SignNow provides substantial benefits, including a streamlined documentation process, enhanced accuracy in tracking expenses, and the ability to eSign and share documents securely. This ensures that truck drivers can focus more on their driving while efficiently handling their tax obligations.

-

How can I ensure my truck driver tax deductions worksheet is compliant with tax regulations?

To ensure compliance when using a truck driver tax deductions worksheet, it's essential to include accurate and detailed records of expenses. airSlate SignNow allows you to create customized templates that align with tax guidelines, helping you maintain accuracy and meet compliance requirements effectively.

Get more for Truck Driver Tax Deductions Worksheet

- Form n 848 rev 2018 power of attorney forms 2018

- 2022 instructions for form 8889 instructions for form 8889 health savings accounts hsas

- 2020 2022 form hi dot n 884 fill online printable

- Pa schedule oc other credits pa 40pa 41 oc form

- About form 8288 a statement of withholding on irs

- Portalctgov mediadepartment of revenue services form ct 941x drs use only

- Your household income must be no form

- Schedule k 1 form n 35 rev 2022 shareholders share of income credits deductions etc

Find out other Truck Driver Tax Deductions Worksheet

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free