Up Vat Challan Download PDF Form

What is the Up Vat Challan Download Pdf

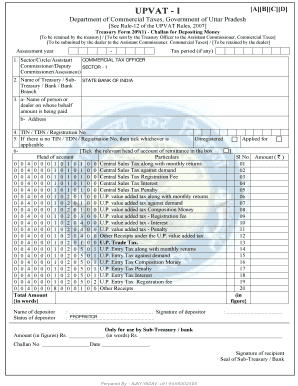

The Up Vat Challan Download Pdf is a crucial document used for the payment of Value Added Tax (VAT) in the state of Uttar Pradesh, India. This form serves as an official receipt for tax payments made by businesses and individuals. It is essential for maintaining compliance with state tax regulations. The challan includes details such as the taxpayer's information, the amount of VAT being paid, and the payment date. By downloading this PDF, users can ensure they have a formal record of their tax payments, which is vital for both accounting and legal purposes.

How to use the Up Vat Challan Download Pdf

Using the Up Vat Challan Download Pdf involves several straightforward steps. First, download the PDF from a reliable source. Once downloaded, open the document using a PDF reader. Fill in the required fields accurately, including your name, address, and the specific amount of VAT you are paying. After completing the form, print it out for your records. It is advisable to keep a copy of the filled challan for future reference, especially during audits or tax assessments.

Steps to complete the Up Vat Challan Download Pdf

Completing the Up Vat Challan Download Pdf requires careful attention to detail. Follow these steps:

- Download the PDF file from a trusted source.

- Open the file in a PDF reader.

- Enter your personal details, including your taxpayer identification number.

- Specify the amount of VAT being paid.

- Select the payment method, whether online or offline.

- Review the information for accuracy.

- Print the completed form for your records.

Legal use of the Up Vat Challan Download Pdf

The Up Vat Challan Download Pdf holds legal significance as it serves as proof of tax payment. To ensure its legal validity, it must be filled out correctly and submitted to the appropriate tax authority. Compliance with local tax laws is essential, as failure to do so may result in penalties. The document must also be retained for a specified period as outlined by state regulations, allowing for verification during audits or inquiries.

Key elements of the Up Vat Challan Download Pdf

Several key elements are essential to include in the Up Vat Challan Download Pdf to ensure its completeness and accuracy:

- Taxpayer Information: Name, address, and taxpayer identification number.

- Payment Details: Amount of VAT being paid and the payment method.

- Date of Payment: The date on which the payment is made.

- Challan Number: A unique identifier for tracking the payment.

- Signature: Required for verification of the document.

Examples of using the Up Vat Challan Download Pdf

Businesses and individuals utilize the Up Vat Challan Download Pdf in various scenarios. For instance, a small business owner may use the challan to pay their quarterly VAT dues, ensuring compliance with state tax regulations. Similarly, a freelancer may fill out the challan when making VAT payments for services rendered. Each example highlights the document's role in maintaining accurate tax records and fulfilling legal obligations.

Quick guide on how to complete up vat challan download pdf

Effortlessly Prepare Up Vat Challan Download Pdf on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Up Vat Challan Download Pdf on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign Up Vat Challan Download Pdf with Ease

- Find Up Vat Challan Download Pdf and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details, then click the Done button to save your changes.

- Select how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Up Vat Challan Download Pdf to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the up vat challan download pdf

How to create an electronic signature for your PDF file online

How to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What is UP VAT Challan Excel format?

The UP VAT Challan Excel format is a standardized spreadsheet designed for businesses in Uttar Pradesh to manage and submit their VAT payments efficiently. It allows users to easily input transaction details, calculate taxes, and generate a compliant challan for submission to tax authorities.

-

How can airSlate SignNow help with UP VAT Challan Excel format?

airSlate SignNow streamlines the process of using the UP VAT Challan Excel format by facilitating eSigning and secure document sharing. Users can fill out their challan forms electronically and send them for approvals without the hassle of printouts and manual signatures.

-

Is there a cost associated with using airSlate SignNow for UP VAT Challan Excel format?

Yes, airSlate SignNow offers a variety of pricing plans to cater to different business needs. While there is a subscription fee to access premium features, the platform remains cost-effective, especially for companies regularly handling UP VAT Challan Excel format submissions.

-

Can I integrate airSlate SignNow with other accounting software for UP VAT Challan Excel format processing?

Absolutely! airSlate SignNow offers integrations with popular accounting software, enabling seamless handling of UP VAT Challan Excel format submissions. This integration ensures accurate data flow between platforms, reducing manual efforts and enhancing efficiency.

-

What features does airSlate SignNow offer for managing UP VAT Challan Excel format?

airSlate SignNow includes features such as customizable templates, eSignature capabilities, and secure cloud storage, specifically tailored for managing UP VAT Challan Excel format. These tools eliminate paperwork and enable quick, compliant submissions.

-

Are there any benefits of using airSlate SignNow for UP VAT Challan Excel format compared to traditional methods?

Using airSlate SignNow for UP VAT Challan Excel format offers multiple benefits, including reduced processing time, improved accuracy, and enhanced security. Businesses can avoid common errors associated with manual processing and ensure their VAT submissions are both timely and compliant.

-

How does airSlate SignNow ensure the security of documents related to UP VAT Challan Excel format?

airSlate SignNow employs top-notch security protocols, including encryption and secure access controls, to protect documents related to UP VAT Challan Excel format. This dedication to security helps businesses securely manage sensitive financial information and comply with industry regulations.

Get more for Up Vat Challan Download Pdf

Find out other Up Vat Challan Download Pdf

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF