Tax Year Form MW506NRS Maryland Return of Income Tax Withholding 2021-2026

What is the Tax Year Form MW506NRS Maryland Return Of Income Tax Withholding

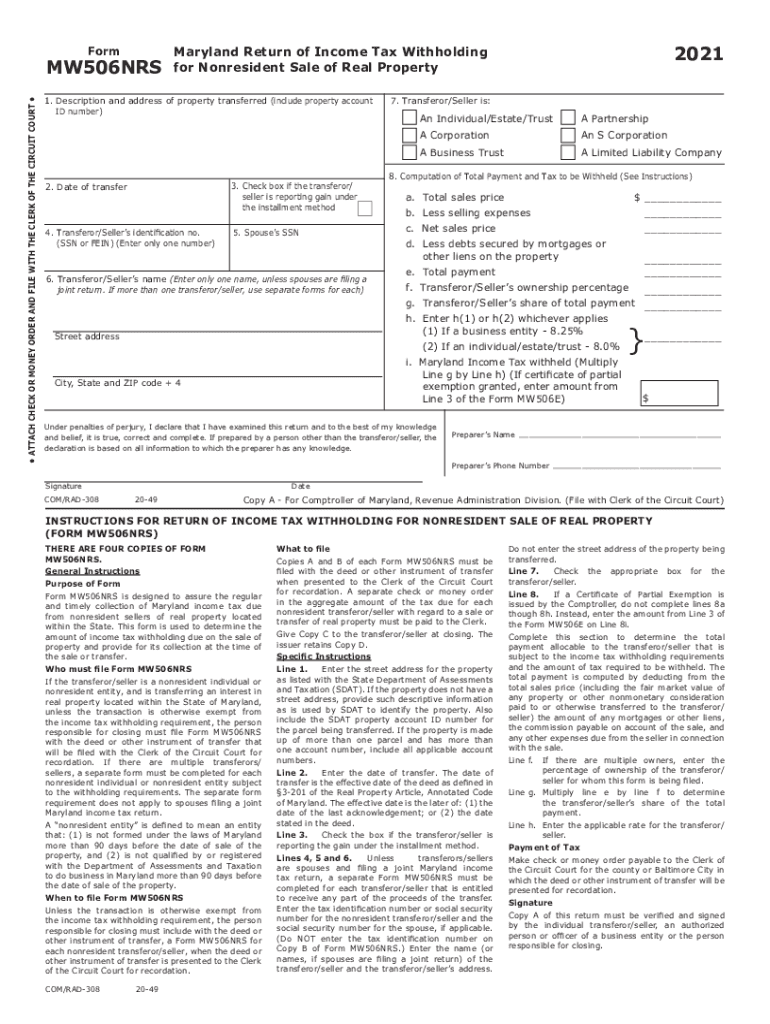

The Tax Year Form MW506NRS is a crucial document for non-residents who need to report income tax withholding in Maryland. This form is specifically designed for individuals and entities that earn income in Maryland but do not reside in the state. It allows them to accurately report the amount of tax withheld from their income, ensuring compliance with Maryland tax laws. By using the MW506NRS, taxpayers can fulfill their obligations and avoid potential penalties associated with incorrect filing.

How to use the Tax Year Form MW506NRS Maryland Return Of Income Tax Withholding

Using the MW506NRS form involves several steps to ensure accurate completion. First, gather all necessary documentation, including income statements and any relevant tax withholding information. Next, carefully fill out the form, ensuring that all sections are completed accurately. Pay special attention to the calculation of tax withheld, as errors can lead to complications. Once completed, the form can be submitted electronically or via mail, depending on the taxpayer's preference. Utilizing digital tools can streamline this process, making it easier to manage and submit the form.

Steps to complete the Tax Year Form MW506NRS Maryland Return Of Income Tax Withholding

Completing the MW506NRS form involves a series of detailed steps:

- Obtain the latest version of the form from the Maryland Comptroller's website or authorized sources.

- Fill in your personal information, including your name, address, and Social Security number.

- Report the total income earned in Maryland and the amount of tax withheld.

- Double-check all entries for accuracy, ensuring that calculations are correct.

- Sign and date the form to validate it.

- Submit the form according to the preferred method, whether online or by mail.

Legal use of the Tax Year Form MW506NRS Maryland Return Of Income Tax Withholding

The MW506NRS form is legally binding when completed and submitted according to Maryland state regulations. It is essential for taxpayers to understand that electronic signatures are acceptable, provided they comply with the eSignature laws in the United States. This form must be submitted by the specified deadlines to avoid penalties, ensuring that all tax obligations are met legally. Compliance with these regulations protects taxpayers and ensures that their submissions are recognized by the state.

Filing Deadlines / Important Dates

Filing deadlines for the MW506NRS form are critical for compliance. Typically, the form must be submitted by the due date for the tax year in question. For most taxpayers, this date aligns with the federal tax filing deadline, which is usually April fifteenth. However, it is important to check for any specific updates or changes from the Maryland Comptroller’s office, as these can affect submission timelines. Late submissions may incur penalties, making awareness of these dates essential for all non-resident taxpayers.

Who Issues the Form

The MW506NRS form is issued by the Maryland Comptroller's office, which is responsible for tax administration in the state. This office provides the necessary guidelines and updates related to the form, ensuring that taxpayers have access to the most current information. It is advisable for users to refer to the Comptroller's official resources for any changes or specific instructions regarding the MW506NRS, ensuring compliance with state regulations.

Quick guide on how to complete tax year 2021 form mw506nrs maryland return of income tax withholding

Complete Tax Year Form MW506NRS Maryland Return Of Income Tax Withholding effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents rapidly without any holdups. Handle Tax Year Form MW506NRS Maryland Return Of Income Tax Withholding on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest method to edit and electronically sign Tax Year Form MW506NRS Maryland Return Of Income Tax Withholding with ease

- Obtain Tax Year Form MW506NRS Maryland Return Of Income Tax Withholding and hit Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Tax Year Form MW506NRS Maryland Return Of Income Tax Withholding and ensure excellent communication throughout your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax year 2021 form mw506nrs maryland return of income tax withholding

Create this form in 5 minutes!

How to create an eSignature for the tax year 2021 form mw506nrs maryland return of income tax withholding

How to create an eSignature for a PDF document in the online mode

How to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the mw506nrs 2024 and how does it benefit my business?

The mw506nrs 2024 is an advanced signing solution that simplifies the document signing process for businesses. With its user-friendly interface, it allows teams to eSign documents efficiently, enhancing workflow and productivity. Utilizing this tool can reduce turnaround time for approvals and improve overall operational efficiency.

-

How much does mw506nrs 2024 cost?

Pricing for mw506nrs 2024 varies based on your business needs and the features you choose. airSlate SignNow offers various pricing plans that cater to different sizes of organizations, ensuring cost-effective solutions for everyone. Visit our pricing page to find the plan that best suits your requirements.

-

What features are included with mw506nrs 2024?

mw506nrs 2024 includes features such as customizable templates, advanced document tracking, and mobile accessibility, allowing users to manage documents anywhere. Additionally, it offers seamless integrations with other platforms to enhance your signing experience. This combination of features makes it a comprehensive solution for all document management needs.

-

Can mw506nrs 2024 integrate with other software I use?

Yes, mw506nrs 2024 supports integration with numerous third-party applications, including CRMs, cloud storage, and productivity tools. This interoperability allows teams to streamline their workflows by connecting their existing software with airSlate SignNow. Check our integration page for a full list of compatible applications.

-

Is mw506nrs 2024 suitable for international use?

Absolutely! mw506nrs 2024 is designed to comply with various international eSignature laws, making it suitable for global transactions. Businesses can confidently use it to send and sign documents across borders with legal assurance. This flexibility opens up opportunities for expanding your business internationally.

-

What security measures are implemented in mw506nrs 2024?

mw506nrs 2024 employs robust security measures, including encryption and multi-factor authentication, ensuring that your documents remain secure and confidential. airSlate SignNow prioritizes user data protection, and all eSignatures are legally binding to meet compliance requirements. Your business can trust that sensitive information is safeguarded.

-

How does mw506nrs 2024 improve document efficiency?

By utilizing mw506nrs 2024, businesses can signNowly improve document efficiency through streamlined workflows and quick turnaround times. The solution enables users to send, sign, and manage documents all in one platform, eliminating delays caused by traditional paper processes. This enhancement in efficiency can lead to increased productivity and reduced operational costs.

Get more for Tax Year Form MW506NRS Maryland Return Of Income Tax Withholding

Find out other Tax Year Form MW506NRS Maryland Return Of Income Tax Withholding

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself